In Q2 2025, tariff volatility and regulatory shifts have become a defining force in enterprise strategy — no longer a “trade” issue, instead a board-level risk. The most sophisticated multinationals are now deploying structured stress-testing frameworks to model “policy shock” scenarios: tariff spikes, export control expansions, carbon border pricing, and compliance detentions. These models link granular HS-code exposure, supplier geography, and product carbon intensity to real-time profit-and-loss simulations —quantifying the margin at risk and working capital requirements under each regulatory outcome. For directors, the strategic question is shifting from “Where should we produce?” to “How fast can we re-position when the rules change?”

Key takeaways:

- As of 2025, tariff shock has become a systemic lever. The National Retail Federation estimates that lever: since 2018, U.S. import tariffs have added up to $132 billion in import costs borne by American firms (per National Retail Federation estimates).

- Rapid-switch back planning has increasingly become a necessary enterprise capability to quickly reverse or reroute its sourcing, production, or logistics strategy when policy or market conditions change faster than its long-term plans.

- Mitigating regulatory divergence allows companies to treat supply chains not as static cost centers, but as dynamic instruments of geopolitical and regulatory agility.

- In an age defined by economic warfare and regulatory whiplash, companies that can switch back faster will preserve both margins and market share.

The emergence of corporate switch-back planning

Born from the last five years of tariff shocks, export controls, sanctions, and climate-driven disruptions, rapid-switch back planning refers to an enterprise’s ability to quickly reverse or reroute its sourcing, production, or supply chain strategy. Previously, where decisions once thought stable for decades can be upended overnight.

For corporate boards, this concept moves beyond simple dual-sourcingdual sourcing. It’s about institutionalizing a muscle memory of operational reversibility — designing supplier contracts, transportation lanes, and product bills of material in ways that can pivot within weeks rather than quarters.

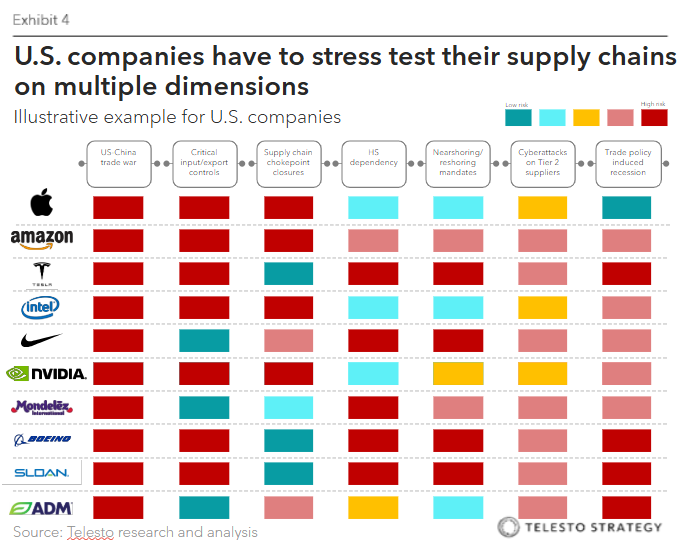

Leading multinationals are embedding rapid-switch frameworks directly into their risk and capital allocation models. For example, electronic firms are maintaining parallel qualified suppliers in both ASEAN and Mexico. Similarly, automakers are building “swing capacity” in secondary plants to respond to sudden tariff changes. Also, consumer good giants are co-locating packaging and ingredient suppliers across multiple trade blocs to hedge against regulatory divergence.

In the model global trade regime, HS (harmonized system) code exposure and rapid-switch back planning are two sides of the same strategic coin — one defines the magnitude of vulnerability, the other defines the speed and agility of response.

The companies that succeed will not be those that forecast every policy move — but those that institutionalize the muscle to flex across them, translating geopolitical unpredictability into operational advantage.

A number of leading technology, life sciences, and consumer companies have been building in this agility into their supply chains. A few notable examples:

- Apple with Foxconn and Tata. Accelerated “China-plus-India” for iPhones sold in the U.S. In 2025 Apple broadened India production so that most U.S.-bound new iPhone models are assembled in India, air-shipped when needed; Foxconn exported 97% of India-made iPhones to the U.S. March–May 2025, and Foxconn committed $1.5B more to its India unit. Purpose: cut tariff exposure and add routing options if transshipment rules tighten further. Impact: a visible shift in the U.S. smartphone mix away from China and a much larger India pipeline ready to flex up or down.

- Global pharma (Pfizer, AstraZeneca, Merck, Roche, Amgen, etc.). Rushed to on-shore U.S. manufacturing and buffer inventories ahead of new branded-drug tariffs, with multi-billion programs and fast tech-transfers to U.S. plants. Purpose: Create tariff insulation and regulatory certainty; management had flagged a limited near-term tariff hit in 2025 due to inventory positioning and in-flight U.S. capacity adds. Impact: Ability to swing supply back to the U.S. on short notice.

