Introduction & Context

U.S. university endowments collectively hold more than $800 billion in assets, with approximately 50% in alternative investments and 30-40% in public equities. These portfolios are vital to funding scholarships, research, and campus operations. However, these entities are facing heightened exposure to climate-related risks, including stranded assets in fossil fuels, physical damage to tangible assets, and transition risks stemming from regulatory and market changes. Analysis suggests $1-4 trillion in fossil fuel assets globally could become stranded by 2050 if climate policies tighten, creating potential permanent impairments for equity holders. Some elite institutions still report fossil-fuel exposure of 2–6%.

Urgency is rising as students, donors, and faculty demand alignment with climate goals, and stakeholder pressure has already led more than 140 U.S. colleges (about 3% of institutions) to adopt divestment commitments that cover roughly 39% of total endowment assets. The leadership question is clear: how can a university’s board of trustees manage climate risk while ensuring endowments continue to support institutional mission and growth?

Strategic Case Analysis

Higher education institutions leading full transformations

Leading universities are moving beyond divestment debates to adopt integrated portfolio strategies that both mitigate exposure and capture opportunities in the transition economy.

University of California has achieved a fossil-free status and is expanding sustainable solutions: University of California exemplifies comprehensive climate risk management. In May 2020, UC became the first major public system to achieve fossil-free portfolios, divesting over $1 billion in fossil holdings while simultaneously investing over $1 billion in clean energy infrastructure. UC’s approach integrated risk management with opportunity capture, positioning the $150+ billion combined endowment and pension system as a climate solutions investor. Its 2024 TCFD report details portfolio-wide scenario testing, financed-emissions metrics, and investments in renewables and climate tech.

Harvard Management targets net zero by 2050: Harvard pledged a net-zero endowment by 2050 and has reduced fossil-fuel exposure to under 2% while directing more than 1% into climate-solution assets. Its governance reforms include an annual climate report and clear metrics for progress.

Mixed progress and strategic laggards

- Princeton University has enacted targeted fossil fuel dissociation. Princeton voted in 2022 to dissociate from 90 fossil-fuel companies and tilt investments toward solutions. While significant, it stops short of full divestment, leaving exposure through external managers and private funds.

- Yale University adopted fossil fuel investment principles. Yale adopted its principles in 2021, identifying ineligible companies and enhancing oversight. Implementation remains gradual, with some exposure persisting. Transparency has improved but reporting cadence lags peers.

- University of Texas System remains tied to oil and gas: The UT System remains tied to hydrocarbons as its endowment is fuelled by substantial oil-and-gas royalties, and portfolio holdings still include energy-linked assets. State law also limits working with firms seen as “boycotting” energy, narrowing divestment and manager options. Taken together, revenue reliance, exposure, and legal constraints leave UT behind peers that have shifted capital toward climate solutions and heighten the risk that today’s assets become tomorrow’s stranded liabilities.

Strategic Implications: What delay really costs

Failing to integrate climate risk into endowment strategy is no longer a neutral choice – it creates compounding financial, reputational, and strategic liabilities. From stranded assets and credit downgrades to student activism and missed investment opportunities, universities that delay action expose themselves to greater volatility and diminished competitiveness.

- Financial risk management. Transition risk creates asymmetric downside for endowments by turning carbon-intensive holdings into stranded assets. In 1.5°C pathways, the IEA projects steep declines in fossil-fuel demand by 2040, especially for oil and gas, implying valuation pressure on producers. Scenario analyses show that if markets reprice equities to align with 2°C carbon budgets, oil company share prices could fall materially, and a disorderly transition could trigger bankruptcies across high-emitting subsectors. Credit rating agencies now factor climate into higher-education assessments; Moody’s frames environmental risks as a “moderate” influence and views proactive climate risk management as a governance positive. Institutions with sizable fossil exposure face greater volatility and write-down risk, while peers tilting toward climate solutions often benefit from improved funding access and lower financing costs.

- Stakeholder and reputational dynamics. Climate performance is now a reputational driver. Student activism drives policy pressure, with divestment referenda passing at over 50 campuses by overwhelming margins (80%+ support at Yale, MIT, Cornell) Faculty resolutions and alumni pressure campaigns create reputational risks for institutions perceived as climate laggards. Surveys show over 60% of applicants weigh a school’s climate commitment when deciding enrolment. Donors increasingly favour institutions demonstrating stewardship.

