In Q2 2025, tariff volatility and regulatory shifts have evolved from a “trade” concern to a core business performance variable. For management teams, the implications reach across finance, operations, and strategy. The companies that outperform are those that treat regulatory shocks as operational scenarios to rehearse, not surprises to react to.

Leading enterprises are building structured stress-testing frameworks that simulate “policy shock” scenarios — tariff spikes, export-control expansions, carbon border pricing, and customs detentions. These models connect product-level exposure (HS codes, supplier geography, product carbon intensity) with real-time P&L impact, quantifying the margin and working-capital at risk.

For management teams, the question is shifting from “Where should we produce?” to “How fast can we pivot when the rules change?”

Key takeaways for management teams:

- Tariffs are now systemic: Since 2018, U.S. import tariffs have added more than $132 billion in costs borne by U.S. firms (National Retail Federation).

- Switch-back planning is a strategic capability: Enterprises need the ability to rapidly reverse, reroute, or rebalance sourcing, production, or logistics when policy or market conditions shift faster than strategic plans.

- Agility protects profitability: Treating supply chains as dynamic, policy-aware assets allows leadership teams to preserve both margins and market share during shocks.

- Speed is the differentiator: In an era of economic warfare and regulatory whiplash, companies that can switch faster win on cost, continuity, and credibility.

The evolution of ESG governance—and what It means for management teams

ESG duties used to be loosely integrated into Audit or Governance committees. But between 2018 and 2023, a growing share of companies created dedicated board-level Sustainability Committees, especially in sectors like energy, materials, and consumer products.

For management teams, this translates to a more structured reporting cadence, more frequent board touchpoints, and a growing need to quantify the financial impact of sustainability strategy.

The rise of switch-back planning

Rapid switch-back planning emerged from five years of tariff shocks, sanctions, export controls, and climate disruptions. It measures an organization’s operational reversibility — its ability to pivot suppliers, shift production, or reroute logistics within weeks, not quarters.

For management, it’s not just about dual sourcing — it’s about institutionalizing agility across procurement, contracts, and capital planning.

Leadership teams are embedding switch-back capabilities into risk, finance, and operations models, for example:

- Electronics manufacturers maintain parallel supplier bases across ASEAN and Mexico to flex between tariff zones.

- Automakers are investing in “swing capacity” — idle or underutilized lines that can scale when trade rules shift.

- Consumer-goods leaders co-locate packaging and ingredient suppliers across multiple trade blocs to avoid bottlenecks.

In today’s environment, HS-code exposure and switch-back readiness are twin metrics of resilience: one measures vulnerability, the other measures recovery speed.

The companies that outperform won’t be those that predict policy perfectly — but those that can execute pivots confidently, turning unpredictability into advantage.

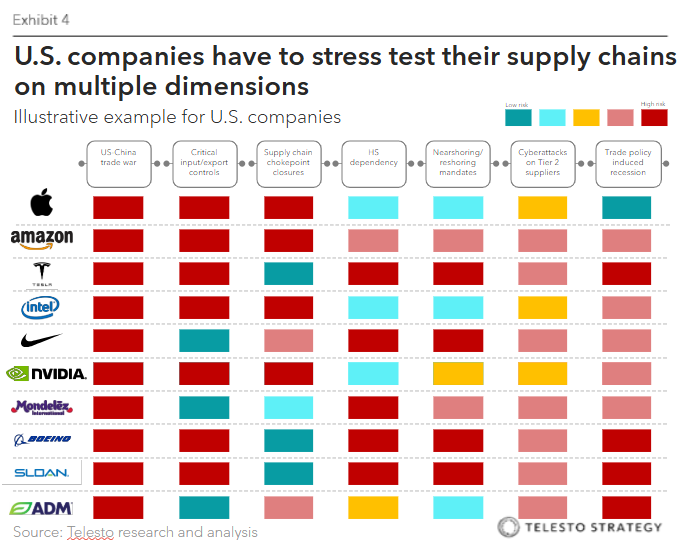

Agility at work

Apple, Foxconn, and Tata. Apple’s partnership with Foxconn and Tata offers a clear illustration of rapid switch-back planning in motion. In 2025, the company accelerated its “China-plus-India” production strategy for iPhones sold in the U.S., broadening assembly operations across India to reduce exposure to tariff volatility. Between March and May 2025, Foxconn exported roughly 97% of India-made iPhones to the U.S. and announced an additional $1.5 billion investment in its Indian unit. The result is a more flexible production and shipping model that can adjust quickly if transshipment rules tighten, giving Apple the ability to balance its manufacturing footprint and maintain steady product flow to the U.S. market.

