Corporate Director Insights

Written to equip Corporate Directors with questions and leading practices to mitigate ESG and climate risks, anticipate regulatory changes, and oversee climate and sustainability disclosures & reporting.

Insights for the boardroom

In 2026, geopolitics no longer simmers in the backdrop; instead, it should be considered a design constraint for growth, capital allocation, and operational continuity. As opposed to thinking about which conflict is most likely to erupt, leaders will have to understand which stack of pressures will compound fast enough to break our assumptions. The World Economic Forum’s 2026 Global Risks Perceptions Survey puts geoeconomic confrontation (e.g., tariffs, investment restrictions, resource leverage) as the top short-term risk, now overtaking armed conflict. The central question worth exploring – can your firm absorb shocks without halting growth?

As corporate complexity multiplies into 2026, the board chair will have to grapple with the upheaval on the corporate landscape. Historically centered on governance stewardship, strategic guidance, and CEO partnership, the chair is increasingly becoming the architect of enterprise risk governance and – in real-time – the chief navigator for continuous strategic revision.

Over the last two years, the AI conversation in boardrooms has shifted from “What is this?” to “How can we best deploy?” The next wave for early adopters is to advocate for including AI agents as de facto members of the board – embedded in the board portal, continuously scanning risk, proposing agenda items, and generating draft resolutions. For large multinationals, the question is no longer whether AI will set in the boardroom - it already does. The question becomes, how far should boards go in treating AI systems as quasi-members of the governance team? And, what does it mean for fiduciary duty, legal liability, and board dynamics?

Over the last two years, the AI conversation in boardrooms has shifted from “What is this?” to “How can we best deploy?” The next wave for early adopters is to advocate for including AI agents as de facto members of the board – embedded in the board portal, continuously scanning risk, proposing agenda items, and generating draft resolutions. For large multinationals, the question is no longer whether AI will set in the boardroom - it already does. The question becomes, how far should boards go in treating AI systems as quasi-members of the governance team? And, what does it mean for fiduciary duty, legal liability, and board dynamics?

Audit committees have long been the mandated nexus of corporate financial reporting, internal controls, and risk management. Even though these committees face a full slate of topical oversight and compliance – financial, internal audit, AI, cyber, ESG, Sustainability, DEI – 2025 has also brought forward a new suite of risks. Namely, trade and tariffs, and geopolitical conflict. With so much responsibility across a broad spectrum of issues, have audit committees become the “kitchen sink” of corporate boards?

Over the last two years, the AI conversation in boardrooms has shifted from “What is this?” to “How can we best deploy?” The next wave for early adopters is to advocate for including AI agents as de facto members of the board – embedded in the board portal, continuously scanning risk, proposing agenda items, and generating draft resolutions. For large multinationals, the question is no longer whether AI will set in the boardroom - it already does. The question becomes, how far should boards go in treating AI systems as quasi-members of the governance team? And, what does it mean for fiduciary duty, legal liability, and board dynamics?

In the next decade, the most competitive companies will be governed not by the most prestigious resumes, but by boards engineered for complexity. U.S. boardrooms are re-skilling under pressure from four converging forces: (i) AI deployment and risk, (ii) supply chain and ESG regulation that reaches deep into suppliers, (iii) increasing geopolitical tensions, and (iv) heightened investor scrutiny of board capability, disclosure, and refreshment. In 2025 and beyond, governance sophistication is no longer optional – it is a determinant of market value, stakeholder trust, and competitiveness.

U.S. university endowments collectively hold more than $800 billion in assets, with approximately 50% in alternative investments and 30-40% in public equities. These portfolios are vital to funding scholarships, research, and campus operations. However, these entities are facing heightened exposure to climate-related risks, including stranded assets in fossil fuels, physical damage to tangible assets, and transition risks stemming from regulatory and market changes. Analysis suggests $1-4 trillion in fossil fuel assets globally could become stranded by 2050 if climate policies tighten, creating potential permanent impairments for equity holders. Some elite institutions still report fossil-fuel exposure of 2–6%.

Quantum computing is moving fast from theoretical promise to boardroom strategy. With venture funding topping $2.6 billion globally in 2024, of which $1.7 billion went to U.S. companies, U.S. multinationals are launching quantum pilots and assessing their risks to encryption threats. Whether it’s big tech, pharmaceutical, or energy, if fully commercialized, analysts estimate a $2 trillion economic impact by 2035. Can your organization gain the quantum advantage?

