Copyright © 2023 Telesto Strategy LLC, All rights reserved.

Introduction: Unveiling the Financial Lens

For real estate firms looking to create long-term value, the integration of environmental factors continues to be a strategic imperative. While some real estate firms hesitate and perceive ESG initiatives as a financial hurdle, a closer look reveals that the benefits far outweigh the costs.

Looking at the correlation between sustainability disclosures and value generation provides a key example for the financial imperative to green real estate. An academic study sponsored by Nareit found REITs that voluntarily disclose more sustainability measures have stronger financial performance than those that do not. As many investors are increasingly weighing ESG factors into their investment decisions, disclosing strong ESG performance can attract a larger investor base and lower the cost of capital.

Embedding sustainability into real estate can reap a variety of benefits, including reducing costs, attracting tenants and investors, and minimizing risks associated with climate events. One can identify positive ROI developed from sustainability initiatives in five key ways:

1. Revenue uplift and the green premium

Sustainable real estate practices have the potential to enhance property value and add allure for both homeowners and investors willing to pay a premium for eco-friendly features. Data from the U.S. Green Building Council (USGBC) highlights that a majority of builders recognize the willingness of consumers to pay more for green homes. The USGBC determined that investment in green building features can increase asset value by 10 or more percent. Notably, 73% of single-family builders and 68% of multifamily builders say consumers will pay more for green homes. This is further supported by consumers themselves: a poll of over 2,000 Americans found that 49% consider eco-friendly features more important than luxury items in a home.

In the same research, the USGBC found that the resale value of homes built with green standards saw an increase in select markets. Looking at the Austin-Round Rock Metropolitan area from 2008-2016, for example, researchers found that homes built to LEED standards and those built to a wider range of green standards saw an 8% and 6% increase in value, respectively.

Non-residential buildings also see revenue uplift from investing in sustainability. By investing in energy efficient buildings, real estate players can attract new tenants willing to pay higher rents. Over a 10-year analysis, U.S. LEED-certified projects collect 3.7% higher rent and maintain 4% higher occupancy rates than noncertified buildings. The same holds true for buildings certified by ENERGY STAR, which collect 2.7% higher rent and have 9.5% higher occupancies.

2) Reducing costs and emissions through efficiency interventions

Especially over the long-term, operational savings can mitigate the sometimes-large upfront costs associated with sustainability initiatives.

LEED buildings, for instance, have reported almost 20 percent lower maintenance costs than typical commercial buildings, and green building retrofits typically decrease operation costs by almost 10 percent in just one year.