- MGA Entertainment (toys for Walmart and Target). Pulled forward a 40% production shift out of China to India, Vietnam, and Indonesia within ~6 months to keep U.S. shelves stocked regardless of tariff scenarios. Purpose: keep price points and fill-rates steady; gain switch-back lanes across three countries. Impact: accelerated diversification timeline and reduced single-country exposure.

Examples of stress-testing scenarios

Modern stress-testing frameworks for tariffs and supply chain risks in the current geopolitical and U.S. domestic policy context are moving beyond static models toward more dynamic, data-driven, and AI-powered approaches.

The practice borrows from financial stress testing but extends across operations, blending CFO discipline, legal foresight, and supply-chain visibility. The aim is not prediction but preparedness — knowing where to pull cost, pricing, and sourcing levers before a policy shock crystallizes into a financial one.

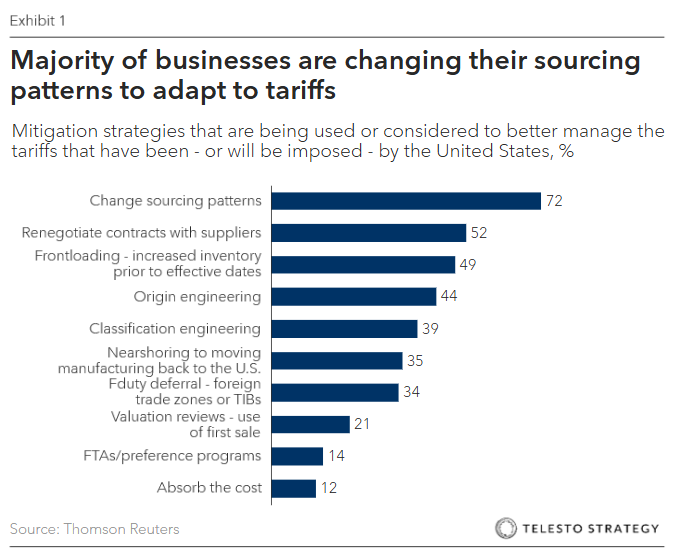

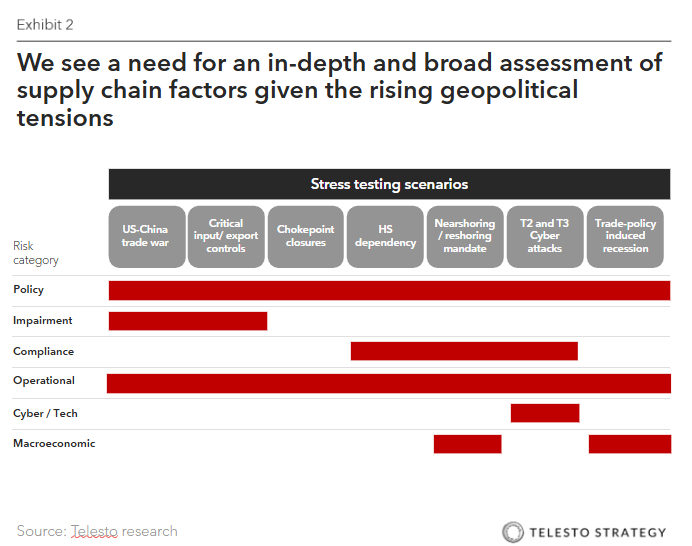

- Escalating U.S. – China trade war. Stimulate a scenario where tariffs on a specific country or region, such as China, escalate by 10-25% on a particular category of goods, forcing companies to find new sourcing options in an accelerated time frame

- Critical input/export controls. Model situations where a key component, like rare earth elements or semiconductors from a strategic rival, given tightening export controls of both U.S. and China.

- Supply chain chokepoint closure. Simulate a disruption at a major global shipping chokepoint like the Red Sea or the Panama Canal, causing major transit delays and cost increases for insurance and shipping.

- HS Dependency. Companies with high HS dependency (e.g. electronics or automotive OEMs) treat each HS code as a “shock node” in their scenario stress tests, overlaying exposure indexes with switch-back costs to decide which sourcing lanes to prequalify.

- Nearshoring and reshoring mandates. Test a scenario where new U.S. domestic policies or subsidies encourage or mandate shifting production closer ot home or back to the U.S., which accounts for altering cost structures and supplier networks.

- Cyberattacks on Tier 2 suppliers. Stimulate a cyberattack that takes a critical second-tier supplier’s manufacturing plant or data systems offline for an extended period, causing cascading effects on production.

- Trade policy. induced recession. Financial institutions use scenarios like the “Tariff and Trade War Recession 2.0” to model the effects of tariffs driving up costs, disrupting supply chains, and causing a global recession. Key indicators include a rise in unemployment, persistent inflation, and declines in consumer spending.