With broad policy upheaval in the U.S. under President Trump’s second term, Sustainability Committees on corporate boards stand on shaky ground. The administration has effectively terminated and significant allocations for renewable energy, retreated from the Paris Agreement, spurred ESG-backlash, weakened the EPA, NOAA, and SEC mandates. At the same time, the global momentum for ESG and Sustainability persists. Even if the political momentum is going in one direction, board members will have to balance the reality of climate, social, litigation, and governance risks remain financially material and globally governed.

With broad policy upheaval in the U.S. under President Trump’s second term, Sustainability Committees on corporate boards stand on shaky ground. The administration has effectively terminated and significant allocations for renewable energy, retreated from the Paris Agreement, spurred ESG-backlash, weakened the EPA, NOAA, and SEC mandates. At the same time, the global momentum for ESG and Sustainability persists. Even if the political momentum is going in one direction, board members will have to balance the reality of climate, social, litigation, and governance risks remain financially material and globally governed.

With broad policy upheaval in the U.S. under President Trump’s second term, Sustainability Committees on corporate boards stand on shaky ground. The administration has effectively terminated and significant allocations for renewable energy, retreated from the Paris Agreement, spurred ESG-backlash, weakened the EPA, NOAA, and SEC mandates. At the same time, the global momentum for ESG and Sustainability persists. Even if the political momentum is going in one direction, board members will have to balance the reality of climate, social, litigation, and governance risks remain financially material and globally governed.

With broad policy upheaval in the U.S. under President Trump’s second term, Sustainability Committees on corporate boards stand on shaky ground. The administration has effectively terminated and significant allocations for renewable energy, retreated from the Paris Agreement, spurred ESG-backlash, weakened the EPA, NOAA, and SEC mandates. At the same time, the global momentum for ESG and Sustainability persists. Even if the political momentum is going in one direction, board members will have to balance the reality of climate, social, litigation, and governance risks remain financially material and globally governed.

With broad policy upheaval in the U.S. under President Trump’s second term, Sustainability Committees on corporate boards stand on shaky ground. The administration has effectively terminated and significant allocations for renewable energy, retreated from the Paris Agreement, spurred ESG-backlash, weakened the EPA, NOAA, and SEC mandates. At the same time, the global momentum for ESG and Sustainability persists. Even if the political momentum is going in one direction, board members will have to balance the reality of climate, social, litigation, and governance risks remain financially material and globally governed.

With broad policy upheaval in the U.S. under President Trump’s second term, Sustainability Committees on corporate boards stand on shaky ground. The administration has effectively terminated and significant allocations for renewable energy, retreated from the Paris Agreement, spurred ESG-backlash, weakened the EPA, NOAA, and SEC mandates. At the same time, the global momentum for ESG and Sustainability persists. Even if the political momentum is going in one direction, board members will have to balance the reality of climate, social, litigation, and governance risks remain financially material and globally governed.

Despite recent headlines, global corporations continue to implement their sustainability and environmental, social, and governance (ESG) programs, including building sustainable, transparent, and resilient supply chains. As a result, suppliers of all sizes and across all sectors are increasingly being asked to demonstrate their ESG performance.

Months into the new administration, campus sustainability efforts continue to face heightened scrutiny and shifting political headwinds. For university leaders, the question isn’t whether this work still matters—it’s how to continue advancing it amid the risks and pressures. Some institutions have chosen to keep a lower profile. Others are rebranding or reframing their efforts to stay aligned with changing expectations. In this environment, strategy - not silence - is the key to staying on course.

The U.S. power grid is straining under the weight of aging infrastructure, extreme weather, and surging demand from AI, EVs, and electrification. Real estate, which consumes the 75% of U.S. electricity, is going to be directly impacted. What was once a stable utility is now a strategic risk—and potentially, a competitive advantage. The question isn’t whether grid disruption will affect your portfolio, but how you’ll lead through it.

With broad policy upheaval in the U.S. under President Trump’s second term, Sustainability Committees on corporate boards stand on shaky ground. The administration has effectively terminated and significant allocations for renewable energy, retreated from the Paris Agreement, spurred ESG-backlash, weakened the EPA, NOAA, and SEC mandates. At the same time, the global momentum for ESG and Sustainability persists. Even if the political momentum is going in one direction, board members will have to balance the reality of climate, social, litigation, and governance risks remain financially material and globally governed.

The passage of The Big Beautiful Bill (OBBBA) on Friday, July 4th, marks a decisive recalibration of U.S. clean-energy policy and incentive structure—elevating urgency, compliance, and strategic flexibility for corporations. The upending of financial incentives create a real-time operational challenge. Boards must respond by aligning capital schedules, fortifying supply chains, and taking out cost from their decarbonization strategies. How should enterprises evolve their capital allocation for operational effectiveness, ESG targets, and financial return?

