Copyright © 2023 Telesto Strategy LLC, All rights reserved.

Rather than treating climate risk as just another compliance exercise, businesses should invest the necessary time and resources to capture value (or avoid loss) as the world transitions to hotter weather and a carbon-free economy.

In an era defined by increasing climate-related challenges and a growing global awareness of environmental issues, businesses are facing a pressing imperative: the need to integrate climate risk into their operations, strategy, and public disclosures. The consequences of climate change, including extreme weather events, resource scarcity, and shifting consumer preferences, are becoming more pronounced, making it essential for companies to take proactive steps to manage and mitigate these risks – and capitalize on attendant opportunities.

This article explores how businesses can think about climate risk and outlines key actions to integrate it effectively into their risk and strategy functions, as well as key considerations when preparing disclosures aligned with the Task Force on Climate-related Financial Disclosures (TCFD) recommendations.

The growing importance of climate risk assessments

Businesses face significant risks and opportunities as climate becomes more extreme and society transitions towards more sustainable practices. Extreme weather events pose a new risk to physical assets and supply chains, while shifting buyer preferences and regulatory regimes will impact successful business models. Some 20% of businesses may face credit downgrades by 2035 due to climate vulnerabilities. Businesses are waking up to this threat, with 23% of U.S. companies citing climate change as among their top three material issues, up from 16% in 2018.

As of today, only 1.2% of companies are making substantial disclosures of their climate risks and mitigation strategies. This figure is expected to rise over the coming years due to various regulatory pressures, including:

- Proposed SEC climate-related reporting enhancements would require US public companies to disclose information across a variety of climate-related topics, including climate-related risks and impacts. Climate risk disclosure requirements are expected to closely follow the TCFD’s recommended approach. The final SEC rule enhancements are currently expected in October 2023, though public companies will have several years to reach compliance.

- The proposed “Federal Supplier Climate Risks and Resilience Rule” for federal agencies would require major US federal contractors to disclose their emissions, SBTi targets, and climate-related financial risks. Like the SEC rule enhancements, climate risks should be assessed in accordance with the TCFD’s recommendations. The rule is expected to be implemented in late 2024 or early 2025.

- The EU’s Corporate Sustainability Reporting Directive (CSRD) is expected to affect thousands of US companies with significant operations in Europe during its final phase-in period beginning in 2024. Among its many directives is a requirement for robust reporting of companies’ climate-related financial risks and opportunities using an approach that broadly aligns with the TCFD.

Defining climate risks

Climate risk can be categorized into two types of risk: physical and transition. In the sections below, we dive into both types of risk and how companies can build robust risk identification and mitigation strategies.

