Geopolitical volatility, shifting trade policies, and rising tariffs are redefining supply chain risk. More than ever, agility and transparency raise to the top of board and management’s priorities. Generative artificial intelligence offers powerful tools—predictive insights, scenario modeling, and real-time visibility—that can help enterprises anticipate shocks, ensure compliance, and sustain continuity. Moreover, agentic AI will allow companies to deploy “self-driving” supply chains to hasten decision-making and realize greater benefits of timeliness, cost-containment, and more. The challenge for directors is not whether to adopt AI, but how to govern its integration: ensuring management has the data infrastructure, talent, and oversight to capture value.

Key takeaways:

- Leveraging generative AI across supply chain operations requires governance, data readiness, and upskilled talent – starting with a focused set of well-defined pilots will yield better outcomes

- The most aspirational companies are looking to build a more autonomous global systems — a “self-driving” supply chain — through agentic AI

- B2C and B2B giants have leveraged AI in a host of logistical and planning operations with a shared goal of cost-reduction, brand uplift, improved customer experience, and more resilience and transparency

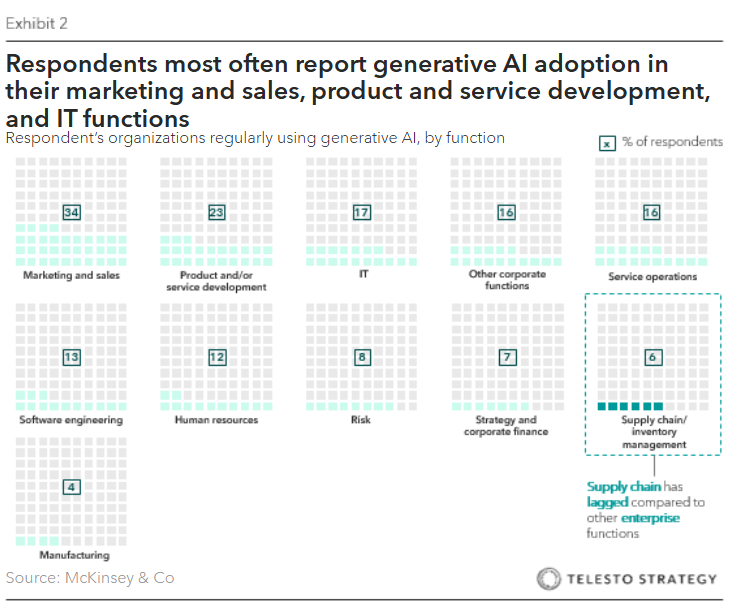

- Supply Chains have lagged behind functional peers in their enterprise in adopting AI, lessons can be drawn from marketing and sales, product development to better design and execute AI integrations

What is the state of AI adoption across multinationals?

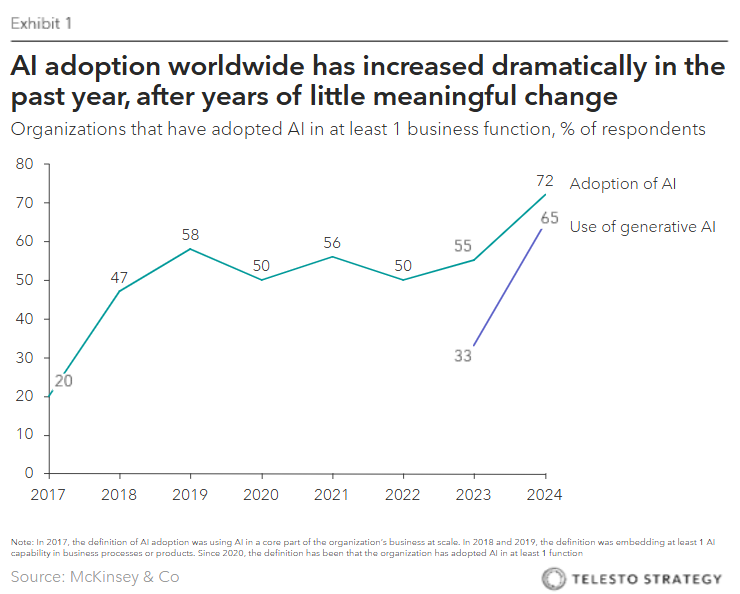

With the push for generative AI integration across enterprise operations, business leaders are hoping to move from reactive and static operations to more proactive and agile positions. A recent global survey found that AI adoption has reached ~72% (up from 40% in 2023). Responses suggest that companies have introduced AI to more parts of their businesses; ~50% of respondents indicate that their organizations have adopted AI in two or more business functions.

Integrating AI solutions for supply chain application — namely demand and risk forecasting, intelligent automation and optimization, and end-to-end visibility and transparency — with the objective of material improvement in resilience, agility, cost reduction, operational efficiency, brand reputation, sustainability, and customer satisfaction.

