In 2025, the global shipping industry stands at one of its most turbulent crossroads in decades — buffeted by geopolitical conflict, climate stresses, regulatory turbulence, aging infrastructure, and labor unrest. For large multinational businesses, global shipping is not a background logistical commodity. Instead, it is a strategic vulnerability — an axis on which market continuity, cost control, ESG credibility, and competitive stability spin. Boards must anticipate persistent instability across shipping corridors, pressure-test supply chains for chokepoint failure, and diversify transport strategies.

Key takeaways:

- With intensifying geopolitical risks, shipping is now a strategic vulnerability, not just a logistics cost. Boards must treat maritime risk as a top-tier source of enterprise exposure

- ESG scrutiny across logistics systems is intensifying, with pressure on directors and management teams to ensure transparency into Tier-2/Tier-3 suppliers and to avoid reliance on poorly insured shadow fleets

- The boardroom questions should shift from “what is the cost of shipping? to “what if this corridor fails tomorrow—how do we adapt?”

- With no resolution to the Red Sea and Suez Canal restrictions in sight, boards should expect prolonged increased complexity to global supply chains and maritime operations

Global maritime trade by numbers

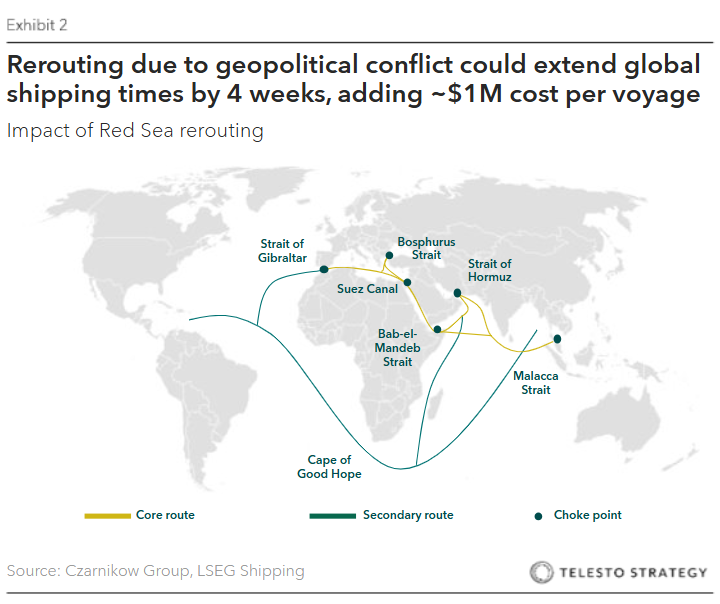

Global trade heavily relies on critical canals and straits known as chokepoints, such as the Suez Canal, Panama Canal, Strait of Hormuz, Strait of Malacca and Taiwan, and the Bab el-Mandeb Strait. These ultimately reduce travel times and connect major bodies of water.

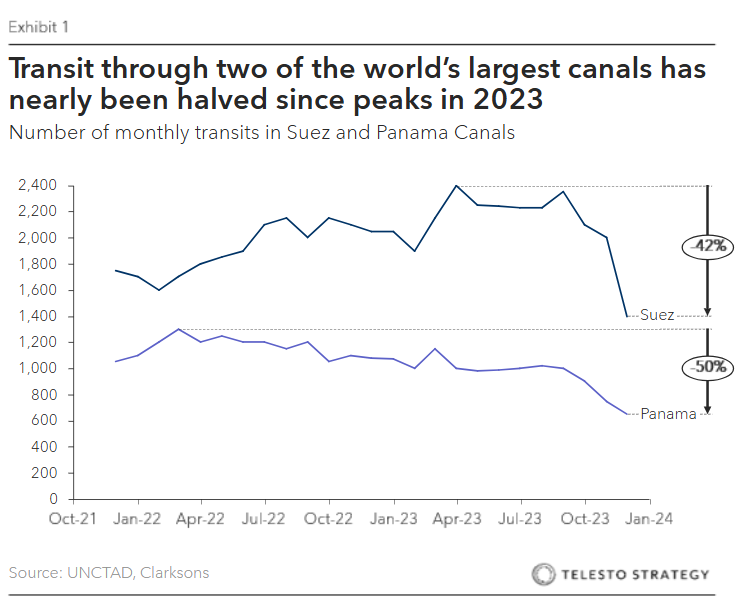

Up to half of the world’s sea trade is now considered at risk of interruption due to increasing geopolitical tensions and climate risks. As shown in Exhibit 1 below, transits in both the Suez and Panama Canal have been down YOY.