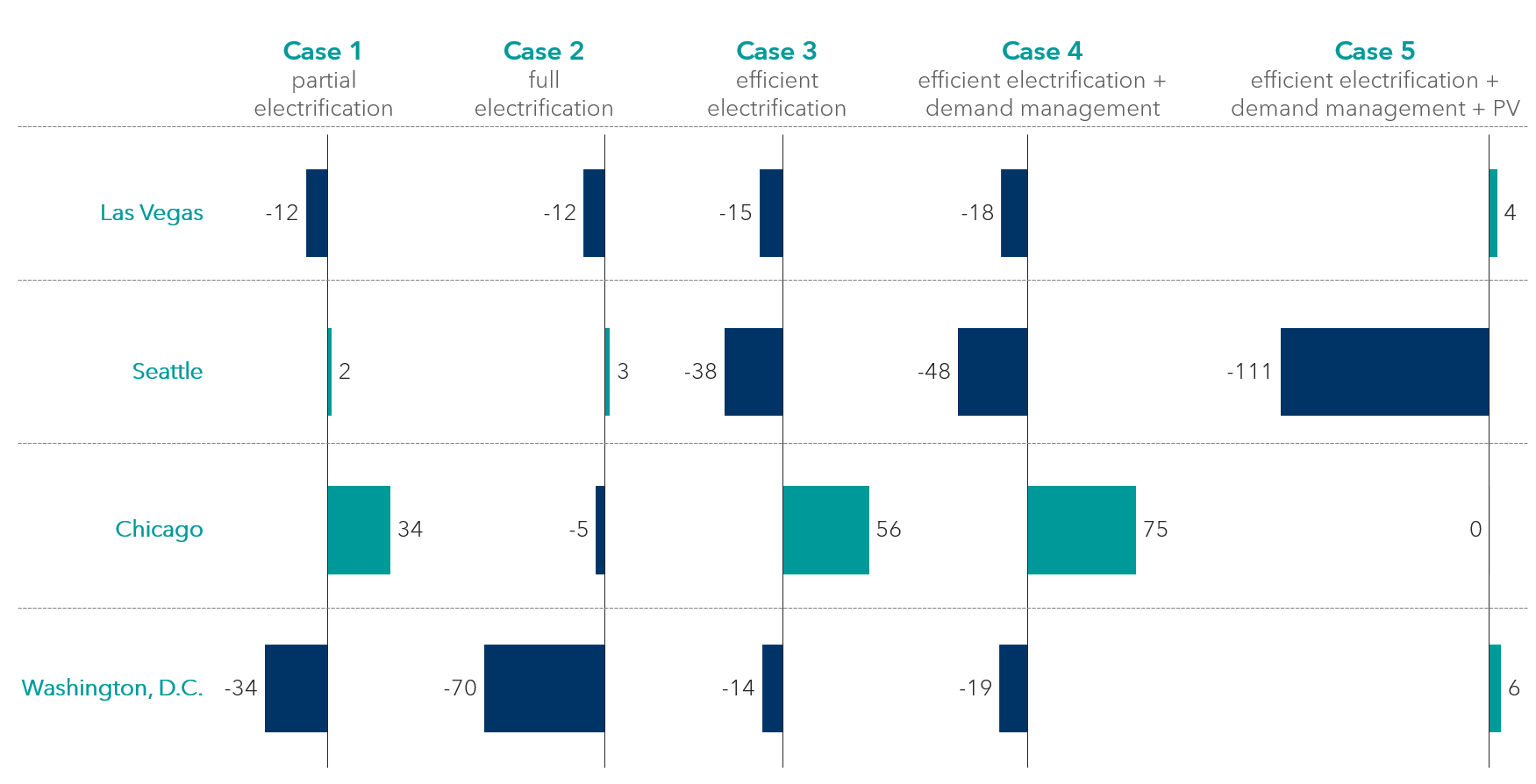

Building owners are often uncertain about the economic return that decarbonization retrofits offer. An RMI report analyzed electrification retrofit packages for mid-sized office buildings with packaged rooftop units in four US cities, finding that cost-effective retrofit solutions exist in all studied scenarios, as can be seen in the figure below. Coupling the right retrofit package in each city with other energy efficiency measures will save energy, cost, and carbon.