Physical risk

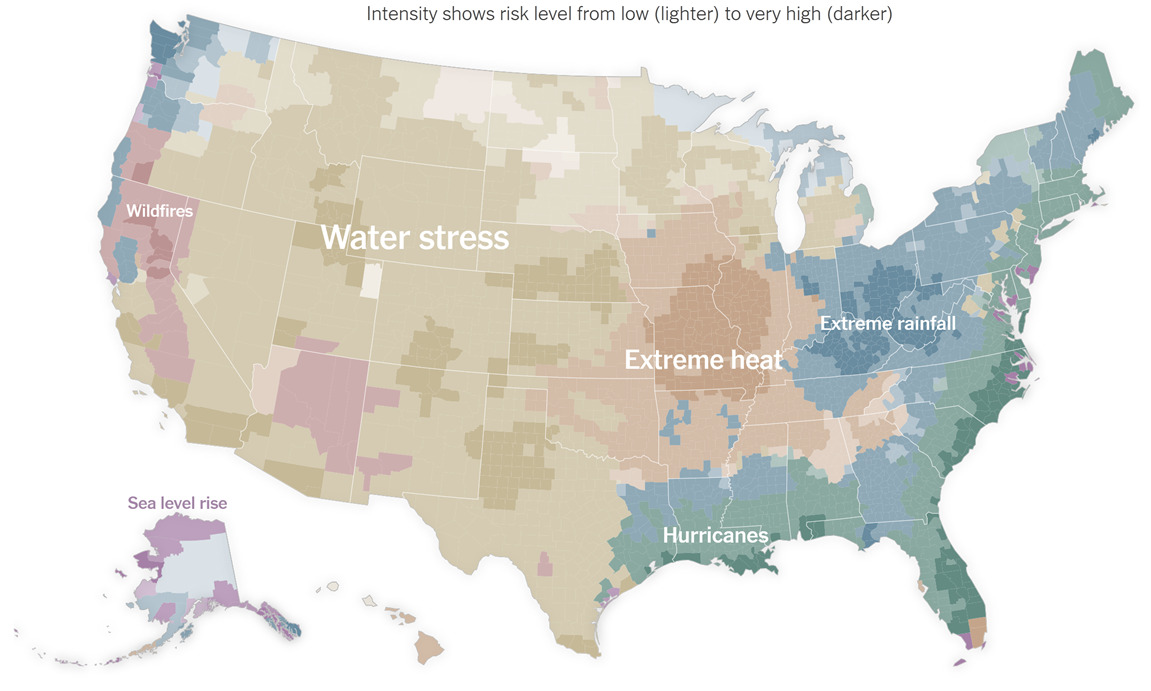

Physical risk is the risk of damage, disruption, and harm to assets and people as a result of extreme weather events. This can include extreme heat events, hurricanes, flooding, wildfire, and droughts. The likelihood of these events is increasing across the United States, though not equally – for example, bigger and more frequent hurricanes will disproportionately impact coastal regions.

SOURCE: Four Twenty Seven

The increased frequency and severity of extreme weather will have a profound impact on businesses. Upkeep and repair of physical assets will increase, with some likely becoming financially unviable to maintain. Extreme heat will limit the capacity of outdoor labor in industries such as construction agriculture, while flooding will disrupt transportation networks. Business travel, employee commutes, and supply chains will be more frequently disrupted while droughts and crop failures may lead to resource scarcity.

Transition risk

Transition risk includes the businesses risks associated with the anticipated shift to a lower carbon economy. It is driven by a variety of factors including policy changes, disruptive technologies, shifts in supply chain and consumer demand for products, or changing public perception of products or companies.

For example, a recent report by Deloitte Economics found that the US’s clean energy, government services, professional services, and manufacturing sectors all stand to gain more than $100B per year by 2070 in a low-emissions scenario, while the transport, resources, and conventional energy all stand to lose more than $100B. Individual companies within these sectors may see relatively different sets of risks and opportunities depending on their particular business model – for example, while fracking companies may at first appear to be at significant risk of decreased value capture in a low-carbon economy, some players may see significant opportunities in the emerging carbon capture and storage market.

Using risk management to drive value

Identifying, assessing, and managing climate risks can generate significant value for organizations. Appropriate management yields operational resilience in the face of disruption, enabling companies to outperform competitors in times of climate-induced market turbulence. Moreover, rigorous climate risk disclosures signal to customers and investors that businesses are adequately considering and mitigating material risks.

To ensure rigorous and impactful climate risk assessments, companies should leverage the following best practices:

- Define clear outcomes supported by concrete risk assessment outputs. Climate risk assessments can serve many purposes such as regulatory compliance, building supply chain resilience, shaping portfolio management, and informing capex deployment. Climate risk assessors should work with leaders across the organization to ensure their outputs match the structure, fidelity, and assurance levels required by their stakeholders.

- Start simple and layer in complexity over time. As is the case with many ESG initiatives, organizations may find that they lack sufficient data for a robust and granular climate risk assessment. Rather than abandoning the effort, assessors should proceed with available data and use proxies, benchmarks, or stakeholder interviews to supplement gaps – while noting potential areas for improvement in future assessments.