The global market for AI in supply chain, including generative AI, is projected to surge from $4.5 billion in 2024 to $157.6 billion by 2033, growing at a rapid compound annual growth rate (CAGR) of 42.7%

The pace of change is staggering. Even in the relatively nascent area of sustainability tracking and measurement across supply chains, AI adoption is as high as 62%.

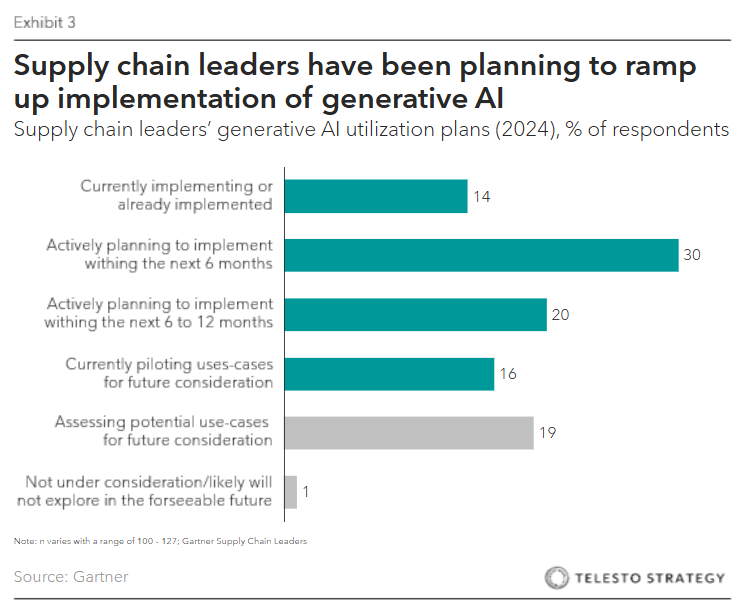

While there is significant buzz across generative AI’s application to a host of business models, supply chain has lagged compared to other enterprise functions, like marketing and sales. This could present an opportunity for supply chain organizations to be “fast followers” and capitalize on early learnings and technology investments from other functional partners.

What are the most relevant supply chain applications of generative AI?

Generative AI tools are being applied broadly to supply chain operations, especially as investors pour cash into the technology and executives race to introduce high-return applications. While AI for predictive models has been at play for some time (especially for planning and demand forecasting), agentic AI and decision-making automation are being layered across supply chain operations to improve timeliness and autonomy:

- Forecasting and inventory optimization

- Logistics routing and fulfillment

- Supplier risk and continuity

- Quality and throughput

- Compliance management

- ESG and traceability

- Customer engagement and experience

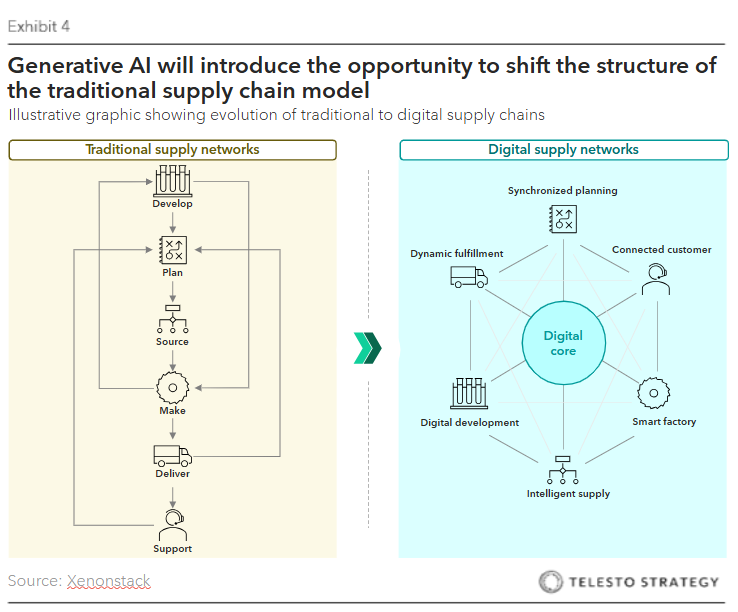

The technological gains from generative AI have the opportunity to shift the structure of global supply chains fundamentally. With a robust, digital enterprise backbone, the former linear model of develop, plan, source, make, deliver, support, will be an integrated data exchange and clearing house.

Which companies are leading the way?

Notable examples from industry leaders include:

- Walmart. Has scaled agentic AI and decisioning across its operations and is in fierce competition with Amazon and Target for e-commerce leadership. While Amazon has invested heavily in its own automated fulfillment network, Walmart is leveraging its vast physical store network with advanced AI and robotics to create a resilient, tech-powered omnichannel operation. Walmart is shifting from traditional, static forecasting to predictive AI models to minimize cost and keep stocks shelved.