20-year NPV of select interventions in 4 American cities,

Thousands of $

SOURCE: The Economics of Electrifying Buildings, RMI

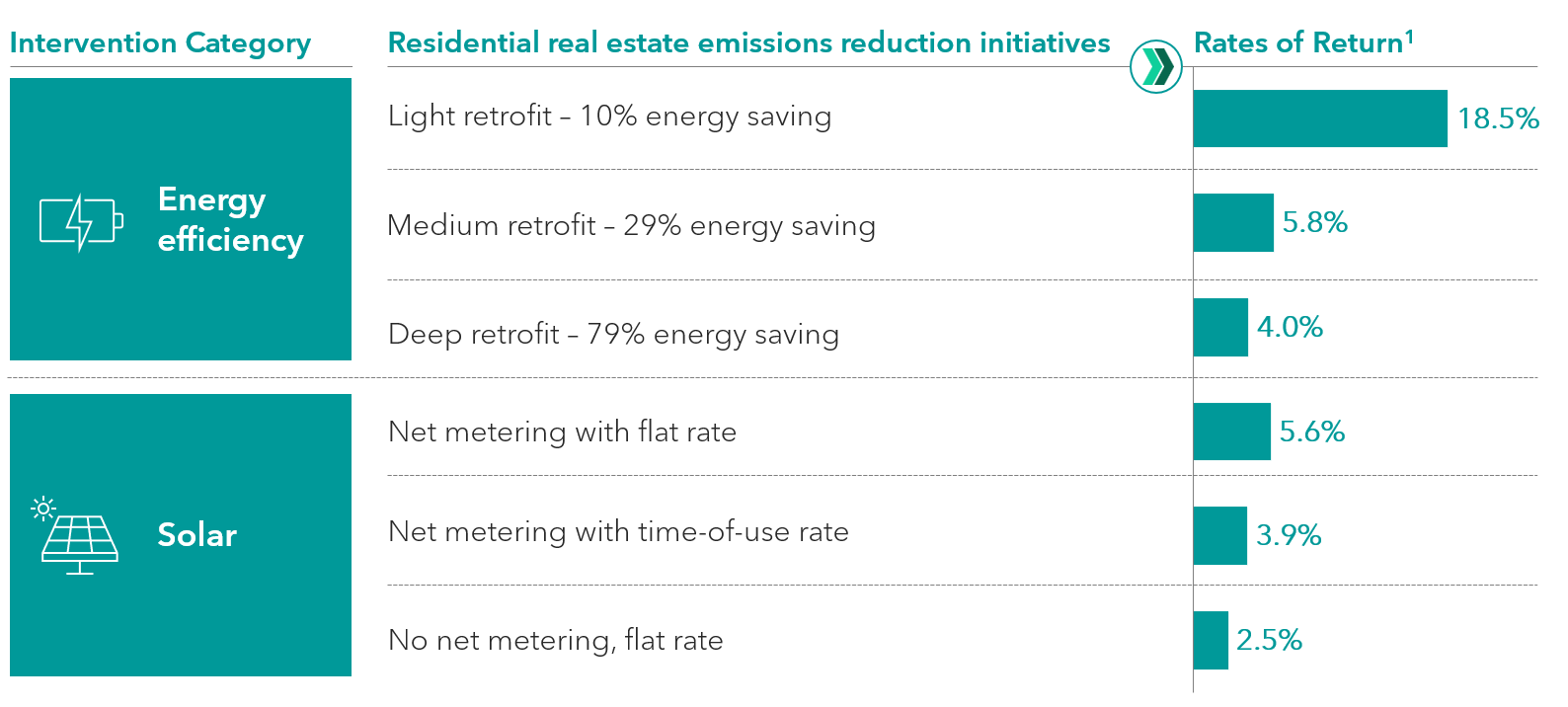

Additionally, a study by the American Council for an Energy Efficient Economy (ACEEE) on energy efficiency and solar retrofits found that certain energy efficiency retrofits can deliver an annual return of up to 18.5%, well above the typical investment threshold for most firms. The returns on efficiency and solar investments, without considering any incentives and residential federal tax credit, can be summarized in the table below:

Rates of return on various efficiency and solar investments

1. Rates of return in this section do not include efficiency incentives, solar incentives and residential federal solar tax credit

SOURCE: For Existing Homes, Energy Efficiency Often Has a Better Return on Investment Than Solar, ACEEE