Implications of re-routing away from the Red Sea

The Red Sea has re-emerged as a central question to the international shipping industry. The region remains highly volatile, with continued Houthi attacks targeting commercial vessels. The ongoing unrest has led to the Red Sea, including the Suez Canal, being classified as “restricted zones” by many shipping companies. The Suez Canal typically facilities passage of 12% of global maritime commerce.

Accordingly, commercial traffic transiting the Bab al-Mandab Strait has plummeted. Instead, ports along the alternative route via the Cape of Good Hope are absorbing increased vessel traffic. This shift significantly impacts on global trade, causing longer delivery times (on average 2-4 weeks), delays, elevated costs and increased freight rates.

With the increased complications in the Suez Canal, shipping costs are escalating. Notable examples include from this February (as compared to 12 months prior):

- Shanghai to Genoa rose by 97%

- Shanghai to Los Angeles rose by 133%

- Shanghai to New York rose by 101%

Moreover, longer routes have led to increased port congestion, fuel consumption, crew wages, insurance premiums and piracy risks, all while raising overall costs and greenhouse gas emissions.

Climate Risks pose long-term challenges to the Panama Canal

Approximately 5-6% of global maritime trade passes through the Panama Canal, a critical chokepoint connecting the Atlantic and Pacific Oceans. This vital waterway handles a significant portion of U.S. trade, with about 40% of U.S. container traffic using the canal annually.

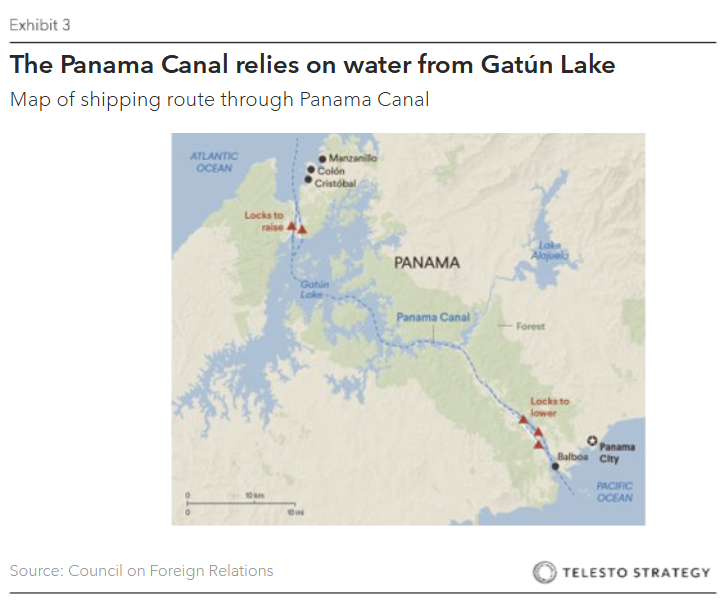

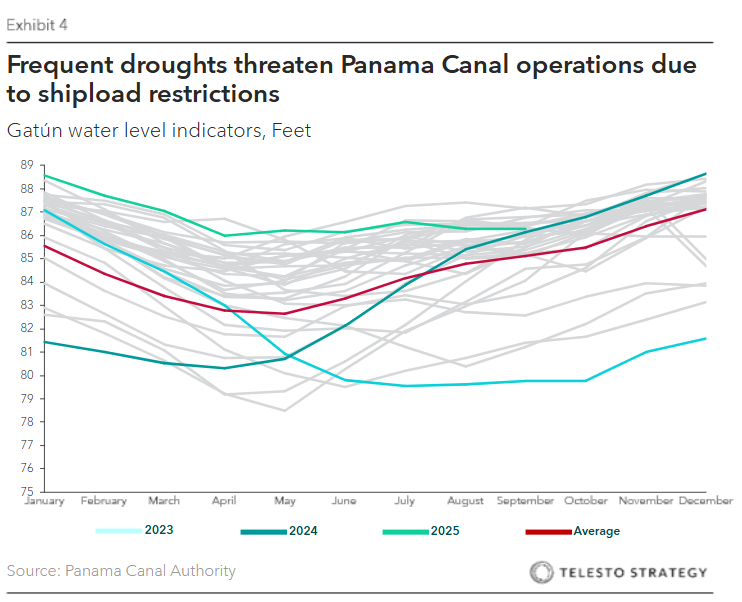

Recurring droughts have created operational challenges for the Panama Canal, reducing water levels and imposing draft restrictions that limit shiploads. The structural issue remains: the Canal relies on freshwater from Gatún and Alajuela lakes, and each lockage consumes ~50 million gallons, which would otherwise be used for Panama’s public water and energy-generation supply.

