Copyright © 2025 Telesto Strategy, LLC

All rights reserved

Geopolitical conflict, climate stresses, tightening regulation, aging infrastructure, and labor unrest have converged to create a fragile global shipping system. These pressures expose multinational companies to chokepoint disruptions that can ripple through every business unit — from manufacturing schedules and procurement costs to customer delivery timelines and sustainability reporting.

For management, the core task is not simply to move goods across oceans. It is to anticipate persistent instability, test supply chains for hidden vulnerabilities, and design adaptive logistics strategies that can withstand shocks.

Key takeaways for management teams

Global maritime trade by the numbers

Critical chokepoints — the Suez Canal, Panama Canal, Strait of Hormuz, Strait of Malacca and Taiwan, and the Bab el-Mandeb Strait — remain the arteries of global commerce. Up to half of global sea trade is now considered at risk of interruption from geopolitical tensions and climate impacts.

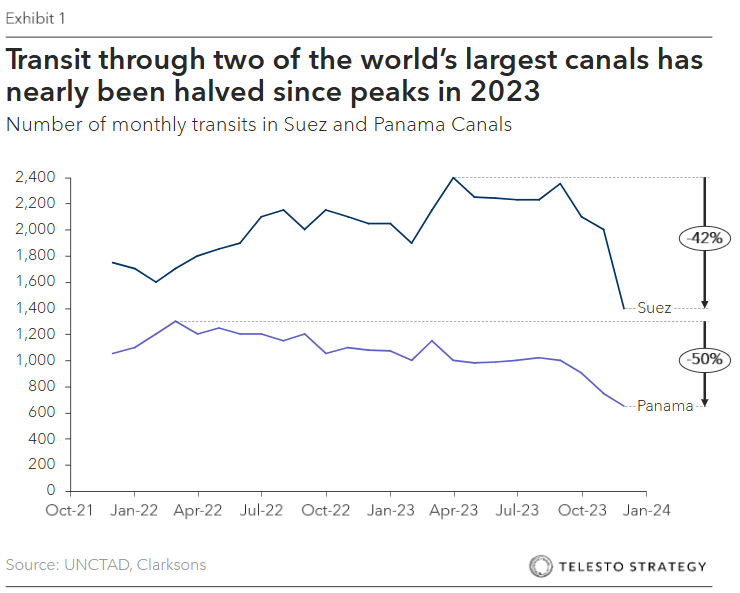

As shown in Exhibit 1, transits through both the Suez and Panama Canals have declined year-over-year. These are not isolated incidents but evidence of systemic strain that could upend global trade flows.

The cost of rerouting away from the Red Sea

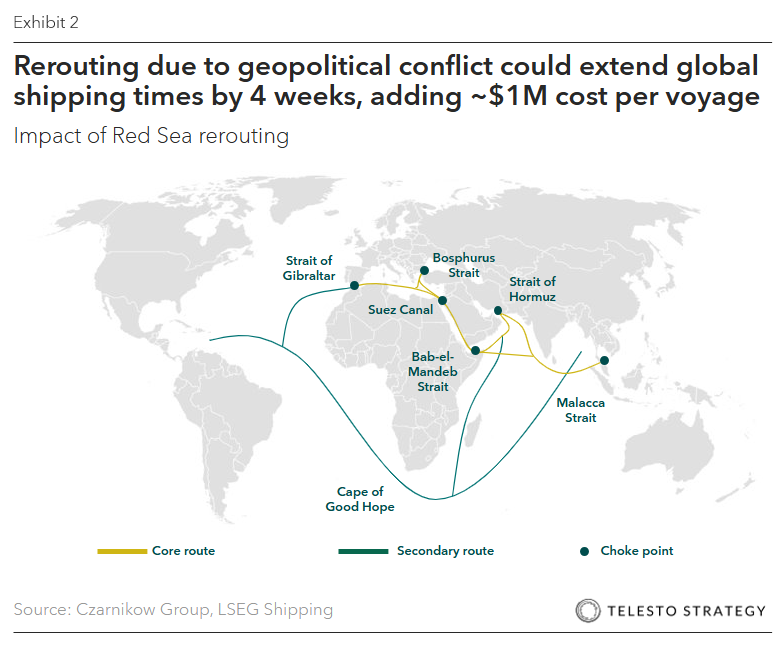

The Red Sea crisis has forced shipping companies to classify the area as a restricted zone. With the Suez Canal handling 12% of global maritime commerce, its disruption cascades across global supply chains.

Traffic through the Bab al-Mandab Strait has collapsed, redirecting vessels around the Cape of Good Hope. This adds 2–4 weeks of transit time, increases fuel consumption, raises crew wages, drives up insurance premiums, and exposes ships to piracy risk.

The costs are stark:

Management teams must account not only for higher shipping rates, but also for congestion, delivery uncertainty, and elevated emissions — all of which carry financial and reputational costs.

