Copyright © 2023 Telesto Strategy LLC, All rights reserved.

By Ben Vatterott and Carrot Wang

Sustainability is rapidly becoming a must-have among leading businesses. With 96% of S&P 500 and 81% of Russell 1000 companies publishing sustainability reports or disclosures in 2021, it is becoming harder and harder to deny the importance the business community is placing on sustainability. This conclusion is set in even more stark relief when viewed from a perspective of change over time: contrast the 96% of S&P 500 companies in 2020 with the 20% which had sustainability reports or disclosures in 2011 and it becomes clear just how quickly the private sector has come to see sustainability as integral to their business operations and strategies.

At the center of any sustainability report or disclosure is the materiality assessment. For the uninitiated, a materiality assessment can at first sound like the latest release in “sustainababble,” but once you get past the jargon and into their purpose, the value of materiality assessments becomes clearer. A materiality assessment, in short, is an exercise which helps organizations – through surveying, convening, and otherwise polling key stakeholders – to identify, evaluate, and prioritize which sustainability-related topics they care about (i.e., what is material to them). A materiality assessment, therefore, helps organizations figure out where to focus their sustainability efforts.

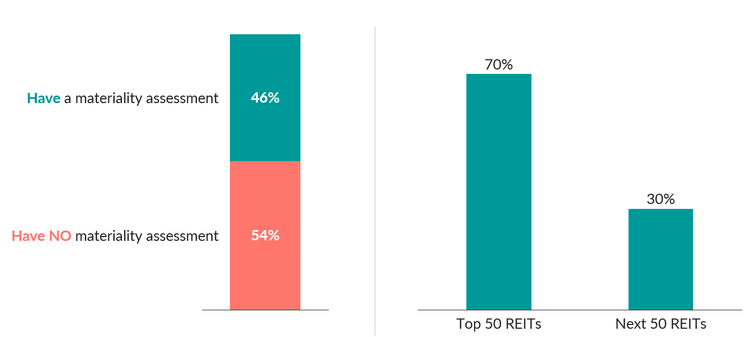

As such, no organization can credibly claim to be serious about sustainability without having a materiality assessment which dictates the material topics they care about. Real Estate Investment Trusts (REITs) are no more exempt from this reality than any other kind of business. And yet, only 46% of the 100 largest REITs have conducted a materiality assessment in the past 3 years. What’s more, this statistic skews heavily towards larger REITs (70% of the 50 largest REITs have a materiality assessment vs. 30% of the next 50 largest), implying large swathes of the REIT landscape are completely bereft of a roadmap for sustainability impact. This is a massive risk for a multi-trillion-dollar sector with over 1,100 REITs in the U.S. alone.

Share of largest 100 REITs (by market capitalization) reporting materiality assessments, 2019-21 (%)

Source: Telesto Strategy; Company sustainability reports & disclosures

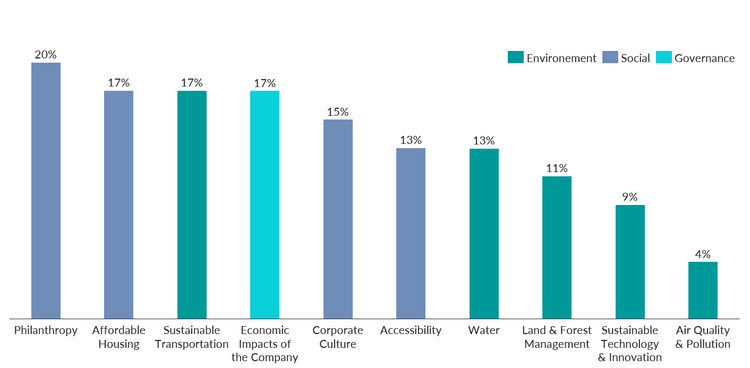

Further cause for concern emerges when one examines the topics that those REITs which have conducted materiality assessments consider material. Among the 46% of REITs which have conducted materiality assessments, there is a pronounced bias towards social themes. Indeed, four of the top five themes by frequency of appearance in reporting REITs’ materiality assessments are social themes (the top three are Stakeholder Engagement, Health & Wellness, and Safety), while only one is governance-focused and none are environment-focused.

While it is hard to find any organization’s commitment to driving impact across social dimensions generally objectionable, a closer inspection of these themes reveals a common characteristic: legal requirements (e.g., building regulations, health codes, community development guidelines) already obligate real estate players to take action across most of these themes. In short, many REITs are taking credit in their materiality assessments for actions that they would otherwise be legally obligated to undertake.

Equally noticeable as the skewing towards social themes is the scarcity of themes which should be relevant for REITs. Indeed, five of the bottom ten themes by frequency of appearance are environment. Some notable examples of neglected environment themes include Water (13% of reporting REITs mention water), Land and Forest Management (11%), and Air Quality and Pollution (4%). And in another particularly glaring instance, only 17% of reporting REITs mentioned Affordable Housing as a material topic.

Bottom 10 themes by share of reporting REITs mentioning the theme,

2019-21 (% of reporting REITs)

Source: Telesto Strategy; Company sustainability reports and disclosures

So, what more can they do? To start, the more than 55% of REITs without a materiality assessment can conduct one, and with all due deliberate speed. Beyond that, REITs wishing to take sustainability seriously should consider three main actions:

1. Start with the right set of themes: Picking the wrong starting point is the easiest way to end up in the wrong spot, no matter how accurate the directions are. Telesto suggests REITs begin with a starting set of 35 comprehensive themes across environment, social, and governance.

Suggested starting materiality themes for REITs

2. Stick to best practices: Perhaps the only thing worse than no materiality assessment is a poorly done one, as this gives readers (and the members of the organization itself) the false impression that an organization is serious about sustainability when it is not. To avoid this pitfall, organizations need to be careful to apply best practices and avoid common mistakes in conducting materiality assessments.

3. Get going on data collection: It’s never too soon to get started with the data gathering. This is one of the most time-consuming steps in any sustainability journey but is unquestionably the most vital. As the old computer science adage goes “garbage in, garbage out.” If your organization’s sustainability journey is built on bad data, it will inevitably be bad itself.

The time for REITs, a multi-trillion-dollar industry, to get serious about sustainability is now. Further delay poses substantial risk not only to the beneficiaries of such initiatives (the planet, local communities, etc.) but to REITs themselves, their portfolios, and their shareholders.