Board series: Armed conflict in the boardroom: Planning for a year of geopolitical flashpoints

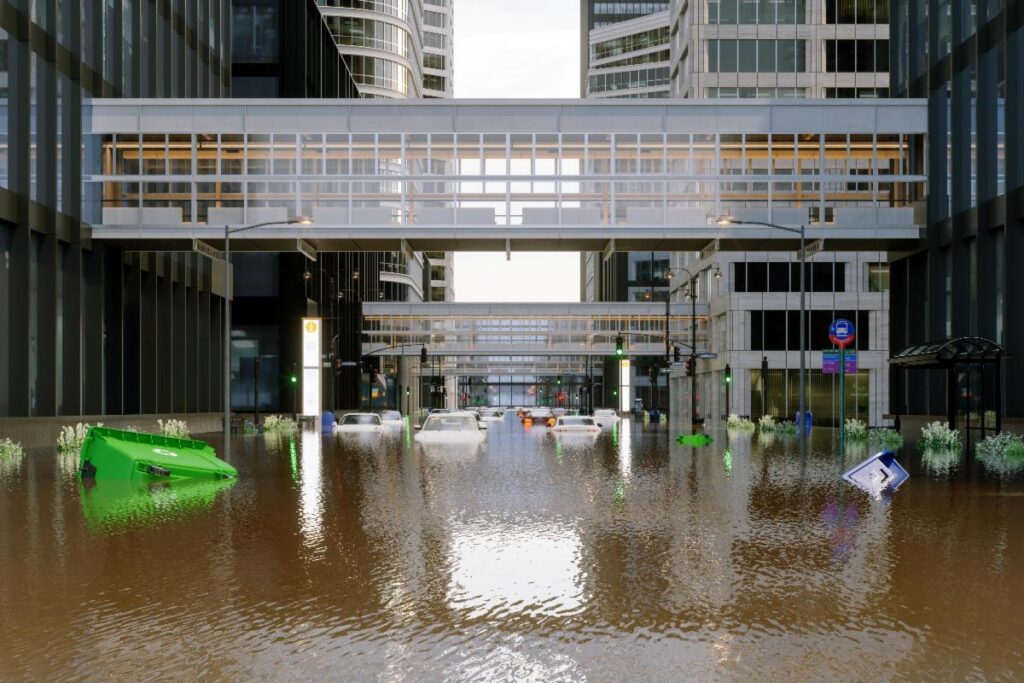

In 2026, geopolitics no longer simmers in the backdrop; instead, it should be considered a design constraint for growth, capital allocation, and operational continuity. As opposed to thinking about which conflict is most likely to erupt, leaders will have to understand which stack of pressures will compound fast enough to break our assumptions. The World Economic Forum’s 2026 Global Risks Perceptions Survey puts geoeconomic confrontation (e.g., tariffs, investment restrictions, resource leverage) as the top short-term risk, now overtaking armed conflict. The central question worth exploring – can your firm absorb shocks without halting growth?