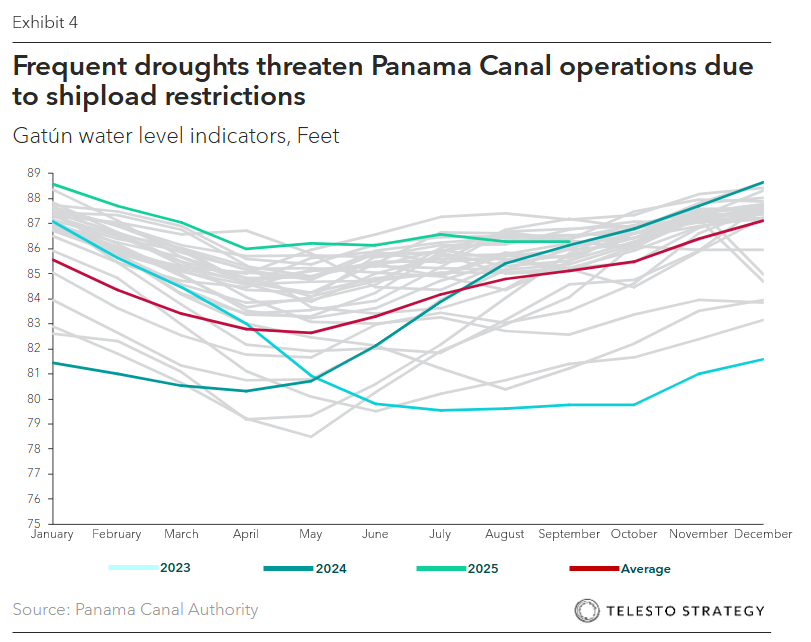

Climate risks in the Panama Canal

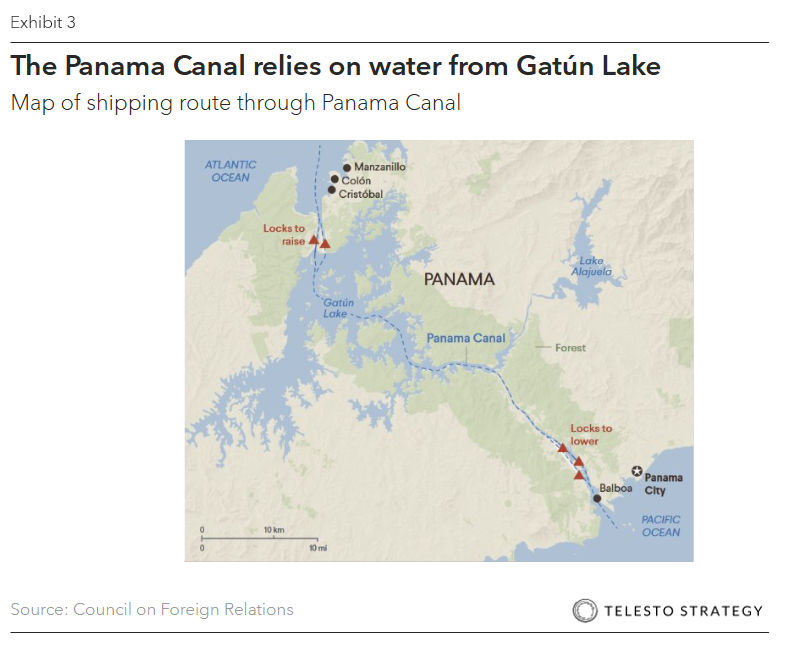

The Panama Canal, which carries 5–6% of global maritime trade and nearly 40% of U.S. container traffic, faces chronic water scarcity. The reliance on freshwater reservoirs means that drought directly limits capacity.

Although operating more smoothly in mid-2025 — averaging 33 transits per day — the Canal remains a water-constrained corridor. Any prolonged dry spell could choke flows with little warning. The proposed $1.6 billion Río Indio reservoir may help, but environmental and political challenges make timelines uncertain.

For management teams, this underscores the need to model drought scenarios in shipping forecasts and diversify transit strategies before constraints reemerge.

ESG scrutiny and shadow fleets

Management cannot ignore the reputational and compliance risks emerging in maritime logistics. Since the invasion of Ukraine, shadow fleets have grown by more than 40%. These aging tankers operate in a regulatory gray zone, often concealing sanctions-violating activity.

While cheaper in the short term, reliance on such fleets introduces material risks: regulatory penalties, environmental liabilities, and reputational damage. Investors and regulators increasingly expect companies to map their suppliers down to Tier-2 and Tier-3 to ensure compliance with EU CSRD, U.S. import rules, and other ESG standards.

Disruptions are already hitting industry

These examples highlight the operational consequences management teams must prepare for: stalled factories, missed market windows, inflated freight budgets, and collapsed regional trade hubs.

Actions management teams can take:

Key questions for management

Additional Telesto resources:

If your organization needs to secure continuity, protect margins, and meet rising expectations in a fragile supply chain, contact Telesto Strategy.

Copyright © 2025 Telesto Strategy, LLC

All rights reserved