Water is rapidly emerging as a defining business case in U.S. real estate, yet it remains largely under-considered in most investment and operational strategies. Scarcity, flooding, infrastructure failures, rising water costs, and regulatory tightening are already impacting asset values, insurance costs, and development feasibility. With half the global population projected to live in water-stressed regions by 2030 and U.S. cities already integrating water stewardship for future developments, proactive water management is becoming a crucial competitive differentiator and financial imperative for real estate leaders.

Key Takeaways

- Water risks are rising rapidly, impacting asset values, operational continuity, and profitability due to increasing scarcity, flooding, and aging infrastructure.

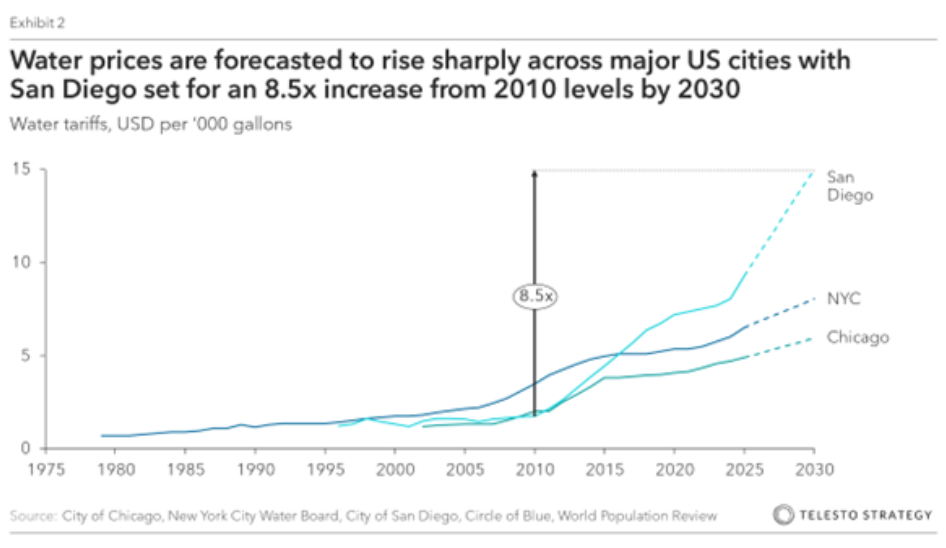

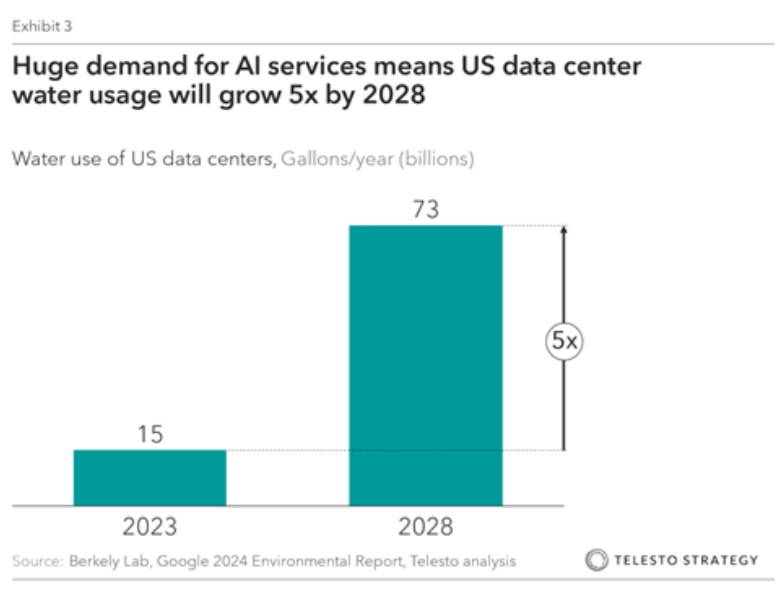

- Water costs are increasing, putting pressure on net operating incomes, especially for water-intensive properties such as resorts, multifamily complexes and data centers.