Recent shifts in U.S. trade policy—particularly the return of tariffs under President Trump—are more than a political issue. They’re a material business risk. Higher input costs, reduced demand, and overall macroeconomic uncertainty are forcing multinational companies to revisit financial projections and stress-test their assumptions. One area now under pressure: impairment testing for non-financial assets such as property, plant, and equipment (PP&E), intangible assets, and goodwill.

The passage of The Big Beautiful Bill (OBBBA) on Friday, July 4th, marks a decisive recalibration of U.S. clean-energy policy and incentive structure—elevating urgency, compliance, and strategic flexibility for corporations. The upending of financial incentives create a real-time operational challenge. Boards must respond by aligning capital schedules, fortifying supply chains, and taking out cost from their decarbonization strategies. How should enterprises evolve their capital allocation for operational effectiveness, ESG targets, and financial return?

Audit committees have long been the mandated nexus of corporate financial reporting, internal controls, and risk management. Even though these committees face a full slate of topical oversight and compliance – financial, internal audit, AI, cyber, ESG, Sustainability, DEI – 2025 has also brought forward a new suite of risks. Namely, trade and tariffs, and geopolitical conflict. With so much responsibility across a broad spectrum of issues, have audit committees become the “kitchen sink” of corporate boards?

Higher input costs and reduced demand due to President Trump’s tariff policy raise red flags under U.S. GAAP and IFRS for impairment testing of non-financial assets such as property, plant, and equipment (PP&E), intangible assets, and goodwill. The increased economic uncertainty and geopolitical volatility mean projections used to determine “Value in Use” or “Fair Value” may fall below carrying amounts, signaling possible impairments. How are Audit Committees anticipating impairment risks from the material change in U.S. trade policy?

Audit committees have long been the mandated nexus of corporate financial reporting, internal controls, and risk management. Even though these committees face a full slate of topical oversight and compliance – financial, internal audit, AI, cyber, ESG, Sustainability, DEI – 2025 has also brought forward a new suite of risks. Namely, trade and tariffs, and geopolitical conflict. With so much responsibility across a broad spectrum of issues, have audit committees become the “kitchen sink” of corporate boards?

Shareholder activism is surging in 2025. Nearly 600 U.S. companies faced demands in 2024 — up 16% from 2022 — and the pressure is only growing. In Q1 2025, activist campaigns targeting U.S. companies jumped 46%. The boardroom is no longer a quiet place. How can directors ready themselves for what will be a turbulent year in the boardroom?

President Trump recently announced the Golden Dome project – his equivalent to his second term’s moonshot with a goal of completion by 2029. The $175 billion project is envisioned to be a multi-layered defense architecture to shield the U.S. from advanced threats, including hypersonic and space-launched missiles. While certain defense and aerospace contractors—the likes of SpaceX, Palantir, Lockheed Martin, Boeing—remain obvious winners, industrial and CPG companies should consider the ramifications for their sectors over this decade-long investment. With the rise of national security investment, what will be the financial opportunities and operational complexities?

President Trump recently announced the Golden Dome project – his equivalent to his second term’s moonshot with a goal of completion by 2029. The $175 billion project is envisioned to be a multi-layered defense architecture to shield the U.S. from advanced threats, including hypersonic and space-launched missiles. While certain defense and aerospace contractors—the likes of SpaceX, Palantir, Lockheed Martin, Boeing—remain obvious winners, industrial and CPG boards should consider the ramifications for their sectors over this decade-long investment. With the rise of national security investment, what will be the financial opportunities and operational complexities?

