Real estate stands at a pivotal juncture, profoundly impacted by intensifying climate risks. Climate change is no longer an abstract scenario—it is an immediate strategic imperative. Climate risks could reduce annual returns for real estate portfolios by up to 40% by 2030 and climate-related impacts could cost the global real estate sector approximately $559 billion by 2050. Investor scrutiny is also intensifying, with 78 % of U.S. real-estate investors now identifying climate risk as a material financial concern. As climate costs mount and investor scrutiny intensifies, are you preparing your portfolio to be a climate liability or a future-proofed opportunity?

Key takeaways:

- Accelerating climate hazards and escalating insurance costs are reshaping real estate valuations and increasing asset risk.

- Investor expectations and mandatory disclosure mandates (e.g., California SB 261, Corporate Sustainability Reporting Directive) are significantly heightening compliance and transparency demands.

- Embedding scenario-based climate analytics into investment strategies and governance frameworks is essential for proactive risk management.

Four factors amplifying climate risk in real estate

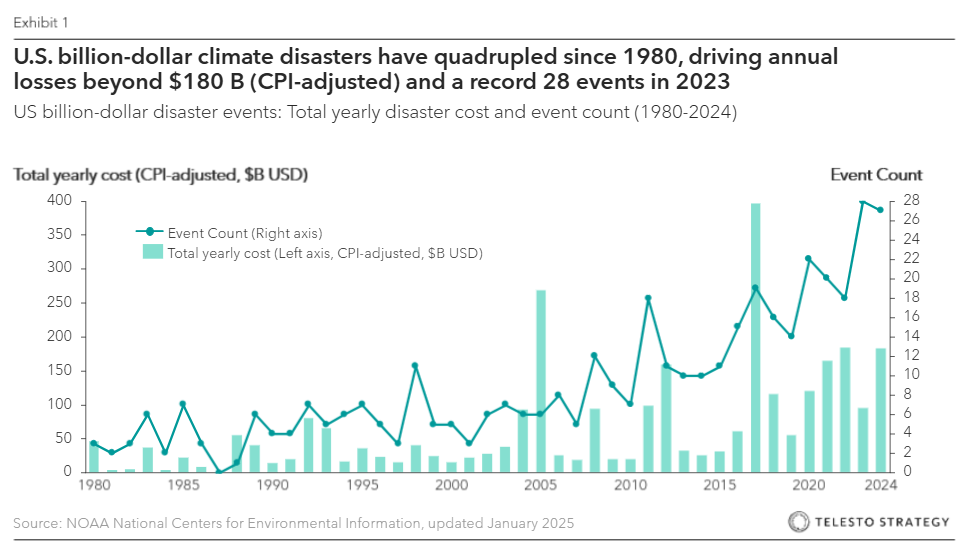

- Physical and infrastructure stress. Climate threats are accelerating. The U.S. saw a record of 28 weather events with damages above $1B in 2023. In early 2025, Los Angeles wildfires caused $250–$275B in damage and coastal floodings continue to erode asset values significantly. Meanwhile, real estate—responsible for 75% of U.S. electricity use—is increasingly exposed to grid instability from storms, heatwaves, and electrification.

- Supply chain disruptions and cost inflation. Climate disruptions inflate construction and operating costs. As disasters intensify, the underlying damage they inflict on factories, ports, and logistics corridors triggers supply-chain bottlenecks that elevate prices for construction materials and labour. Rebuilding after Hurricane Ian (2022) drove regional shortages and price premiums for plywood, roofing insulation, and drywall. Transportation disruptions, like the 2022 Mississippi drought, sharply increased freight costs. Moreover, IMF research confirms extreme weather events rapidly translate into global supply-chain pressures and inflation within approximately three months.

- Policy and transition pressures. Tightening regulations and shifting investor priorities are amplifying transition risk. NYC’s Local Law 97 is expected to trigger $24.3B in building retrofits by 2030. Similarly, state mandates (e.g., California SB 261) and investor pressure are making climate risk reporting effectively mandatory. Investors managing +$5.3T in real estate now demand property-level climate resilience measures, allocating capital accordingly.

- Market repricing and insurance stress. Financial markets are now beginning to price in climate risk. Up to $7.5T in global real estate assets could become stranded due to climate-related events. U.S. real estate value alone could fall by $1.4T over the next 30 years due to climate exposure. Payouts made by insurers for climate and disaster-related damages worldwide hit $154B in 2024, 27% above the 10-year average. Premiums rose on average 12% in 2022 in the U.S., spiking significantly in high-risk regions such as Florida and California, leaving some properties effectively uninsurable.

Considerations for real estate leaders:

- Are our assets adequately positioned against emerging climate risks?

- Is climate risk effectively integrated into our investment decisions?

- Are we leveraging climate intelligence optimally for competitive positioning?

- Are our climate strategies clearly communicated to stakeholders, enhancing trust and market perception?

Connect with Telesto Strategy to turn climate risk into a strategic advantage and position your real estate portfolio for long-term resilience.

Let’s talk.

Our people

Andrew Alesbury

Partner, Washington DC

Andrew supports real estate investors and other firms with large portfolios of physical assets to create sustainable strategies which integrate resilience and sustainable risk management into their business models and investment processes.

Ben Vatterott

Partner, San Francisco

Ben supports clients on a number of strategic topics such as setting net zero targets, embedding sustainability and emissions reduction into capital deployment, and capturing sustainable growth opportunities.

Diego Bernstein

Manager, Miami

Diego helps real estate practitioners implement their sustainability strategies including net zero roadmaps, climate risk strategies, building economic models, demonstrating his expertise in renewables and sustainable technologies.