- Proactive water stewardship is critical, requiring comprehensive analytics, targeted retrofits, and clear objectives to mitigate risks and secure long-term asset resilience.

Six structural trends elevating water as a business case in real estate

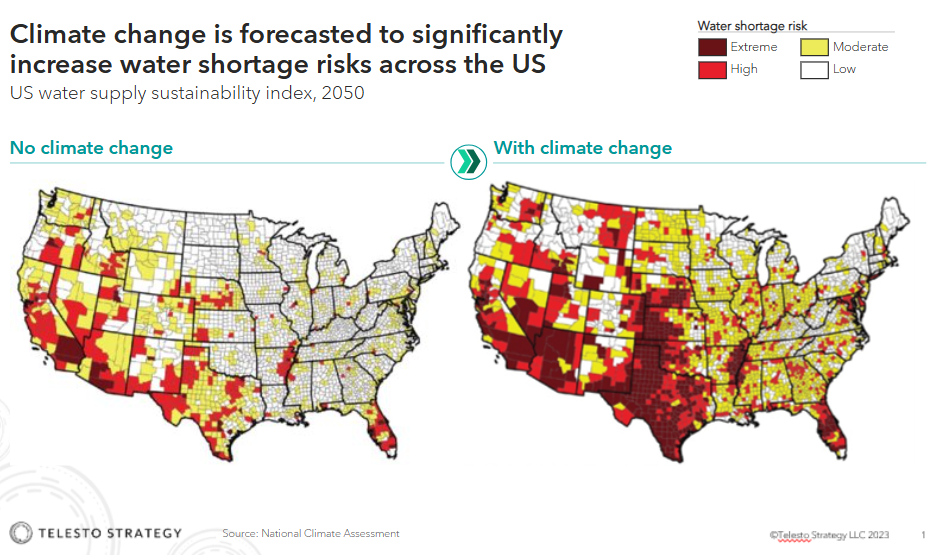

- Rising physical and operational exposure: Water-related events such as droughts, severe rainfall and floods are growing in intensity and frequency. A 2024 UCS analysis projects nearly 1,100 U.S. infrastructure assets — fire stations, wastewater plants, public housing — will face disruptive flooding at least twice annually by 2030. Recent catastrophic events underscore this risk. In July 2025, Texas Hill Country floods caused between $18 and $22 billion in total damage and economic loss. Shortly after, New Mexico faced flooding from 3.5 inches of rain in just 90 minutes. Meanwhile, states like California and Arizona are witnessing chronic water stress that disrupts construction timelines, reduces operating efficiency, and increases insurance complexity.

- Water availability and quality challenges: The U.S. loses an estimated 6 billion gallons of treated water daily due to leaky pipes, with over 250,000 water main breaks annually. Infrastructure upgrade needs are expected to be over $1 trillion during the next two decades. Properties are increasingly affected by service interruptions, boil notices, and localized failures that degrade tenant satisfaction and increase OpEx.

- Rising water costs and pricing volatility: Water is becoming an increasingly large and volatile operating expense for real estate assets. Between 2010 and 2017, water tariffs surged by an average of 54% across major U.S. cities, and residential bills climbed ~64% nationally during 2012-23. These hikes are squeezing NOI, particularly for water-intensive properties like resorts, multifamily complexes, and data centers. Unlike energy, water cost increases are less easily mitigated through efficiency or alternative sourcing, leaving owners exposed to unpredictable surcharges.

- Investor & insurer re-pricing of water risk: Water stress has become a critical determinant in asset valuation and insurance underwriting. Leading investors, like BlackRock, now include water risk assessments into real estate evaluations. Properties situated in areas with extreme flood or water-stress risk face valuation discounts of 5–10%. Similarly, commercial properties in high-risk regions have experienced increases of 100% or more in insurance costs over five years, and in water-stressed states, like Florida, major insurers are withdrawing altogether.