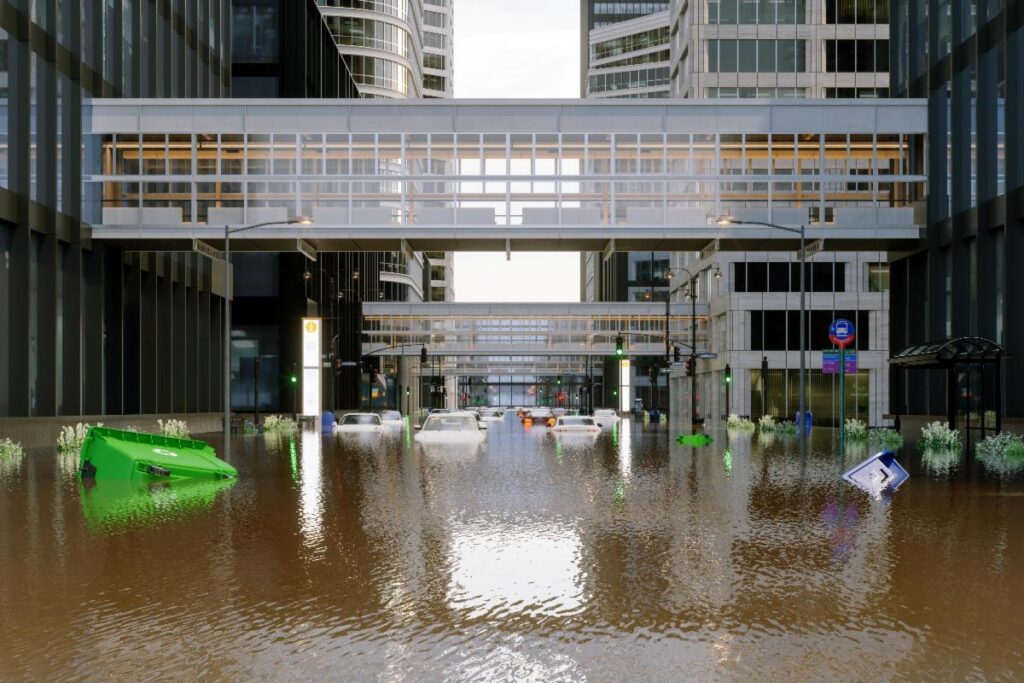

With the reorientation of manufacturing to the U.S. in response to President Trump’s trade policy, multinationals focus on potential site evaluation and selection. Be it Hyundai in Indiana, Apple in Texas, or Toyota in North Carolina, global companies have made public commitments to bring back parts of their complex supply chains to the U.S. While a myriad of factors must be considered – talent pools, state incentives, land availability, access to first-tier supplies—an underrated question is that of physical climate risks. As manufacturing returns, corporate boards will have to ask their teams what climate-driven risks—water shortages, extreme heat, or flooding—will these new sites face? Where will climate-related hazards pose the greatest threat to business continuity and long-term profitability? Is it enough to reconsider our site location?

Some have attributed the unexpected wins for progressive-leaning candidates in Canada and Australia to the “Trump Effect”—where policies and approach from U.S. President Trump have inadvertently galvanized electorates to non-populist electoral victories. While it may be too soon to call it a definite trend, corporate boards should evaluate key elections in 2025 to determine where there might be more political turbulence than anticipated. What additional surprises will 2025 hold?

Some have attributed the unexpected wins for progressive-leaning candidates in Canada and Australia to the “Trump Effect”—where policies and approach from U.S. President Trump have inadvertently galvanized electorates to non-populist electoral victories. While it may be too soon to call it a definite trend, corporate boards should evaluate key elections in 2025 to determine where there might be more political turbulence than anticipated. What additional surprises will 2025 hold?

Alex Kruzel, Founder and CEO of Chicago-based management consulting firm Telesto Strategy recently spoke to students in the Chicago Field Study program at Northwestern University about the current state of sustainability investments amidst a backdrop of federal policy upheaval on energy, trade, and higher education, as well as emerging anti-ESG and anti-Climate tensions. Students in the Field Studies program earn academic credit while working full-time and exploring key business topics through classroom discussion. Using the 10 pillars of sustainability from Kruzel’s book, students were divided into teams to explore the reasons why – or why not – to continue supporting sustainability investments in support of President Trump’s whole of government national security strategy.

With multinational businesses stretched by intensifying geopolitical conflict, macroeconomic shocks, and global trade tensions, CEOs will need expert counsel from their corporate boards more than ever. Yet, new data shows that only one-third of CEOs say they are highly confident in their board’s ability to help them navigate the challenges facing their organization. What’s missing? What are CEOs not getting from their boards and how can the confidence gap be overcome?

As tensions between D.C. and Beijing escalate, corporate directors are looking to better understand and reduce their exposures to the U.S.-China trade war. As of mid-April 2025, we offer a review of China’s non-tariff countermeasures that target the U.S. With an unclear off-ramp for either side, corporate boards will have to further build scenarios that offer greater supplier optionality in the short-term while also re-evaluating long-term enterprise strategy. Overall, the cost of doing business in and with China will increase for U.S. business and will likely have lasting impact. How can businesses manage through China’s escalating retaliation?

With global trade tensions escalating, supplier diversification has been embraced as the leading antidote to mitigate short-term risks. Thus, rapid pushes for multi-sourcing, local-for-local, component substitution, stockpiling, and scenario planning have engulfed corporate boards. CPG companies are accelerating years of work in nearshoring and onshoring suppliers and production. While the financial benefits of supplier diversification seem straightforward, the risks posed to an enterprise without a robust know your supplier program will expose new threats to reputation, operations, customer interfacing, and more. How should corporate directors re-imagine due diligence during Trump 2.0 and global trade upheaval?