- Leverage forward-looking quantitative forecasts. While none can say for certain what climate change will bring, it is assured that tomorrow’s climate will be more extreme than yesterday’s. Historical or current-day risk assessment models – such as FEMA’s National Risk Index – are useful for initial assessments, but do not account for increased extreme weather as the world continues to warm. Businesses should strive to use forward-looking models that account for continued warming and thus provide a more accurate assessment of attendant risks.

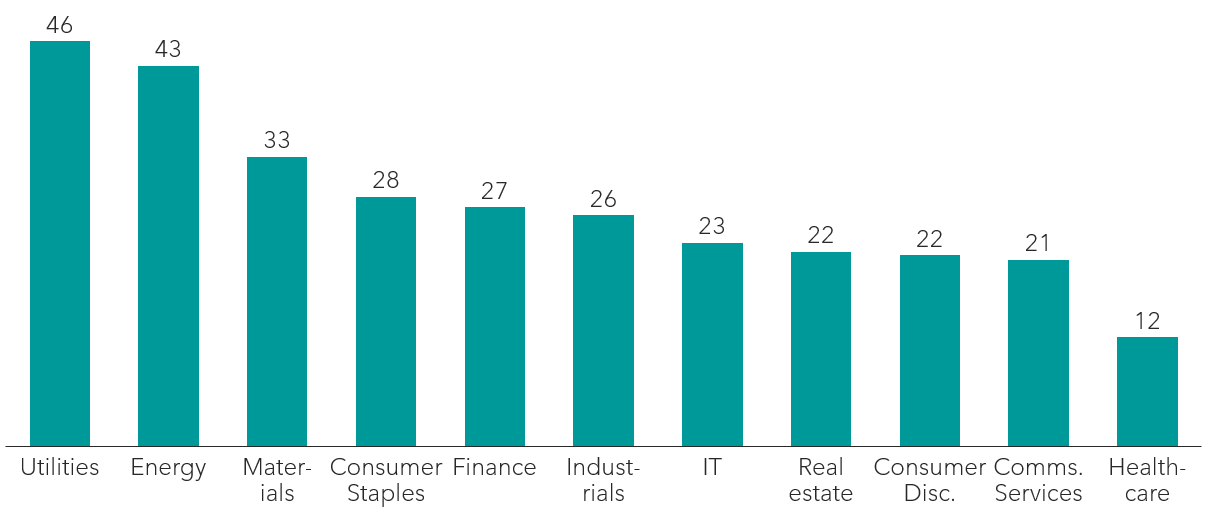

- Use multiple scenarios. Organizations should also leverage multiple scenarios to understand the sensitivity of both their physical and transition risks. Potential transition risk scenarios to consider are carbon taxes, the speed of the clean energy transition, and shifts in consumer preferences. Sectors such as utilities and energy, which are likely to see the greatest impact from the shift to a carbon-free economy, are already employing multiple transition scenarios in their assessments, but other sectors are lagging. For physical risks, organizations should examine both “middle of the road” and “worst case” emissions and warming scenarios.

The use of scenarios in climate risk transition risk assessments varies significantly by sector (% of companies surveyed)

SOURCE: S&P Corporate Sustainability Assessment 2021

- Consider interdependencies and knock-on effects. Risks do not exist in a vacuum – they are often multidimensional and interrelated. For example, extreme heat waves will likely tax local power grids potentially leading to brownouts, and could also lead to flight disruptions due to unstable air conditions. As such, businesses should consider potential interdependencies and knock-on effects of their material climate risks.

- Integrate findings into operations and strategic planning. After completing a climate risk assessment, organizations should design and implement cross-functional risk management solutions. For example, capital planning teams should consider increased extreme weather for both new assets and when conducting routine maintenance of existing assets. HR teams should consider potential impacts to employee travel and remote work due to extreme client. And most importantly, company leaders should integrate material transition and physical risks into their long-term strategic planning.

Undertaking a rigorous, data-backed, and impartial climate risk assessment can be a daunting task for an organization. If you or your team are interested in conducting an assessment, please reach out to a member of our team.