Pfizer, AstraZeneca, Merck, Roche, and Amgen. Major pharmaceutical companies have also been stress-testing their supply chains to build tariff resilience. In anticipation of new branded-drug tariffs, global firms such as Pfizer, AstraZeneca, Merck, Roche, and Amgen accelerated the onshoring of U.S. manufacturing and expanded domestic inventories. These programs, backed by multi-billion-dollar investments and rapid technology transfers, created an operational buffer that minimized the near-term impact of tariffs in 2025. As a result, these companies now could swing supply back to U.S. facilities on short notice, ensuring regulatory certainty and continuity of patient access even under new trade rules.

MGA Entertainment. In the consumer-goods sector, MGA Entertainment — known for its toy lines distributed through major retailers like Walmart and Target — moved quickly to diversify its manufacturing base. Within six months, the company shifted roughly 40% of production out of China and into India, Vietnam, and Indonesia. This shift ensured that product availability and price points remained stable despite potential tariff disruptions. By establishing multiple manufacturing lanes across three countries, MGA not only accelerated its diversification timeline but also significantly reduced single-country dependency — a capability that now functions as a core element of its operational resilience strategy.

Stress-testing scenarios for the C-Suite

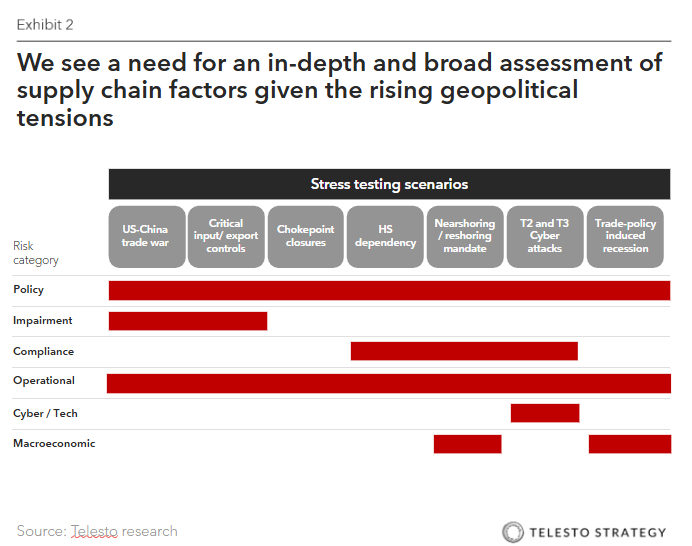

Modern supply-chain stress-testing now resembles financial scenario modeling — only broader, faster, and more dynamic. CFOs, COOs, and CSOs are using AI-powered systems to model geopolitical, regulatory, and operational shocks:

- Escalating U.S.-China trade war. Stimulate scenarios where tariffs on a specific country or region, such as China, escalate by 10-25% on a particular category of goods, forcing companies to find new sourcing options in an accelerated time frame.

- Critical input/export controls. Model situations where a key component, like rare earth elements or semiconductors from a strategic rival, given tightening export controls of both U.S. and China.

- Supply chain chokepoint closure. Simulate a disruption at a major global shipping chokepoint like the Red Sea or the Panama Canal, causing major transit delays and cost increases for insurance and shipping.

- HS dependency. Companies with high HS dependency (e.g., electronics or automotive OEMs) treat each HS code as a “shock node” in their scenario stress tests, overlaying exposure indexes with switch-back costs to decide which sourcing lanes to prequalify.

- Nearshoring and reshoring mandates. Test a scenario where new U.S. domestic policies or subsidies encourage or mandate shifting production closer ot home or back to the U.S., which accounts for altering cost structures and supplier networks.

- Cyberattacks on Tier 2 suppliers. Stimulate a cyberattack that takes a critical second-tier supplier’s manufacturing plant or data systems offline for an extended period, causing cascading effects on production.

- Trade policy-induced recession. Financial institutions use scenarios like the “Tariff and Trade War Recession 2.0” to model the effects of tariffs driving up costs, disrupting supply chains, and causing a global recession. Key indicators include a rise in unemployment, persistent inflation, and declines in consumer spending.

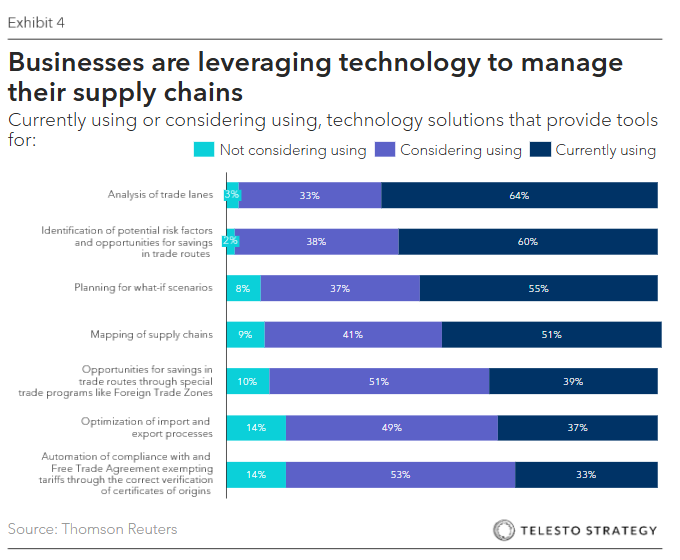

Technology and AI accelerate agility

Next-generation AI-driven supply-chain intelligence tools now enable management teams to:

- Map HS-code exposure across suppliers and SKUs

- Run “policy shock” simulations in real time

- Model financial impacts across working capital, tariffs, and margins

- Recommend reroute options based on cost, lead time, and regulatory alignment

In short: AI transforms reaction time into a measurable advantage.