After a week of wild swings in markets and growing demands from investors, President Trump’s trade war may be coming into clearer focus with Wednesday’s (4/9) pause on most reciprocal tariffs for 90 days. With stocks surging on Wednesday, many are hoping that his goal is clearer – China containment. President Trump cited talks with foreign nations in explaining the reversal, but said China would not be included after Beijing announced further retaliations. While the China angle is feasible, we also offer a spectrum of scenarios to help decision-makers play-out risks and opportunities. How will boards assess their risks and re-conceptualize their strategies – supply chain, CapEx, de-valuation, and more?

As global trade and security challenges continue to escalate as President Trump begins his second term, an insightful and compelling new book, The Courage to Continue, calls for a non-partisan approach to evaluate how businesses can effectively advance their environmental sustainability agendas and support America’s national security priorities. Authored by Alex Kruzel, founder of Chicago-based management consulting firm Telesto Strategy, the book prompts decision-makers across all industries and sectors with crucial questions and considerations for leaders to advance their corporate sustainability goals.

Real estate company boards are navigating RTO policies by balancing financial impacts, employee preferences, and market trends. The rise of remote and hybrid work has led to underutilized office spaces and changes in tenant demand, prompting boards to explore repurposing, flexible leasing, and strategic property acquisitions. To retain talent, companies are adopting hybrid work models while carefully planning space utilization. Companies are also capitalizing on market downturns by acquiring discounted office properties to adapt to evolving business needs. As the landscape continues to shift, the question is whether boards are being bold enough to rethink the traditional office model, or are they merely reacting to short-term trends?

In the past, political risk has been a specific category of risks that boards and management teams reviewed quarterly and managed through insurance policies. Acute issues were handled by task forces or crisis management teams when needed. Now, under President Trump’s second administration, companies are inundated with constant geopolitical threats and uneven operating conditions. A blurring of political risks is happening in real-time, as political risk is broadening to include: protectionist trade policy, sanctions, tariff retaliation, export/import bans, regional strife and conflict, border security, human rights, international terrorism, failed multilateral cooperation, increasing influence of populist governments, and more. With many of these themes presenting themselves weekly and even daily, how do companies recast their political risk management under Trump 2.0?

As President Trump ramps up his tariff policies in an effort to protect U.S. industries, key trading partners—including Canada, Mexico, the European Union (EU), and China—have announced retaliatory measures. These responses range from reciprocal tariffs to export restrictions on critical raw materials and industrial goods, posing significant risks to U.S. businesses. Understanding these developments and their implications is crucial for corporate executives navigating supply chain disruptions, pricing volatility, and international trade negotiations.

Headlines have proliferated on corporate rollbacks of promises, goals, and investment in ESG (Environmental, Social, and Governance) and Sustainability—in the U.S. and globally. This can be a range of topics – be it emissions reduction goals, waste reduction goals, and, most dramatically, Diversity Equity & Inclusion (DEI). We are seeing an intensifying pressure on U.S. corporate leaders to limit their legal exposure to concepts that were only recently championed as critical to their success.

In 2024 alone, over 3,000 trade restrictions were implemented globally. This global trend is reflected predominantly in President Trump's protectionist trade agenda. With their complex international footprint, global companies like Caterpillar, Komatsu, Unilever, Nestlé, BMW, Mercedes, Toyota will either face the impact of tariffs or retaliatory measures. While President Trump's policies create cost and uncertainty, they also call for adaptation, domestic investment, restructuring, joint ventures, automation, and process innovation. Finally, new climate-related compliance requirements add more complexity to global trade flows with China and Europe.

In February 2025, President Trump reinstated the full 25% tariff on steel imports and increased aluminum tariffs to 25%, eliminating all previous exemptions and alternative agreements. This action expanded the tariffs to include key downstream products and terminated all general approved exclusions. Analysts expect these tariffs to lead to price hikes in vehicles, canned and other consumer products, and construction projects especially. But, if the first round of steel and aluminum tariffs are indicative, U.S. producers generally saw economic gains, job creation, while international companies faced increased costs and market uncertainties. For CPG, Industrial, Automative, and Construction sectors especially, proactive agility and consistent monitoring will be necessary to reduce exposure to global supply chain volatility and increased costs.

With a whole-of-government national security approach, Trump’s America-first policies have intensified competition with China. For good reason, headlines abound on the escalation of trade wars with China – a 10% levy is in effect on goods from China, as well as negotiations with Canada and Mexico -, new tariffs announced on aluminum and steel. What’s falling to the backdrop in his trade policy upheaval, is the neglect of the economic advantages of beating China in renewable tech. Clean energy technology contributed to a record $1.6 trillion to China’s economy in 2023. Consequently, the U.S. and its businesses are losing out on material economic gains.