- Coca-Cola. Has a initiated a five-year $1.1 billion partnership with Microsoft to apply Azure AI and OpenAI across operations, to improve demand forecasting, optimizing logistics, and enhancing employee efficiency. The company is exploring generative AI digital assistants to help employees in the bottling network by providing quick answers to common questions about inventory and forecasts. This reduces time spent on manual processes, such as training and answering emails, and frees employees to focus on more strategic tasks. Finally, for its “Create Real Magic” campaign, Coca-Cola used OpenAI’s DALL-E and GPT models to generate original artwork from its archives and even a personalized holiday experience with a conversing AI Santa.

- PepsiCo. Using generative AI has become part of Pepsi’s effort to create a “self-driving” supply chain. This involves deploying AI agents across all stages of the supply chain — from procurement and manufacturing to logistics and retail sales —to increase efficiency and improve data-driven decision-making. The company has formed strategic partnerships with Salesforce and Amazon Web Services to build the necessary technology backbone.

- BMW. Has developed and deployed several AI applications, such as the multi-agent system Alconic, the Offer Analyst, and the Tender Assistant to automate tasks, improve efficiency, and optimize decision-making. Moreover, BMW also uses generative AI to create and analyze its “Virtual Factory” digital twins, which are virtual replicas of its physical production sites. The digital twins allow the company to simulate various production scenarios, test new factory layouts, and optimize robotics and logistics systems.

- DHL. Has leveraged generative AI to enhance customer service, boost data accuracy, and streamline warehouse and back-office operations to compete more effectively with vertically integrated retailers like Amazon and Target, which manage their own logistics networks. To improve global back-office operations, DHL is automating often tedious office processes. This includes summarizing lengthy legal and financial documents, drafting inventory reports, and streamlining IT and HR requests.

- Nestlé. For product development, Nestlé uses generative AI to accelerate product research and development. It can generate over 1,300 product ideas in minutes — a process that traditionally took months. In collaboration with IBM Research, Nestlé developed a generative AI tool to create more sustainable packaging materials, optimizing for functionality, recyclability, and cost-effectiveness. This allows Nestlé to bring new products to market faster and align with consumer demands for sustainability.

- Caterpillar. One of Caterpillar’s goals with generative AI is to maximize equipment uptime for customers and increase high-margin service revenue, rather than focus on speed and volume as do B2C retailers with different supply chains. For its Condition Monitoring Advisors (CMAs), generative AI is used to automatically generate and summarize reports from sensor data and other sources. This can dramatically reduce the time needed for a human expert to create a maintenance recommendation and reduce unscheduled downtime.

Actions boards can take:

- Set strategic direction. Ensure AI is explicitly tied to enterprise objectives of resilience, continuity, and compliance—not just efficiency

- Engage in enterprise discussions. Coordinate and invite organization collaboration to discuss the implications, risks, and change management needed for AI adoption success

- Strengthen scenario planning and risk oversight. Direct management to use AI-driven simulations and digital twins to test trade policy shocks, tariff changes, and geopolitical disruptions

- Anchor on 3-5 high-value use cases. Tie AI initiatives to essential business priorities and well-defined P&L targets (e.g., forecast bias shrinkage, service-level lift, inventory turns). Set baselines and finance-approved measurements for each pilot

- Ensure data and enterprise readiness. Standing up pilots without a policy on data lineage, IP leakage, and regulatory exposure (especially with supplier data and trade compliance) exposes teams to unnecessary operational risk

- Ready talent. Evaluate and create plan to upskill planners and engineers

Questions for the boardroom:

- What is our AI supply chain roadmap over 1-3 years? Which use cases are high value vs. exploratory?

- Which top three AI use cases are scaled across the network today?

- What is the verified impact on service, cost, and cash this quarter and YTD?

- Do we have a unified, governed data layer feeding our planning suite and a scenario library for key operational shocks (e.g., tariff adjustments, climate shocks, geopolitical conflicts)?

- Do we have visibility deep enough upstream (raw materials, tier 2 and 3 suppliers)? If not, what investments are needed?

- Is our data infrastructure capable (real-time, high quality, integrated) to support AI tools meaningfully?

- Who in the organization owns supply chain AI strategy? Do we have more to gain if it’s centralized or distributed? Are there capable leaders and teams in place?

- What’s our upskilling plan for planners, engineers, and other key stakeholders across our supply chains (internal and with partners)?

Additional Telesto resources:

- Board series: Know your supplier – Diversification risks admist escalating trade wars

- Board series: Navigating the storm – Global shipping in turmoil

- Atlas, equips your organization’s corporate directors and leaders with the insights and knowledge necessary to stay up to date, mitigate risks, and seize business opportunities associated with sustainability, climate, and ESG

- Prism, our ESG benchmarking tool, helps your organization to rapidly strengthen its Sustainability, Climate, and ESG performance and disclosures through in-depth benchmarking of industry peers and identification of gaps and areas of distinction