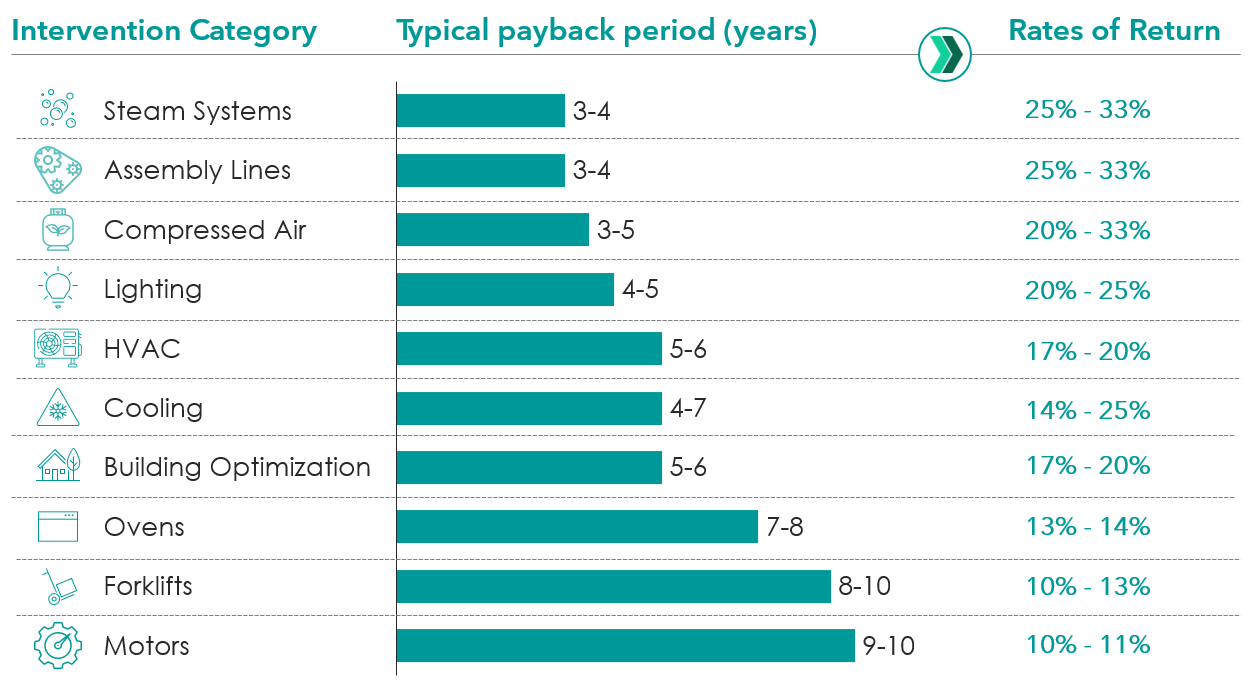

As exhibited below, building retrofits with tax incentives often result in a typical average payback period ranging from 3 to 10 years. Furthermore, common real estate interventions in commercial and multifamily residential such as installing high efficiency HVAC units, leveraging LED lighting, and optimizing boiler systems have the potential to yield significant rates of return, ranging from 18% to 25% (Note: Values are based off average payback period in the US).

Leveraging tax incentives can also lower upfront investment costs. In the U.S., increased investment and updated tax incentives can reduce the cost of solar and onshore wind by as much as 60% and 1.8 cents/KWh, respectively, and grants may provide as much as 50% of the eligible costs. Players should closely monitor the changing regulatory and tax landscape to leverage all available tax credits and other economic advantages.

Typical payback periods and rates of return for common commercial and multifamily interventions

SOURCE: Telesto insights

3. Lower cost of capital

A sound ESG and sustainability strategy can also decrease a firm’s cost of capital, as shown by the correlation with companies’ ESG scores, and can lead to overall improved financial performance.

Looking at monthly industry adjusted ESG scores, an MSCI report found that companies with higher ESG ratings experienced lower costs of capital, equity, and debt compared to companies with lower ESG ratings. This relationship held true in both the U.S. and global markets.

Further, data backs up the notion that ESG metrics are linked to financial performance. A study from the NYU Stern Center for Sustainable Business and Rockefeller Asset Management looked for evidence of the correlation of ESG and financial performance in over 1,000 research papers from 2015-2020 and found positive results. For the corporate studies (those focused on corporate financial performance), 58% had a positive relationship between ESG and financial performance, 13% neutral, 21% mixed, and only 8% negative. For the investment performance studies (those focused on alpha or Sharpe ratios), 59% showed similar or better performance compared to conventional investments.

4. Reduced risk of climate damage and disruption

Real estate investments are long-term in nature, and the ever-growing physical risks posed by climate change necessitate strategic resiliency planning. As climate change increases the frequency and severity of natural disasters, climate risks continue to impact real estate assets’ value, viability, and prospects.