Jeff Bezos' relationship with President Trump appears much improved in Trump's second term, at least at face value. Bezos, now a key global leader in IT infrastructure and cloud, supply chain, e-commerce, and space ventures, attended Trump’s 2025 inauguration alongside other business executives. He has even expressed enthusiasm about the administration’s space agenda. Additionally, he has downplayed concerns over Elon Musk’s ties to Trump, trusting Musk to act in the public interest. The bigger question remains – with so much exposure in its global operations to trade barriers and tariffs, how will Amazon thrive during Trump’s second administration?

With the EU’s deforestation laws coming online this month, CPG and Industrial companies will need to ensure that select commodities in their supply chains do not contribute to deforestation. The commodities scoped into the regulation include wood, rubber, palm oil, soy, beef, cattle, and cacao. In advancing this regulation, the EU aims to reduce its impact on climate change, greenhouse gas emissions, and biodiversity loss. Companies will have to quickly adapt their commercial operations to ensure compliance and think strategically to gain a competitive edge in doing so.

From Paramita Das's lens as a leading global executive in industrials and critical minerals, we asked her the most pressing questions on the future of ESG and Sustainability. Be it the rise of AI and automation, tariffs, the rolling out of China+1, or other geopolitical issues, business leaders will have to be ready for a myriad of new challenges in 2025 and beyond.

With an “American First” philosophy, President Trump will bring structural shifts to U.S. domestic economy and America’s approach to trade, foreign policy, and investment flows. As Trump takes office today, he will push aggressively to sign what he can immediately. Business will feel immediate pressure and have to navigate peripheral clatter. This will be especially true for businesses that are resource- and knowledge-intensive with global operations. Expect greater deregulation, sweeping tax reform, enhanced competition with China, and a reconfiguration of global supply chains due to broad tariffs, levies, duties, and import/export bans. Corporate directors will have to ensure readiness to absorb major policy shocks and redirects in Q1 and well beyond.

Uncontrolled wildfires continue to menace and destroy communities in Los Angeles under a rare red flag warning. Even with the deadly fires still raging across a large swath of Southern California, the estimated damages have made the fires the region’s worst natural disaster in decades. The issues mount – lack of water, cascading electrical outages, un-insurability, privatization of first responder support, finger pointing between local, state, and federal levels. With all of this in mind, the LA fires demonstrate a new vulnerability for Americans. Residents and business leaders alike must call into question closely held assumptions on normalcy in one of the biggest and most prosperous U.S. cities

Central to the health of the domestic and global economy, corporate directors have a responsibility to understand the dynamic energy landscape both in the U.S. and globally. 2025 will bring tensions of oversupply, price increases, deregulation, and restructured incentives for renewables. This will lay on top of an already complex web of geopolitical conflict, tariffs, trade restrictions, export bans, and more. With the climate crisis intensifying, an increased focus for all corporate boards should be on decarbonization, energy security, and system resilience. Perhaps most succinctly put, the headline on energy in 2025 is that there is no easy headline.

Elon Musk’s influence transcends the domains of technology and business, extending into regulatory frameworks and geopolitical dynamics. As the CEO of Tesla, SpaceX, and other ventures, Musk has actively shaped industries ranging from renewable energy to space exploration. His outspoken advocacy for deregulation and his ventures' geopolitical implications have both catalyzed innovation and sparked controversy. Elon Musk’s influence on policy, could be shaped by his personal relationships with political figures, including President-elect Donald Trump. But it doesn’t come without risks that Directors are evaluating in the board rooms.

With the U.S.-China trade simmering as Trump begins his second term, Apple will be vulnerable to the proposed China tariffs and export restrictions of critical minerals. Since Apple makes majority of its products in China, it must deflect what otherwise would be amount to hundreds of millions of dollars in taxes. Although Apple has shifted production to India with the iPhone 15 (2022), Apple has yet to start fabrication in the U.S. With Trump proposing a 60% tariff on goods imported from China and a 20% levy on things made elsewhere, Apple will have to use every lever to contain costs, sustain demand, secure mineral inputs, and gain policy exemption. So, with so much at-stake, what will Apple do?

The "America First" agenda under President Trump’s second term, particularly its trade and tariff policies, will significantly impact China's economy, trade dynamics, and geopolitical strategy. As China retaliates, corporate directors must stay informed and proactively safeguard their companies' interests. Moreover, with the changing global landscape and supply chain strategies, companies should consider the intersection of natural security with ESG, Sustainability, and Climate.

