Building Performance Standards (BPS) represent the most significant regulatory transformation in commercial real estate since modern zoning codes. Unlike voluntary sustainability frameworks, BPS regulations impose mandatory carbon and energy targets backed by substantial financial penalties, effectively placing a price on building inefficiency.

Regulatory changes transform real estate economics

As of 2024, thirteen U.S. cities and several states have enacted BPS, impacting approximately 25% of the nation’s building stock. The financial stakes are immediate and escalating: New York’s Local Law 97 levies $268 per excess ton of CO₂, Washington D.C. imposes penalties up to $10 per square foot (capped at $7.5 million per building), and Boston enforces daily fines reaching $1,000 for large buildings.

For real estate investment trusts (REITs) which typically concentrate holdings in major urban markets, BPS fundamentally alters portfolio economics. The first compliance deadlines have already in motion: New York City’s law took effect in 2024 (and survived legal challenge in 2025), Boston’s BERDO 2.0 begins enforcement in 2025, and D.C.’s cycle is underway. Early projections indicate 11% of NYC buildings will incur fines in the first compliance period, rising to over 60% by 2030 if owners delay action. This compressed timeline is forcing REITs to rapidly reassess capital allocation priorities, tenant engagement strategies, and asset valuation methodologies. This regulatory risk is now urgent, demanding immediate focus from top executives.

Cases in point:

Real Estate Investment Trusts (REITs) are exhibiting markedly different approaches to Building Performance Standards, resulting in varied outcomes across their portfolios.

- Empire State Realty Trust (ERST): Proactive compliance as competitive advantage. Anticipating regulatory pressure, ESRT invested $31 million in comprehensive retrofits including HVAC modernization and envelope improvements across its flagship property. The financial results demonstrate strategic foresight: energy consumption dropped 40%, generating annual savings exceeding $4 million, while emissions fell 54% from 2009 levels — positioning the asset ahead of 2024 thresholds and avoiding projected six-figure annual penalties. Beyond regulatory compliance, management notes the retrofit attracted premium tenants seeking efficient space, supporting occupancy in a challenging office market. By converting compliance obligation into competitive positioning, ESRT demonstrates how strategic capital deployment simultaneously mitigates regulatory risk and enhances market differentiation.

- JBG Smith: Transparent risk disclosure in a high-exposure market. With significant Washington D.C. holdings, the REIT explicitly acknowledged that “properties that cannot meet performance standards risk fines for non-compliance, as well as a decrease in demand and a decline in value” —effectively treating BPS as material financial risk rather than operational detail. This candour signals mature risk management. With D.C. penalties reaching $10 per square foot, a 500,000 square foot building facing partial shortfalls could incur multi-million-dollar payments. JBG Smith’s transparent disclosure maintains investor confidence while managing capital deployment to systematically reduce portfolio exposure.

- Boston Properties: Pre-emptive decarbonization at portfolio scale. BXP achieved operational carbon neutrality in 2024 through efficiency investments and renewable contracts, while maintaining 91% of its portfolio at LEED Gold/Platinum certification. This pre-emptive approach has yielded strategic advantages: minimized BERDO fine exposure, enhanced tenant attraction in premium segments, and strengthened investor positioning. By embedding sustainability as core strategy rather than compliance overhead, BXP converted potential regulatory burden into market differentiation — particularly valuable where tenant sustainability requirements increasingly drive leasing decisions.

- Data center REITs: Voluntary alignment with sustainability imperatives. Equinix achieved 96% renewable energy coverage across global operations, while Digital Realty contracted 1.5 GW of renewable capacity. These investments respond to tenant requirements while pre-empting potential federal regulations — demonstrating how proactive sustainability investment creates competitive advantage across property types.

