Copyright © 2023 Telesto Strategy LLC, All rights reserved.

By Ben Vatterott & Carrot Wang

As discussed in another Telesto Special Report, “Living In A Material World: Avoiding The Pitfalls Of Meaningless Materiality Assessments,” materiality assessments are the foundational building block that kick off an organization’s sustainability journey. When done correctly, the assessments help organizations prioritize which ESG topics matter most to the business and align their strategic focus.

Real Estate Investment Trusts (REITs), which allow investors to pool their resources and invest in a diversified portfolio of real estate assets, are an industry that would benefit from additional direction on where to focus their sustainability efforts. REITs have gained significant popularity as an investment vehicle in recent years, and in order to claim to be serious about sustainability, they must use materiality assessments to identify and prioritize ESG factors across their portfolios. As outlined in a recent Morningstar report, over two thirds (67%) of asset managers view ESG issues as increasingly material, underscoring the importance of conducting material assessments and disclosing their findings.

To gain a better understanding of the EGS challenges and opportunities for REITs, Telesto conducted research on the materiality assessments of the largest 100 REITs by market cap. Our team reviewed public disclosures of these 100 REITs over the past 4 years, analyzing 800+ material issues and synthesizing the results into 35 themes.

Share of largest 100 REITs with materiality assessments by market cap and year, 2019-22 (%)

SOURCE: Companies’ ESG/sustainability reports, Telesto’s analysis

In 2022, nearly half (48%) of the top REITs conducted materiality assessments, up from a low 22% in 2019. The share of REITs conducting two-dimensional assessments, those that consider both importance to the company and to stakeholders, has also risen by 20% from 2019-2022. However, despite this increase, half of the industry still does not conduct any assessments.

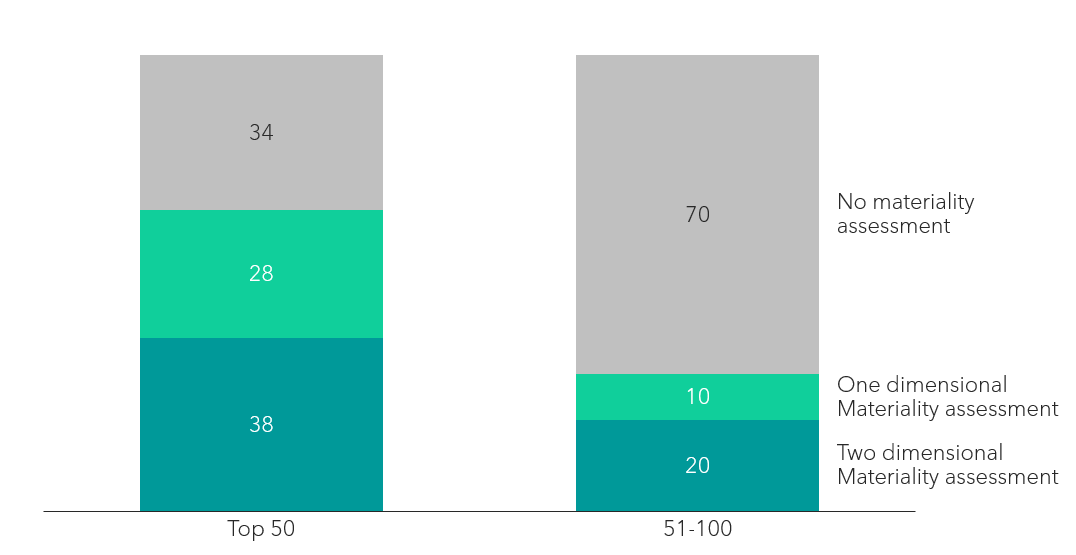

Share of largest 100 REITs with materiality assessments by market cap, 2022 (%)

SOURCE: Companies’ ESG/sustainability reports, Telesto’s analysis

Taking a closer look at the breakdown by market cap, one can see that the increase in published materiality assessments is driven by the top 50 REITs, with 66% of the top 50 vs. 30% of the 51-100 conducting assessments.

