Copyright © 2023 Telesto Strategy LLC, All rights reserved.

Turner Impact Capital is an organization that puts social impact, including affordable housing, at the center of its real estate strategy. The firm invests in affordable housing opportunities that are often overlooked by conventional investors. Since 2015, the firm has acquired and enriched over 13,6000 housing units in under-resourced communities throughout the U.S.

How can the real estate industry tackle the “S” in ESG? Beyond their core business of developing, buying, and selling properties, real estate firms share a social responsibility to contribute to the communities they serve. Real estate companies are uniquely positioned to impact the wellbeing of the communities and the development of the neighborhoods in which they operate. Companies are already taking action: in a JLL report of over 800 real estate practitioners across 12 markets, 92% responded that they see real estate as a vehicle to support both environmental and social value goals, and 93% of respondents say they have a social value strategy in place.

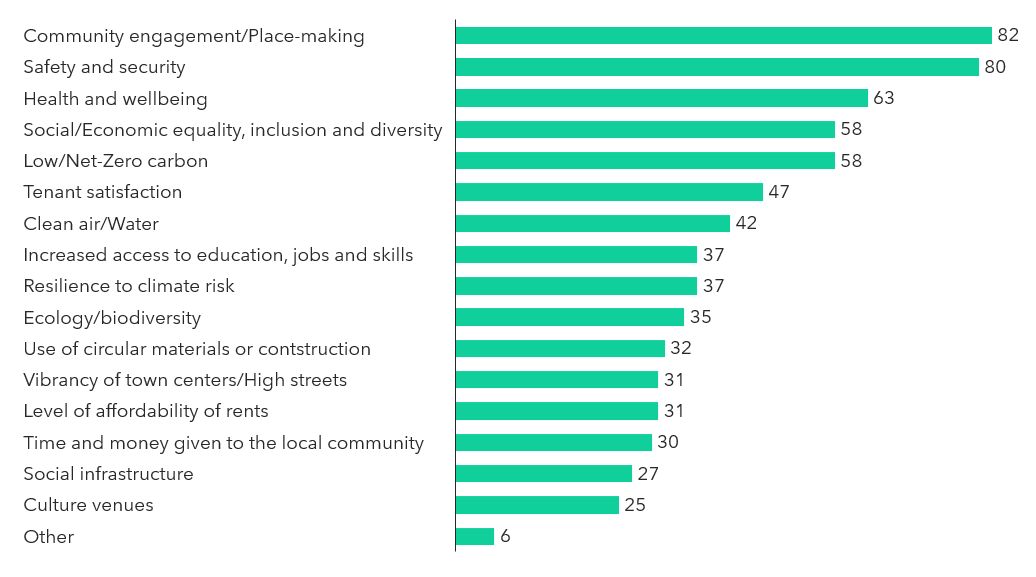

Real estate firms use a variety of social value metrics to measure their impact on communities. In a study of leading social value metrics for real estate firms conducted by the Urban Land Institute, results found that community engagement and safety and security were highlighted as key social value metrics by a striking 80% or more of respondents from real estate firms. Health and wellbeing, social/economic diversity, equity, and inclusion, and low/net-zero carbon were also ranked by over half of all respondents. These response rates are expected to increase as interest in measuring social value increases within the real estate industry.

Social value metrics measured by leading ESG real estate companies, % of respondents

SOURCE: Urban Land Institute survey (2021)

Real estate firms integrate their social impact goals into their strategies and projects in several key ways:

Community Development and Affordable Housing

Real estate firms, including REITs, share a responsibility to engage in community development initiatives and drive lasting social value. Real estate development can help foster sustainable, inclusive growth by creating affordable housing options that contribute to the stability and diversity of neighborhoods. By working closely with local governments, non-profit organizations, and community stakeholders to incorporate affordable housing (e.g., mixed-income housing into their projects), real estate firms can help bridge socio-economic gaps and reduce inequality.

Furthermore, real estate firms can play a vital role in revitalizing underserved and neglected areas. They can breathe new life into communities that have often been overlooked. Investing in these communities through property development, infrastructure improvements, and community facilities can help create more vibrant neighborhoods and raise property values. Real estate projects should be designed and executed with a focus on minimizing displacement, especially in vulnerable communities, which involves thoughtful planning to ensure that existing residents are not adversely affected by rising property values or development projects.

In general, prioritizing the well-being of tenants and residents involves providing safe and comfortable living spaces. Real estate firms can contribute by incorporating wellness-focused designs, addressing security concerns, and implementing health and safety measures within all types of properties. The same considerations are taken for working spaces, where sustainable and inclusive design approaches shape the working experience, as exemplified in JLL’s workplace redesign projects.

