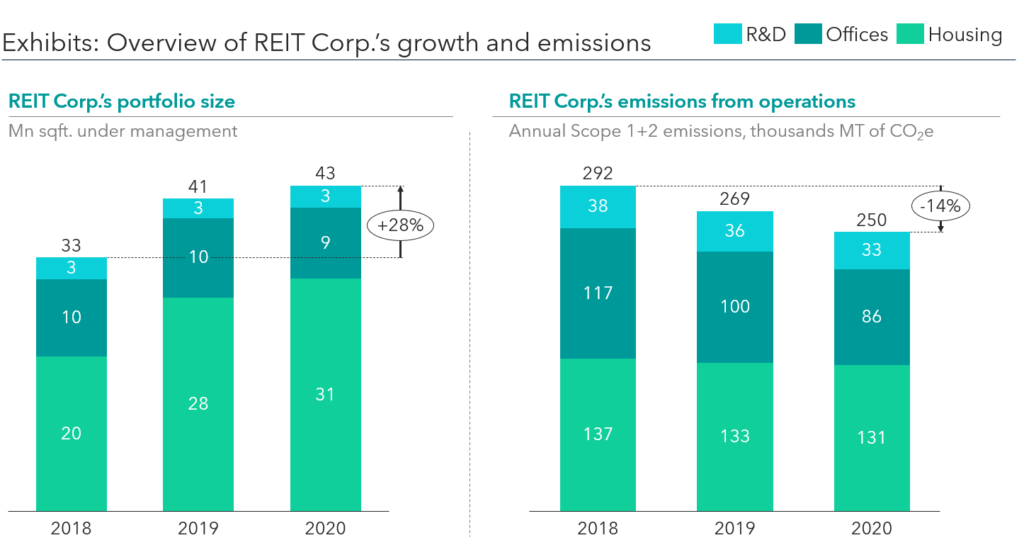

To determine the annual rate during 2018-20, we take the 2020 value and subtract it from the 2018 value:

292 – 250 = 42 MT of CO2e per year

To calculate in what year REIT Corp. will reach zero emissions, we divide the 2020 value by the annual rate of decline:

250 / 42 = ~6 years

So, REIT Corp. should achieve net zero emissions by 2026, which is 1 year later than the 2025 target

To reach net zero by 2025, REIT Corp would need to achieve an average rate of decline of

250 / (2025 – 2020) = 250 / 5 = 50 MT of CO2e per year

To calculate the percent increase in the rate of decline: (50 – 42) / 42 = 8 / 42 = ~19% increase