Supply chains sit at the intersection of geopolitical volatility, shifting trade policy, and rising tariffs — pressures that are redefining risk and raising the stakes for executive leadership. For the C-suite, supply chain transformation is no longer a back-office exercise. It is a lever of competitive advantage and a determinant of resilience, profitability, and brand reputation.

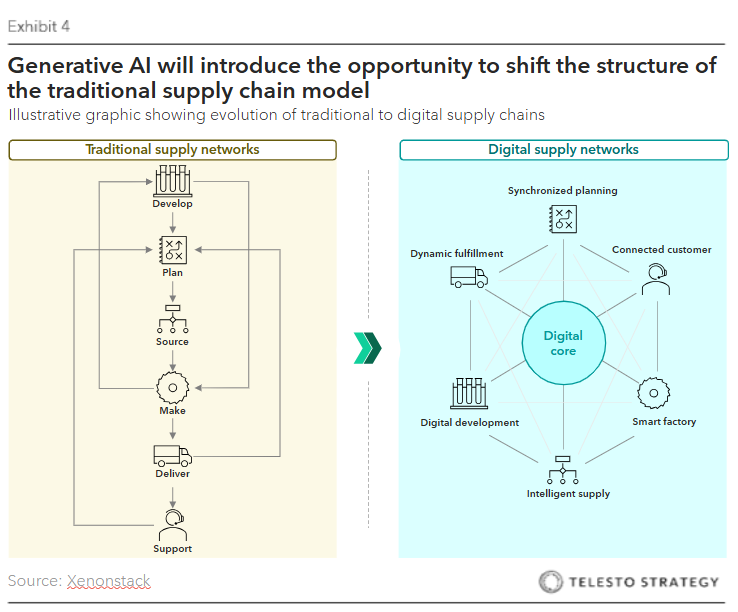

Generative artificial intelligence offers management teams new capabilities — predictive insights, scenario modeling, and real-time visibility — that shift operations from reactive firefighting to proactive planning. Agentic AI, in particular, is enabling “self-driving” supply chains: systems that accelerate decision-making and automate operational choices. The opportunity for leaders is clear: greater timeliness, cost containment, compliance, and resilience. The risk is equally clear: without data infrastructure, cross-functional ownership, and upskilled talent, investments in AI will stall.

Why C-suite leaders cannot ignore AI in the supply chain

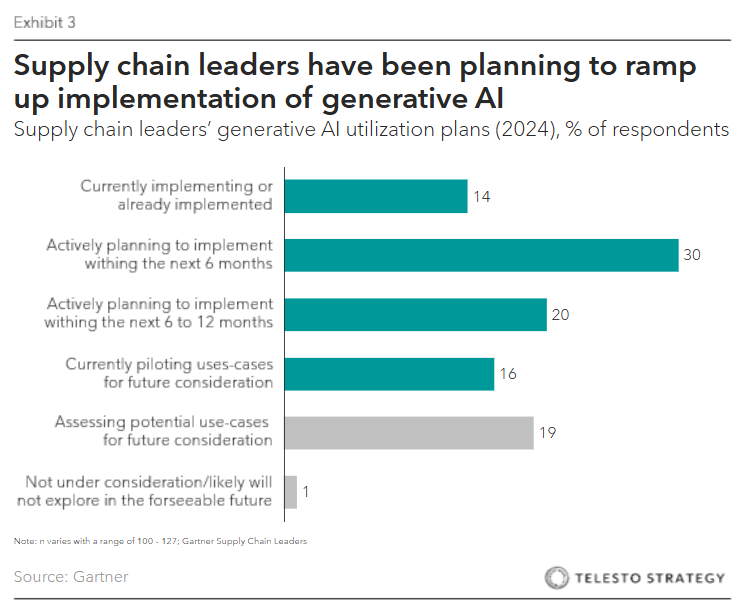

With the push for generative AI integration across enterprise operations, many organizations are hoping to move from reactive and static models to more proactive and agile positions.

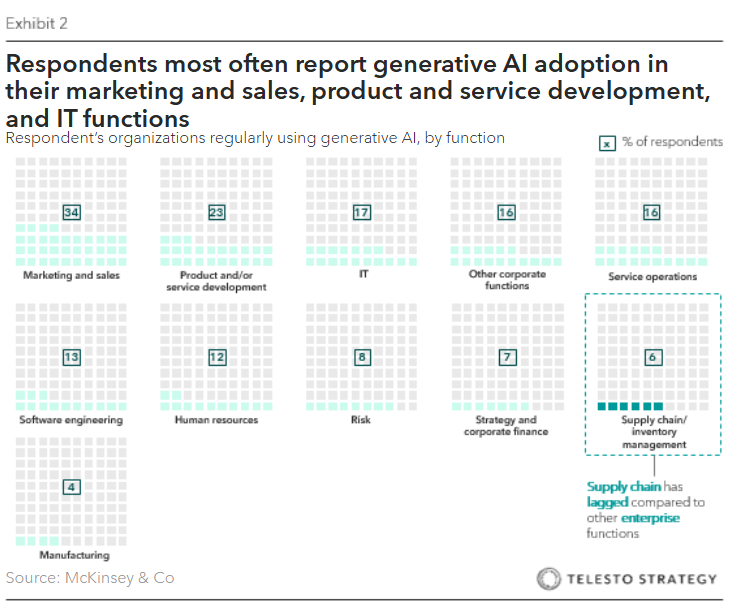

While there is significant buzz around generative AI’s application across business models, supply chain functions have often lagged compared to peers such as marketing and sales. This may present an opportunity for supply chain leaders to be “fast followers” — drawing on early lessons and technology investments from other functions.