Where technology can help

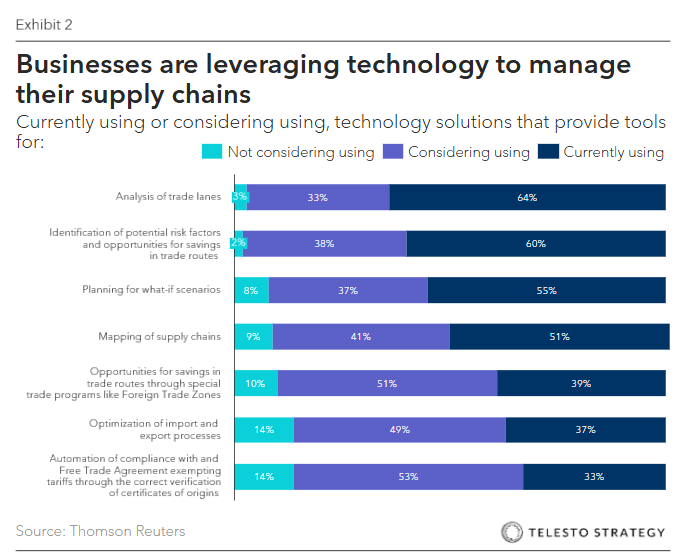

As with the greatest enterprise risks, rapid technological advancements can help mitigate regulatory divergence risk and improve switch-back planning capacity. Technology, especially advanced and agentic AI-driven tools, are being leveraged to assess trade lanes, identify risks factors, and plan for what-if scenarios.

What is HS-Code exposure?

“HS-Code exposure” refers to the risk (financial, compliance, operational) that a company faces because of how its goods (or input materials) are classified under the Harmonized System (HS) tariff codes (or related national nomenclature, e.g., HTS in the U.S.). Because tariffs, trade remedies (anti-dumping, countervailing duties), quotas, preferential trade agreements, origin rules, and customs enforcement all hinge on HS code classification, small differences in classification (or mis‐classifications) can have large cost or legal consequences.

How does tariff engineering work?

Tariff engineering refers to the deliberate design, material, and process modifications (or classification shifts) firms make so that their goods fall under lower-tariff HS/HTS codes, or so that origin rules favor more favorable duty treatment. Because marginal changes in classification can trigger materially different duty rates, especially in high-tariff regimes, the payoff for successful engineering can be meaningful.

To pull off tariff engineering strategies, management teams will have to ensure engagement across the enterprise – product design, legal, logistics, operations – to ensure both innovative strategies and compliance with trade regulations. The changes must represent genuine, commercial modifications (not cosmetic or reversible gimmicks) and must survive customs authority scrutiny, specifically on rules like “substantial transformation” or origin designation.

- Material substitution. Using alternative materials that qualify for lower tariff rates

- Component-based imports. Importing products in disassembled form when individual parts are taxed at lower rates than finished goods

- Manufacturing location adjustments. Shifting production or final assembly to countries with favorable trade agreements or lower duties

- Product classification optimization. Structuring goods to fit within HTS codes that carry reduced tariff burdens while maintaining compliance

- Value-based tariff planning. Managing declared customs values within legal guidelines to minimize duties

- Re-pricing. Companies look to reprice certain components of their product to reduce tariff exposure

In sum, tariff engineering is not a silver bullet, but in volatile trade regimes it becomes a critical lever in the resilience playbook.

Actions boards can take:

- Elevate trade and regulatory volalitilityvolatility into formal enterprise risk management

- Require quarterly “policy-shock” drills that test liquidity, pricing power, and supply resilience under alternative tariff or CBAM regimes

- Oversee a “tariff engineering tracker” within a trade risk dashboard, with scenario simulations across key SKUs

- Ensure that decision thresholds have been defined (e.g., minimum duty savings, payback period) beyond which redesign is justified and pre-document engineering rationales

- Ask management to wargame “classification reversal” threats: simulate customs challenging modified designs and ensure fallback strategies are in place

- Establish switch-back KPIs, such as time-to-reroute, alternate supplier readiness, and margin at risk per 30-day delay into executive scorecards

- Review board-level risk appetite and reassess tolerance for concentrated sourcing in high-risk trade corridors (e.g., China, Taiwan, Eastern Europe) and align capital allocation accordingly

- Commission an independent audit of classification compliance

Questions for the boardroom:

- What fraction of our production can we redirect within 60 days?

- How are we testing policy shocks across key markets?

- Does our enterprise planning system treat reversibility as a competitive advantage, not a cost?

- Which 20 HS codes drive 80% of our exposure?

- How does a 15-point tariff shift alter our gross margins?

- Have we mapped which parts of our supply chain sit behind potential choke points (e.g., Red Sea, Panama Canal, South China Sea)?

- Do our current contracts with suppliers and logistics partners enable rapid switching, or are they friction-locked by exclusivity clauses? Are our contracts CBAM and UFLPA-ready?

Additional Telesto resources:

- Board Series: Know your supplier – Diversification risks amidst escalating trade wars

- Board Series: Onshoring to the U.S. – Have boards considered the physical risks?

- Board Series: Tariff Engineering – Boards face new risks as multinationals reduce tariff exposure

- Board series: Entering the Quantum Economy – What boards need to know in 2025

- Atlas, equips your organization’s corporate directors and leaders with the insights and knowledge necessary to stay up to date, mitigate risks, and seize business opportunities associated with sustainability, climate, and ESG