Strategic implications: Beyond compliance to value creation

- Capital expenditure pressures and ROI dynamics. BPS fundamentally reshapes REIT capital priorities. Comprehensive retrofits demand substantial investment amounting to tens of millions for major office towers. However, the business case often favors investment over penalties. An NYC building exceeding its carbon limit by 1,000 metric tons incurs $268,000 in annual fines indefinitely, with no building improvement. Conversely, retrofits generate 20-35% energy savings, improve net operating income, and preserve asset value. Federal incentives significantly enhance economics. The 179D tax deduction provides up to $5.81 per square foot for qualifying improvements. NYC’s Beneficial Electrification Credit offers double emissions credits for heat pump installations before 2027, potentially eliminating penalties for early adopters. These mechanisms can reduce net costs by 30-50%, dramatically improving payback periods.

- Valuation Effects: Green premiums and brown discounts. Market evidence increasingly demonstrates sustainability’s impact on asset values. CBRE research shows LEED-certified offices command 3-4% rent premiums compared to conventional buildings after controlling for location and age. More significantly, the study identifies a “brown discount”— inefficient buildings must offer lower rents to attract tenants or face extended vacancy. This valuation dynamic reflects tenant decision-making: corporations with carbon reduction commitments increasingly prioritize energy-efficient space to manage Scope 3 emissions. Buildings facing ongoing BPS penalties present liability risks that sophisticated tenants and investors incorporate into lease negotiations and acquisition underwriting.

- Beyond fines, enforcement also affects operations and reputation. Several jurisdictions use penalties that are not monetary and these carry real business impact. For example, St. Louis can withhold or deny new occupancy permits for buildings that do not comply, and it can place liens on properties with unpaid penalties. Chula Vista in San Diego County may publicly disclose a property’s noncompliance after a 60-day notice period. New York City assigns an energy grade “F” when an owner fails to file the required benchmarking report, and the grade must be posted at the building entrance. These measures increase the risk of lost revenue, lender scrutiny, and tenant churn, so accurate reporting, early remediation, and clear disclosure plans are as important as the retrofit program.

- Operational excellence and tenant experience. Efficiency investments yield operational benefits beyond compliance. Upgraded systems improve comfort and air quality while reducing maintenance issues — supporting tenant satisfaction in competitive markets. Achieving deep reductions requires landlord-tenant cooperation, accelerating adoption of “green lease” structures that align incentives for efficiency investments and operational practices.

Leadership imperatives: Strategic responses for REIT executives

- Map portfolio exposure and prioritize action. REIT leaders should assess exposure by identifying properties affected by mandates, comparing performance to targets, and evaluating financial risk. Analytics can pinpoint concentration risks, allow targeted investmentinvestment, and turn compliance into portfolio optimization.

- Integrate capital planning and financing options. Progressive REITs align BPS requirements with capital plans;plans, scheduling equipment upgrades for compliance and incentives. They consider financing options like green bonds, PACE loans, and energy partnerships, optimizing funding with incentives and favourable rates to reduce costs.

- Engage stakeholders for competitive differentiation. Top REITs use sustainability investments to boost portfolio value, efficiency, and appeal. For tenants, they implement green leases and highlight shared sustainability benefits; for investors, they provide clear updates on compliance, metrics, and financial impact.