Why leaders should consider AI for their supply chains:

- Operational exposure. Global supply chains have become a frontline for geopolitical shocks, tariff changes, and regulatory scrutiny. AI provides early warning and mitigation.

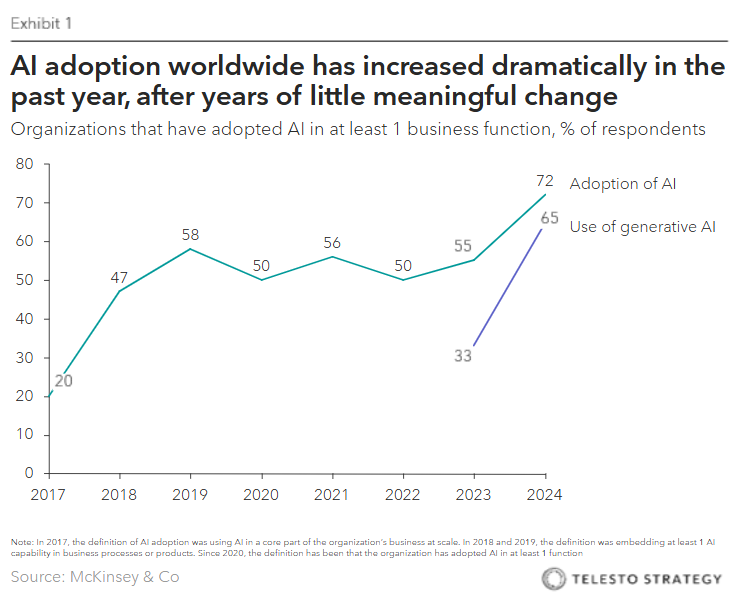

- Lagging adoption. While ~72% of enterprises report AI adoption (up from 40% in 2023), supply chain functions trail marketing, sales, and product development. Leaders must close that gap or risk being left behind.

- Market trajectory. The AI supply chain market is projected to surge from $4.5B in 2024 to $157.6B by 2033 (42.7% CAGR). Adoption in sustainability tracking alone is already over 60%.

- Investor expectations. Capital markets increasingly view operational resilience as part of ESG credibility. AI-powered traceability and risk management are becoming table stakes.

How AI could be applied across supply chain operations

Executives face pressure to cut through hype and direct resources to areas with measurable business impact. Generative and agentic AI could prove particularly relevant in:

- Forecasting and inventory optimization. Reduces bias and improve service levels

- Logistics routing and fulfillment. Real-time adjustments can minimize costs and delays

- Supplier risk and continuity. Enables monitoring of tier 2 and 3 suppliers for disruptions

- Quality and throughput. Using AI vision and predictive analytics to reduce defects

- Compliance management. Automates regulatory reporting and trade compliance

- ESG and traceability. Real-time visibility to meet sustainability and disclosure standards).

- Customer engagement. Predictive demand shaping and tailored service

These applications reframe the supply chain from a linear process to a data-rich, integrated ecosystem.

What leading companies are doing

C-suite leaders can draw lessons from peers already deploying AI at scale:

- Walmart is embedding agentic AI in forecasting and robotics to create an omnichannel operation that rivals Amazon’s automation advantage.

- Coca-Cola has committed $1.1B with Microsoft to integrate AI across forecasting, logistics, and employee efficiency—while also leveraging AI for brand campaigns.

- PepsiCo is pursuing a fully “self-driving” supply chain with Salesforce and AWS, applying AI from procurement through retail.

- BMW uses generative AI, such as the multi-agent system Alconic, to power digital twins of its factories, testing layouts and optimizing robotics before physical deployment.

- DHL automates back-office and warehouse processes with AI, allowing it to compete against vertically integrated retailers.

- Nestlé accelerates product R&D and sustainable packaging innovation using AI-driven ideation and design.

- Caterpillar applies AI to equipment monitoring, maximizing uptime for customers and expanding high-margin services.

Actions management teams can take:

- Set enterprise priorities. Tie AI to resilience, continuity, and growth — not just efficiency

- Engage cross-functionally. Break silos between operations, IT, finance, and commercial leaders

- Use scenario planning. Stres test supply chains against trade, climate, and geopolitical shocks

- Anchor on measurable pilots. Select 3–5 high-value use cases with clear P&L impact and finance-approved baselines

- Ensure enterprise readiness. Establish governance for data lineage, IP protection, and compliance

- Upskill talent. Equip planners, engineers, and managers to apply AI insights daily

Strategic questions for your executive team

- What is our 1–3-year AI supply chain roadmap?

- Which AI use cases are scaled today, and what ROI are we realizing?

- Do we have a governed, real-time data backbone that supports supply chain AI?

- Who owns supply chain AI strategy — central or distributed — and do we have the leadership in place?

- What’s our plan to upskill both internal teams and partners?

Additional Telesto resources

- Board series: Know your supplier – Diversification risks admist escalating trade wars

- Board series: Navigating the storm – Global shipping in turmoil

- Atlas, equips your organization’s corporate directors and leaders with the insights and knowledge necessary to stay up to date, mitigate risks, and seize business opportunities associated with sustainability, climate, and ESG

- Prism, our ESG benchmarking tool, helps your organization to rapidly strengthen its Sustainability, Climate, and ESG performance and disclosures through in-depth benchmarking of industry peers and identification of gaps and areas of distinction