The cost of climate change is clear: From 2017 to 2021, 89 events caused over $788 billion in damages in the U.S., which accounts for 35% of the total costs of billion-dollar U.S. disasters from 1980 to 2021. In 2022, 15 climate disasters each exceeded $1 billion in losses. On the world stage, a recent World Economic Forum report cites climate change costs the world $16 million per hour. These numbers are expected to increase as climate risks become more severe.

Building climate resilience real estate is going to be increasingly important. On a global scale, according to a brief by UN, an investment of USD 1.8 trillion in resilience and adaptation could generate USD 7.1 trillion in total net benefits between 2020-2030; this investment generates a nearly 300% ROI, annualized at 14.71%. The briefing also highlights that every $1 investment in building resilience could generate $3 in benefits from reduced need for humanitarian aid and avoided losses.

On a more local level, resilient design and construction also offer a strong ROI. A report from The Alabama Center for Insurance Information and Research (ACIIR) analyzed the economic value of using a FORTIFIED Multifamily program, which was designed based on ways to strengthen residences, commercial buildings, and multifamily properties against severe weather and natural disasters. The study found that the economic value for properties meeting the FORTIFIED standard could have a return as high as 72%. Though the cost of meeting the FORTIFIED requirements increased the project cost (between 0.29-1.43%), the projected insurance savings outweighed the cost.

5. Staying ahead of regulatory requirements, including legal and regulatory risks

In real estate, a strong ESG proposition is required to foster strong government relations, and compliance with regulations enhance companies’ reputations. Conversely, companies that neglect sustainable initiatives may encounter increasing legal risks and challenges, including in accessing affordable capital. For example, the E.U. has emphasized the benefits of disclosing climate-related information in the EU’s Corporate Sustainability Reporting Directive (CSRD). The penalties for failing to comply with the reporting rules are significant: in Ireland, a breach may lead to a €5000 fine; in Italy, the penalty is €20,000-€150,000; and in Germany, companies face fines of up to either €10 million, 5% of the total annual turnover or twice the total profits made/losses avoided due to the breach. Besides penalties such as fines, companies failing to comply with CSRD reporting requirements may face other legal action. The wide scope of the CSRD has the potential to affect many U.S.-based companies with activities in the E.U.; for example, US companies that have listed securities, such as stocks or bonds, on a regulated market in the European Union will also be subject to the reporting requirements.

The U.S. is updating its sustainability reporting requirements as well. In addition to sweeping upcoming updates to SEC disclosure rules, California and New York have passed bills that include large non-compliance penalties. Under the regulation of California SB253, US-based companies with annual revenues of $1 billion or more doing business in California may receive penalties of up to $500,000 each per year if they fail to file GHG carbon emissions data on time. Under another regulation, SB261, companies are subject to penalties of up to $50,000 in a reporting year if they fail to prepare appropriate climate-related financial risk reports and list measures that help them reduce or adapt to identified risks. New York City’s Innovation LL97 Emissions Law, which places carbon caps on buildings larger than 25,000 square feet, also imposes fines for violations: failure to report comes with a fine of $0.50 per building per square foot per month; exceeding emission limits fines $268 for each metric ton over the building’s established limit; and providing false statements is penalized by a $500,000 fine. These examples provide insight into the gravity of the failure to embed and measure sustainability strategies, and such requirements are only expected to continue to increase.

Read more about how the California laws that will impact companies throughout the U.S. in our special report, “California Leads Way On Climate And Emissions Disclosures: Public And Private Companies Must Now Prepare For New Reporting Requirements.”

Conclusion:

Real estate firms must continue to prioritize sustainability as risks associated with failing to do so continue to increase. As outlined, the potential returns and risk mitigation strategies associated with ESG considerations present a compelling case for real estate players in five key ways: increased revenue, reduced costs, access to capital, mitigated climate risk, and avoidance of legal challenges. By identifying how the long-term benefits of embedding sustainability measures outweigh the costs, real estate firms can stay competitive in an ever-changing market.

For more in-depth information on sustainability initiatives, we invite you to explore our insights on various topics such as climate risks and opportunities, materiality assessments, carbon neutrality, and more.