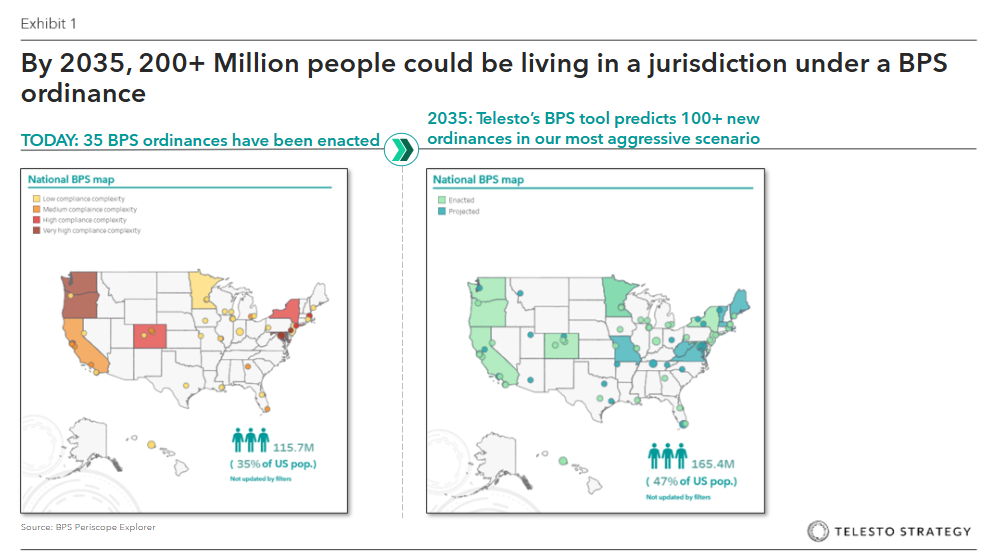

- Use analytics to plan and communicate. Many REIT teams now rely on integrated data tools to translate complex policy into practical action. Telesto’s BPS platform exemplifies this shift: it maps jurisdictional rules against real asset data, models the trade-offs between penalties and retrofits, and produces ROI-ranked compliance roadmaps. The output is a clear exposure dashboard executives can take to boards, lenders, and tenants showing how compliance decisions protect value rather than simply satisfy regulation. Telesto’s Odyssey platform can be used for portfolio-level scenario design and capital expenditure road-mapping.

Strategic questions for REIT leadership

- Have we quantified building-by-building exposure across all BPS jurisdictions, including projected penalties and compliance costs?

- How are we optimizing retrofit investments to maximize emissions reduction per dollar while capturing all available incentives?

- What mix of green bonds, sustainability-linked financing, and traditional capital optimizes our cost of capital for decarbonization?

- How can sustainability leadership enhance tenant attraction, support rent premiums, and strengthen investor confidence?

- Do we have the analytical tools, technical expertise, and cross-functional coordination to execute portfolio-wide compliance efficiently?

- Are we monitoring emerging requirements to anticipate future stringency and incorporate long-term compliance costs into underwriting?

Building Performance Standards mark a fundamental revaluation of real estate based on carbon efficiency. The cost of inaction compounds rapidly: escalating penalties, brown discounts, tenant flight, and stranded asset risk.

Conversely, REITs that proactively invest in efficiency, leverage available incentives, and communicate sustainability leadership are positioned to preserve asset values, reduce operating costs, and capture tenant and investor preference. In an industry where competitive advantage often comes from marginal improvements in cost structure or tenant retention, the strategic upside from BPS leadership is substantial.

The question is no longer whether to comply, but how to convert compliance obligation into strategic advantage. As 2030 deadlines approach and standards tighten, REIT executives who act decisively today will define tomorrow’s competitive landscape.

Our people

Andrew Alesbury

Partner, Washington DC

With a background spanning both urban planning and private real estate development in the United States and Middle East, Andrew supports real estate investors and other firms with large portfolios of physical assets to create sustainable strategies which integrate resilience and sustainable risk management into their business models and investment processes.

Ben Vatterott

Partner, San Francisco

Ben has led sustainability and growth strategy projects for clients across the real estate ecosystem, including investment firms, construction materials manufacturers, PropTech companies, and more. He supports clients on a number of strategic topics such as setting net zero targets, embedding sustainability and emissions reduction into capital deployment, and capturing sustainable growth opportunities.

Diego Bernstein

Manager, Miami

Diego is a seasoned consultant with focus in business strategy, environmental sustainability, and data science.

Diego’s experience includes leading the implementation of the Net Zero strategy for a Fortune 500 Real Estate company and supporting a S&P 500 REIT to embed climate risk in its investment decision processes.