Environmental Impact

By meeting their environmental goals and reducing their ecological footprint, real estate firms also promote healthier living spaces and improve the quality of life of residents. In addition to incorporating green building designs and energy-efficient technologies, these firms can contribute to the conservation of green spaces, creating parks and recreational areas that enhance the overall wellbeing (e.g., physical and mental health) of the community.

Real estate firms can also contribute to community resilience by incorporating disaster-resistant designs and supporting local disaster preparedness initiatives. This is particularly important in regions prone to natural disasters, where thoughtful planning can mitigate the impact on residents. Real estate firms play an essential role in developing strategies for crisis management and resilience planning.

Job Creation, Economic Stimulus, and Labor Practices

Beyond the physical structures they create, real estate firms have an opportunity to stimulate economic growth within their communities. Development projects generate employment opportunities, ranging from construction workers to local suppliers. By prioritizing local hiring and supporting small businesses, real estate developers can contribute to the economic vitality of the areas in which they operate.

While stimulating job creation, real estate firms can shape their hiring practices to promote diversity and inclusion within their workforces. They also can ensure fair labor practices throughout their supply chain while providing fair wages, safe working conditions, and opportunities for professional development.

A portion of the taxes real estate companies incur also get invested back into the communities. As Regency Centers, a real estate investment trust, highlights, real estate taxes fund infrastructure improvements, local services, and public schools, among other community development initiatives.

Social Infrastructure and Community Services

Real estate projects should not exist in isolation; they should be integrated into the existing social fabric of communities. Real estate firms can take the lead in developing social infrastructure (e.g., infrastructure that promotes social interaction and community cohesion) such as community centers, healthcare facilities, and transportation networks. Developers can collaborate with local schools to create educational and mentorship programs, scholarships, and recreational facilities that benefit both students and the broader community. Investing in education and enhancing connectivity and accessibility (e.g., accessibility to people of all abilities and ages) are long-term strategies for inclusive community development.

Building strong relationships with the community is crucial. Real estate projects should include transparent communication and solicited community input to ensure that projects align with local needs and values. Real estate firms should actively seek input from residents through town hall meetings, surveys, and open forums. This collaborative approach ensures that projects align with the community’s values and needs, fostering a sense of ownership among residents.

Social Impact Frameworks

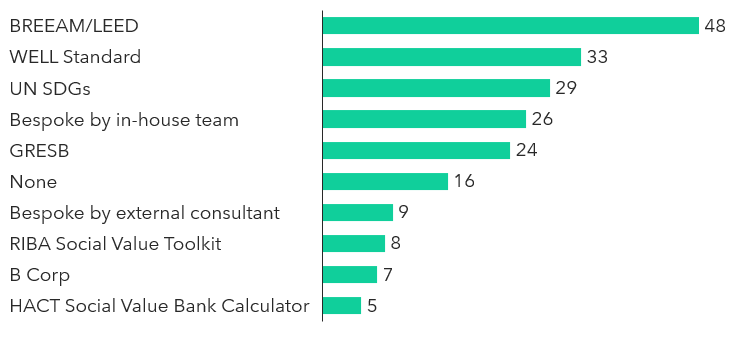

Given the variety of ways to advance social impact, real estate firms should ensure they can quantify their achievements. In the previously mentioned Urban Land Institute report, the study found that global real estate leaders use a variety of social impact frameworks, strategies, and metrics to measure the advancements they are making for people and places. There is no clear consensus on how to track social impact goals: as shown below, no framework is used by a majority of respondents, with BREAM/LEED cited as the top framework (48%), followed by WELL Standard (33%). BREAM/LEED measures sustainability initiatives, while WELL Standard measures features that impact human health and well-being. As the importance of social responsibility for real estate firms continues to grow, frameworks will become more standardized and specific to measure firms’ impacts on society. Moreover, organizations that set and track social impact goals will continue to develop bespoke approaches that reflect their unique context and opportunities, shareholder priorities, and asset classes.

Social impact frameworks used by leading ESG real estate companies, % of respondents

SOURCE: Urban Land Institute survey (2021)

Conclusion

From affordable housing and sustainable design to building community recreational facilities, real estate firms contribute to the immediate needs of neighborhoods and the economic vitality of communities.

By adopting socially responsible practices and actively engaging with residents, real estate firms can create more sustainable, inclusive, and thriving communities. As key players in shaping the development, real estate firms have a key role to play in advancing the “S” in ESG.

For support with determining your firm’s social impact frameworks and strategy, please reach out to a member of our team.