With COP29 now concluded in Baku, Azerbaijan, corporate directors should consider the ramifications for their organizations, especially as they relate to the quickening pace of the global energy transition, worsening portfolio of climate risks, uncertainty on the future of U.S. climate policy, and growing pressure on private financing to bolster climate resilience and adaptation. Although many have called the latest COP a disappointment, the short- and medium-term consequences of the latest climate negotiations should be evaluated thoroughly.

At Telesto, we remain committed to developing cost-effective sustainability solutions and supporting our partners to achieve Paris-aligned climate goals. Regardless of the U.S.’s domestic policy, we see a future of expanded global regulation, propagation of consensus-based voluntary standards, and intensified state-level action that will keep U.S. companies moving towards a greener future.

As climate and ESG litigation cases multiply globally and new legislative frameworks drive regulatory pressure, businesses face increasing scrutiny. This article explores how corporate boards must navigate this dynamic landscape to anticipate emerging risks and adapt their strategies accordingly.

While ESG has grown in prominence in recent years, its historical roots extend back decades. This articles explores its history and key milestones in an effort to equip leaders with the foundational understanding to competently manage ESG in their businesses.

With climate change accelerating faster than ever, business leaders are facing a new reality: weathering the storm of climate-driven hazards that could impact every facet of operation. To navigate this volatile landscape, leaders must identify potential climate risks specific to their operations and develop comprehensive roadmaps to safeguard their businesses against these threats.

The EU’s Corporate Sustainability Reporting Directive (CSRD) is expected to affect up to 50,000 entities that are not currently required to report on ESG activities. US board members must understand its requirements and timing and ensure that their organizations comply and leverage the exercise to build long-term enterprise value.

Consumer Packaged Goods (CPG)

As global trade and security challenges continue to escalate as President Trump begins his second term, an insightful and compelling new book, The Courage to Continue, calls for a non-partisan approach to evaluate how businesses can effectively advance their environmental sustainability agendas and support America’s national security priorities. Authored by Alex Kruzel, founder of Chicago-based management consulting firm Telesto Strategy, the book prompts decision-makers across all industries and sectors with crucial questions and considerations for leaders to advance their corporate sustainability goals.

With national security central to Trump’s policy agenda, sanction compliance directly ties into CPG (Consumer Packaged Goods) boards of directors' duties of care and loyalty. As stewards of the company, directors must ensure responsible and ethical operations, which include strict adherence to sanctions. Failing to comply can expose the company to significant legal and reputational risks, which will ultimately harm shareholders' interests. Therefore, it is imperative that boards fully understand the sanction compliance requirements relevant to their company.

While CPG companies have set decarbonization goals and have made progress towards carbon-neutral products, there is still work to be done as decarbonization is integrated more comprehensively from production through product marketing. Regulators and customers are both pushing for greater transparency for both emissions disclosures, as well as other Environmental, Social, and Governance-related (ESG) metrics (recyclability, biodiversity, fair trade, human rights, etc.) This pressure has started in Europe and continues to grow in North America, Australia, Singapore, and beyond. Board members should understand key drivers around this trend and determine how their organizations should manage reputational risk and operational viability with carbon labeling.

Does the China+1 strategy now apply to U.S. allies of Mexico and Canada? With Trump’s latest announcement about immediate tariffs levied on imports from both Mexico and Canada on day one in Trump’s second administration, Consumer Packaged Goods (CPG) companies are rushing to evaluate their exposure to tariffs, increased costs for inputs, and potential implications to consumer demand.

This article explores the strategic rationale driving a growing number of Consumer Packaged Goods (CPG) company boards to approve vertical integration of their supply chains. Key drivers include strengthening ESG performance, mitigating climate risk, addressing investor activism, and securing supply chains in a geopolitically polarized world.

Given the centrality of palm oil to CPG product development and production, board directors will have to understand the current operational, greenwashing risks to their sourcing of the critical raw material. Moreover, board members will have to guide companies on EUDR (European Union Deforestation Regulation), which looks to increase due diligence and reporting on deforestation-free products.

Data privacy has become a critical issue in the boardroom, especially within the CPG sector. While awareness varies across industries, recent high-profile data breaches and privacy scandals have heightened board-level attention to these matters.

Reporting plays a pivotal role in building trust, driving consumer and investor decisions, and securing long-term business viability. Boards must strategically navigate voluntary versus non-voluntary disclosures, not only to meet current regulatory demands but also to anticipate and shape future standards, turning ESG efforts into a competitive advantage.