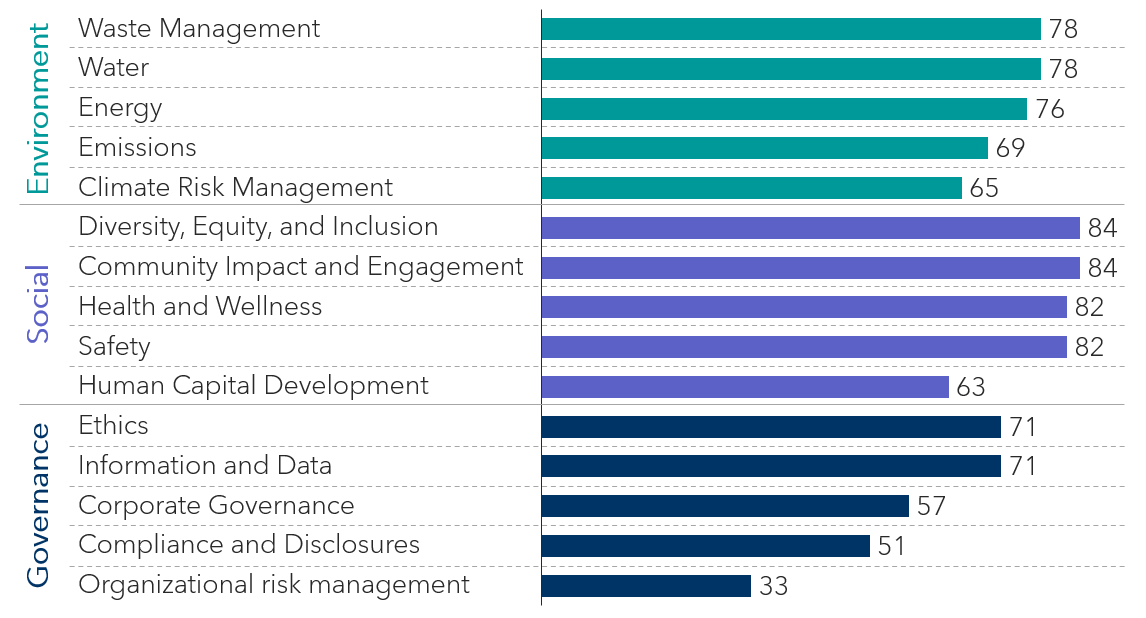

Delving into which issues are of key importance to REITs, our team found that over three quarters reported waste management (78%), water (78%), and energy (76%) as material topics. Material issues are always going to be unique to each company and will vary by type of REIT. Somewhat surprisingly, however, emissions (69%) was not included as a top issue; regulating emissions and climate change adaption-related topics should be at the forefront of all REITs’ strategies given the real estate industry’s role in the climate transition. Furthermore, an increased focus on biodiversity (35%) and air quality and pollution (8%), which ranked lowest, may be necessary to stay in compliance with evolving laws and regulations.

A variety of social topics were also highly ranked: diversity, equity, and inclusion (84%), community engagement and impact (84%), health and wellness (82%), and safety (82%) stood out as key topics, nearly 20% above the next topic.

Among governance topics, ethics (71%) and information and data (71%) were standouts. Compliance and disclosures (51%) was included in half of the materiality assessments, though this is also expected to increase to respond to risk management. In the Morningstar report of asset managers, risk management was the top priority among governance topics.

Top 5 material topics for REITs by Environment, Social, and Governance, 2022 (% of REITs reporting as a material topic)

SOURCE: Companies’ ESG/sustainability reports, Telesto’s analysis

When done correctly, materiality assessments improve risk management, enhance investor confidence, and lead to better-informed strategic decisions. Materiality assessments can ensure compliance with reporting requirements and enhance transparency and accountability towards stakeholders. As seen in our research, companies creating best-in-class assessments involve a variety of stakeholders.

Companies should involve all their stakeholders in a variety of ways. Not all stakeholders must be engaged through surveys; the engagement process can include customer feedback, investor comments, local news sources, third party research, and more. By diversifying the types and level of engagement, companies can gain greater insight into their companies and feel more confident in using the materiality assessments to inform and prioritize business decisions. Finally, firms should consider engaging a third-party to conduct material assessments to provide an impartial outside-in view.

Materiality assessments are essential tools for REITs, guiding them toward better decision-making, compliance, and overall strategic success. As the importance of materiality assessments for REITs continues to grow, companies should follow best practices, involve all stakeholders, and engage a neutral third party to ensure their assessments are being used to inform strategic decisions.

For more information on how your organization can conduct a rich materiality assessment that informs your strategy setting and aligns with global frameworks, please reach out to our team.