Understanding HS-code exposure and tariff engineering

What it means

“HS-Code exposure” is the sensitivity of your product portfolio to tariff codes — and therefore, to changes in trade rules, CBAM, or enforcement.

Tariff engineering in practice

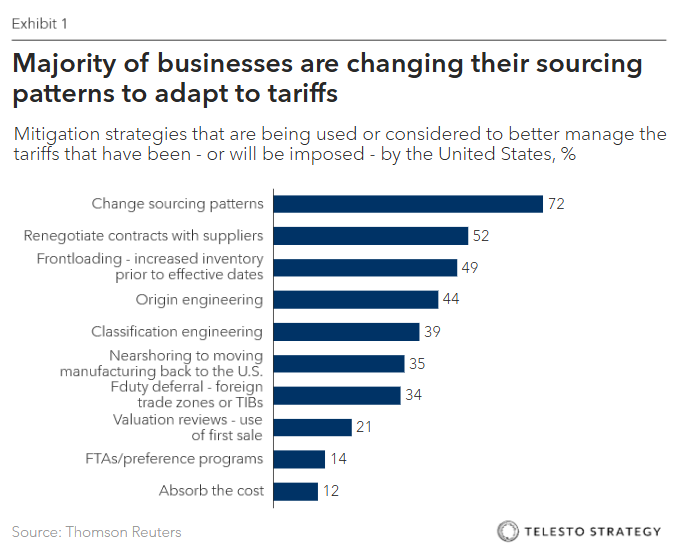

Management teams are redesigning products and processes to legally reclassify goods for lower-tariff treatment:

- Material substitution: Alternative components that qualify for lower rates

- Component imports: Shipping goods disassembled to lower composite duty rates

- Manufacturing shifts: Moving final assembly to lower-tariff countries

- Classification optimization: Designing SKUs to fall within favorable HTS codes

- Value-based planning: Adjusting declared values (within compliance) to minimize duty exposure

- Re-pricing: Modifying internal transfer pricing to rebalance exposure

Effective tariff engineering demands cross-functional alignment — design, legal, operations, and finance — and rigorous documentation to survive customs scrutiny.

Actions for management teams:

- Make regulatory volatility an enterprise risk category. Integrate trade and policy shocks into ERM dashboards and quarterly reviews.

- Run “policy-shock” drills. Simulate liquidity, pricing, and sourcing responses under CBAM or tariff changes.

- Implement a trade-risk dashboard. Track tariff exposure, HS dependencies, and pre-qualified supplier networks.

- Define decision thresholds. Establish ROI or payback metrics for when redesigns or supplier shifts are justified.

- Wargame customs reversals. Simulate enforcement or classification disputes to pre-plan responses.

- Adopt switch-back KPIs. Include time-to-reroute, alternate supplier readiness, and margin at risk per 30-day delay in performance metrics.

- Reassess sourcing concentration. Align risk appetite and capital allocation with exposure in high-tariff or unstable corridors.

- Audit compliance. Commission third-party reviews of tariff classifications and origin documentation.

Questions for management teams

- How much of our production can we redirect within 60 days?

- How are we modeling and testing policy shocks?

- Does our ERP system enable reversibility as a competitive edge?

- Which 20 HS codes drive 80% of our trade exposure?

- What’s our margin hit from a 15-point tariff increase?

- Have we mapped critical chokepoints across logistics lanes?

- Do supplier contracts enable rapid switching, or are they locked by exclusivity clauses?

- Are we CBAM- and UFLPA-ready in every major trade corridor?

Additional Telesto resources

- Board Series: Stress testing supply chains in a fractured world – The case for rapid switch-back planning

- Know your supplier: Diversifying comes with risk, amidst escalating trade wars – Telesto

- Board Series: Onshoring to the U.S.: Physical Risk Considerations for Management

- Tariff Engineering: Multinationals reduce tariff exposure, introducing new risks – Telesto

- Atlas, equips your organization’s corporate directors and leaders with the insights and knowledge necessary to stay up to date, mitigate risks, and seize business opportunities associated with sustainability, climate, and ESG

Connect with Telesto Strategy to stress-test your governance model, align your ESG priorities with financial performance, and prepare your team for the next wave of regulatory and operational shifts.