While 2020 is often remembered for the COVID-19 pandemic and the U.S. presidential election, another significant change was taking place in North America that hasn’t received sufficient board-level attention. On July 1, 2020, the North American Free Trade Agreement (NAFTA) was replaced by the United States-Mexico-Canada Agreement, impacting nearly every Consumer Packaged Goods (CPG) company in the U.S., Canada, and Mexico.

Industrial

For small and mid-sized manufacturers, sustainability assessments like EcoVadis can initially seem like compliance hurdles. However, for Tessy Plastics, a U.S.-based injection molding company, embracing EcoVadis became a catalyst for significant business transformation and revenue growth.

Despite recent headlines, global corporations continue to implement their sustainability and environmental, social, and governance (ESG) programs, including building sustainable, transparent, and resilient supply chains. As a result, suppliers of all sizes and across all sectors are increasingly being asked to demonstrate their ESG performance.

Despite recent headlines, global corporations continue to implement their sustainability and environmental, social, and governance (ESG) programs, including building sustainable, transparent, and resilient supply chains. As a result, suppliers of all sizes and across all sectors are increasingly being asked to demonstrate their ESG performance.

As global trade and security challenges continue to escalate as President Trump begins his second term, an insightful and compelling new book, The Courage to Continue, calls for a non-partisan approach to evaluate how businesses can effectively advance their environmental sustainability agendas and support America’s national security priorities. Authored by Alex Kruzel, founder of Chicago-based management consulting firm Telesto Strategy, the book prompts decision-makers across all industries and sectors with crucial questions and considerations for leaders to advance their corporate sustainability goals.

With national security central to Trump’s policy agenda, sanction compliance directly ties into Industrial companies’ boards of directors' duties of care and loyalty. As stewards of the company, directors must ensure responsible and ethical operations, which include strict adherence to sanctions. Failing to comply can expose the company to significant legal and reputational risks, which will ultimately harm shareholders' interests. Therefore, it is imperative that boards fully understand the sanction compliance requirements relevant to their company.

In today’s dynamic global corporate regulatory landscape, ESG reporting for Industrial companies goes beyond regulatory compliance—it plays a pivotal role in building trust, driving consumer and investor decisions, and securing long-term business viability. However, with expected regulatory upheaval under Trump 2.0, boards should press management teams to reconsider their voluntary reporting strategies. Boards must strategically navigate voluntary versus non-voluntary disclosures, not only to meet current regulatory demands but also to anticipate and shape future standards, turning ESG efforts into a competitive advantage.

While Industrial companies have set decarbonization goals, there is still work to be done to integrate decarbonization strategies across sourcing, assembly, production, transportation, and product marketing. Regulators and customers are pushing for greater transparency for both emissions disclosures and other ESG metrics (embodied carbon, recyclability, biodiversity, fair trade, human rights, etc.) This pressure has started in Europe and continues to grow in North America, Australia, Singapore, and beyond. Board members should understand key drivers around this trend and determine how their organizations should manage reputational and greenwashing risk with carbon labelling.

Data privacy has become a critical issue in the boardroom, especially within the Industrial sector. While awareness varies, recent high-profile data breaches and privacy scandals have heightened board-level attention to these matters. The reputational and financial risks are significant, especially as these risk are no longer insurable. Accordingly, boards have begun recruiting directors with expertise in technology and data privacy as well as improving enterprise data governance and protection (as part of ESG practices). Notably, younger board members often bring a heightened sensitivity to digital and privacy risks, contributing to a more balanced and informed board composition.

As President-elect Donald Trump prepares for his second term, industrial and materials companies will face significant challenges and opportunities stemming from his aggressive trade policies. Boards must anticipate potential changes to tariffs and trade strategies and plan accordingly to navigate these shifts.

Real Estate

As global trade and security challenges continue to escalate as President Trump begins his second term, an insightful and compelling new book, The Courage to Continue, calls for a non-partisan approach to evaluate how businesses can effectively advance their environmental sustainability agendas and support America’s national security priorities. Authored by Alex Kruzel, founder of Chicago-based management consulting firm Telesto Strategy, the book prompts decision-makers across all industries and sectors with crucial questions and considerations for leaders to advance their corporate sustainability goals.

Real estate companies may not be the first casualties of a trade war, but they won’t emerge unscathed. With new tariffs on key building materials and potential retaliatory measures from major trade partners, the sector must prepare for rising costs, prolonged project timelines, and economic volatility. In an environment where financial resilience is paramount, boards must take a proactive approach to mitigating risks and positioning their companies for long-term success or else be caught flat-footed in a shifting global economy.

Want to learn more about how we can help your organization create sustainable value?