- Intensifying regulatory and reporting mandates: Real estate faces growing regulatory scrutiny and investor pressure on water management. States like Arizona are restricting housing permits due to groundwater shortages, directly impacting development. Cities such as Boston and San Jose now mandate annual public reporting of building water use. Voluntary frameworks (CDP, TCFD, GRESB) increasingly demand transparent water metrics, with 89% of market-cap–weighted REITs now publicly reporting building-level water-use intensity, up from 64% in 2021. For example, Ventas, a leading healthcare REIT, has set a 20% water intensity reduction goal by 2030 and already installed smart irrigation and leak controls, cutting usage ~40% at retrofitted senior housing communities.

- Changing tenant expectations: Tenant scrutiny of water resilience is intensifying, particularly in water-intensive sectors like data centers, manufacturing, and hospitality. Data centers, which use approximately 6.8 million gallons per year per MW of generation, are increasingly prioritizing locations with secure water supplies and proven conservation plans. Companies like Microsoft are embedding ambitious water goals into leasing criteria, explicitly assessing local water stress before committing to new sites.

Strategic imperatives for real estate leaders

- Quantify water risk and operating costs exposure to inform capital allocation: Real estate leaders should quantify not only physical and regulatory risks but also rising water-tariff trajectories across their portfolios. Basin-specific analysis with forward-looking tools like Aqueduct and WRI’s Water Risk Atlas enables scenario modelling of operating expenses (based on alternative tariff scenarios), asset values, and net operating income (NOI). Integrating these broader business-case insights into acquisition due diligence and asset management planning ensures proactive capital deployment and resilience.

- Embed advanced analytics and tools for improved water management: For proactive water management, real estate leaders should integrate advanced analytics, like the ones offered by Faros platform, into strategic decision-making. Leveraging GIS and climate-tech tools further helps to pinpoint asset-level risks for targeted action. Other tools like Sloan’s PWT software enhance real-time water management in complex properties.

- Design and retrofit for water efficiency: Although water retrofits typically offer lower paybacks compared to energy upgrades, they remain critical for enhancing resilience, hedging against price volatility and reducing operational risk. Effective strategies, which include the installation of low-flow fixtures, rainwater harvesting systems and others, can potentially lead to water savings of up to 20%. Additionally, LEED-certified buildings with water-efficiency credits can command rental premiums of 4–6%.

- Stay ahead of tenant water priorities to become the landlord of choice: To stay competitive, real estate leaders must align with tenants’ growing water goals — especially in water-intensive sectors like data centers and manufacturing. This means co-setting measurable targets, offering transparent water performance data, and enabling tenant ESG reporting. Proactive partnerships with utilities, municipalities, and industry peers support shared infrastructure and contingency planning. Implementing board-level oversight and transparent disclosures aligned with frameworks like TCFD and GRESB ensures accountability and enhances stakeholder trust.

Considerations for real estate leaders:

- Do we track water consumption and risk exposure across our portfolio?

- Have we integrated water topics into our risk management and strategic decision-making processes?

- Are we capturing all potential value through water-efficient design, branding, and tenant engagement?

- What is our investment case for proactive water resilience – and how does it compare to business-as-usual?

Get in touch with Telesto Strategy to learn how forward-looking firms are turning water risk into resilience — and competitive advantage.

Our people

Andrew Alesbury

Partner, Washington DC

With a background spanning both urban planning and private real estate development in the United States and Middle East, Andrew supports real estate investors and other firms with large portfolios of physical assets to create sustainable strategies which integrate resilience and sustainable risk management into their business models and investment processes.

Ben Vatterott

Partner, San Francisco

Ben has led sustainability and growth strategy projects for clients across the real estate ecosystem, including investment firms, construction materials manufacturers, PropTech companies, and more. He supports clients on a number of strategic topics such as setting net zero targets, embedding sustainability and emissions reduction into capital deployment, and capturing sustainable growth opportunities.

Diego Bernstein

Manager, Miami

Diego is a seasoned consultant with focus in business strategy, environmental sustainability, and data science.

Diego’s experience includes leading the implementation of the Net Zero strategy for a Fortune 500 Real Estate company and supporting a S&P 500 REIT to embed climate risk in its investment decision processes.