- Regulatory and disclosure evolution. The SEC’s climate rule is indefinitely paused, but the direction of travel is clear: ISSB’s IFRS S2 and TCFD are the practical baseline many asset owners already follow. Endowments that voluntarily report governance, risks, metrics, and targets now reduce future compliance shock and meet lender and manager expectations. Pressure is also applied via indirect channels such as managers, bond markets, and credit reviews. Note the policy headwinds: Texas’s anti energy-transition law (SB 13) restricts working with firms deemed to “boycott” energy, constraining divestment and manager choice even as transparency norms rise elsewhere.

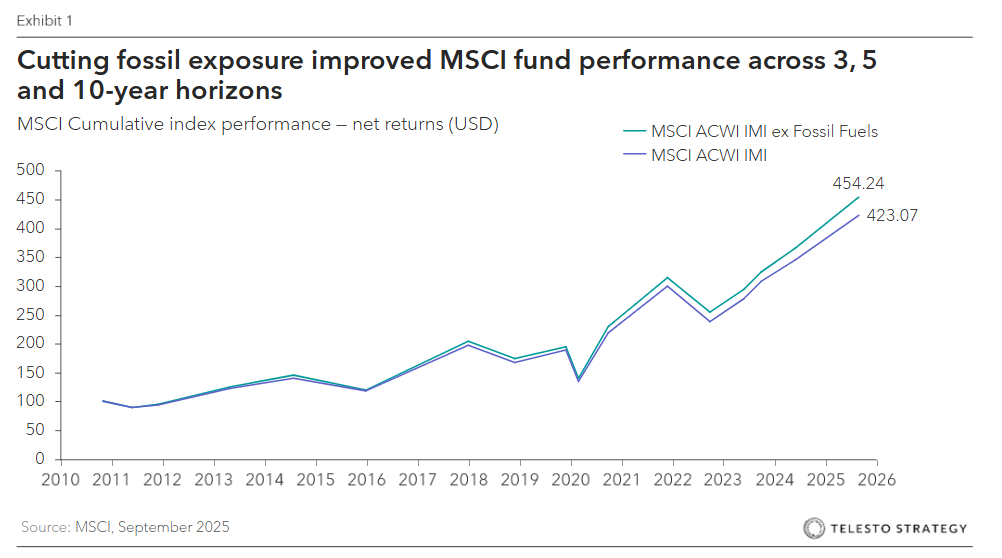

- Opportunity cost. Endowments that delay reallocating capital risk missing attractive returns in the fast-growing green economy. Clean-energy and transition assets are scaling, and investors with early, disciplined exposure are better positioned to capture those growth drivers. The upside is not only financial; visible leadership in impact investing strengthens brand with forward-looking students, faculty, and partners. Practical avenues already exist such as green bonds, renewable infrastructure funds, and climate-tech venture where peers like UC and Harvard have built scalable pipelines and documented allocations.

What higher education leaders can do now:

- Establish baseline: Assess fossil fuel exposure, financed emissions, and climate Value at Risk (VaR) using scenario analysis.

- Stress test: Run simple climate scenarios to spot vulnerable assets.

- Refresh policy: Update Investment Policy Statements to define approach: what to avoid, where to engage, where to tilt

- Mandate managers: Include explicit climate-related requirements in manager agreements, specifying expected data disclosures, proxy voting procedures, and progress reporting methods.

- Allocate to solutions: Target renewables, green bonds, and transition credit with clear allocation goals.

- Adopt reporting cadence: Publish TCFD- or ISSB-aligned reports annually; Report financed emissions baseline and show year-over-year progress.

- Engage board oversight: Quarterly updates to investment committees with clear KPIs.

Questions for Higher Education leadership

- What is our true financed-emissions baseline and fossil-fuel exposure?

- Which mix of engagement, exclusions, and tilts lowers risk without hurting returns?

- What allocation to climate-solution assets is realistic in the next 24 months?

- Which metrics will we disclose, and how often?

- How do our policies align with fiduciary duty and peer governance?

- Do we have the right managers and partners to deliver?

Deferred action on climate risk will erode financial stability and credibility. Universities that align their endowments with transition realities will protect returns, strengthen reputation, and unlock new capital. Plan now to prevent stranded assets and credibility gaps from undermining your mission and trust.

Our people

Andrew Alesbury

Partner, Washington DC

With a background spanning both urban planning and real estate development in the United States, Andrew supports sustainability and facilities departments across higher education institutions to develop and execute strategies which enable them to achieve their ambitions while navigating complex stakeholder environments and addressing student and faculty concerns.

Ben Vatterott

Partner, San Francisco

Ben has led sustainability and growth strategy projects for clients across the higher education and real estate ecosystems, including universities and colleges, private real estate companies, PropTech companies, and more. He supports clients on a number of strategic topics such as achieving net zero targets, embedding sustainability and emissions reduction into capital deployment, and capturing sustainable growth opportunities.