Right now, the Panama Canal is operating more smoothly than in past crises, however, it remains a water-constrained corridor that can tighten quickly in a dry spell. Through July 2025 the Canal maintained its full 50-foot draft and averaged 33 oceangoing transits per day (daily high of 38), versus a sustainable capacity of 36-38.

For the long-term, the Canal’s proposed development of the $1.6 billion Río Indio reservoir, which is intended to secure freshwater and reduce dry-season constraints, is advancing. Yet, it faces real community, environmental, and political hurdles that could affect timing and ultimate capacity.

Increased ESG scrutiny

Environmental, Social, and Governance (ESG) criteria are being applied to maritime logistics and shipping through increasingly strict regulation, investor pressure, and consumer demand for transparency. This heightened scrutiny compels the industry to address its significant environmental impact, improve labor practices, and enhance corporate transparency.

With the rise of geopolitical tensions and conflict, the ESG push towards transparency is also not being leveraged to prevent sanctions avoidance.

Since the invasion of Ukraine, the use of shadow fleets in shipping has been on the rise. From 2022 to mid-2025, the Russian shadow fleet’s size grew more than 40%. Shadow fleets, or dark fleets, are vessels, often old tankers, that are used to bypass international sanctions and conceal illicit or deniable maritime activities (e.g., smuggling oil for sanctioned nations like Russia, Iran, and Venezuela). These ships operate in a legal and regulatory gray zone by using opaque ownership, fake or minimal registries, avoiding port inspections, and employing tactics like ship-to-ship transfers. Under ESG scrutiny, these vessels represent reputational risk, environmental liability, and governance failures—particularly for insurers, charterers, and ports.

What has been the impact to global shipping disruptions?

- Tesla. Halted its production in its German factory for two weeks in early 2024 due to supply chain delays caused by Red Sea shipping disruptions

- Maersk. The Danish shipping giant paused container traffic through the Red Sea, citing “capacity loss of 15-20%” in the Far East-to-Europe and Mediterranean market due to ongoing disruptions

- BP and Shell. These oil and gas multinationals suspended shipments via the Red Sea, pausing transit indefinitely due to safety concerns

- Volvo. Suspended production at its Ghent plant for three days due to shipping constraints. The much longer and more costly shipping route led to delays in receiving components

- H&M. The Swedish fashion giant, which relies on Asian manufacturing, is monitoring developments closely, indicating significant exposure to freight delays and route instability

- Port-level economic collapse. The Port of Eliat, Israel’s only Red Seaport, witnessed a dramatic 85-90% drop in shipping activity, leading to its functional collapse

Actions boards can take:

- Elevate shipping and supply chain to the enterprise risk register. Treat global shipping volatility as a top-tier strategic risk, not as an operational detail

- Integrate dashboarding. Require management to present regular risk dashboards on cost, chokepoint exposures, incident frequency, and supplier dependencies

- Build scenario planning and stress test. Run board-level war-game simulations for Suez and Panama closures, extended Red Sea disruptions, or regional port strikes

- Embed ESG and transparency into maritime strategy. Require mapping of Tier-2 and Tier-3 suppliers to ensure compliance with EU CSRD, EUDR, and U.S. import scrutiny

- Strengthen infrastructure and cyber resilience. Ensure audits of port IT systems, undersea cables, and vessel tracking tools to identify cyber vulnerabilities

Questions for the boardroom:

- How exposed are our supply chains to the Red Sea, Suez Canal, or Strait of Hormuz chokepoints?

- What are our contingency plans if access to the Suez Canal remains disrupted for another 12-18 months?

- Are we dependent on shad fleets or high-risk carriers operating in conflict zones?

- How are we monitoring sanctions, tariffs, sudden trade restrictions, new suppliers, and transhipping risks that could compound maritime disruptions?

- How would extended Panama Canal droughts or extreme weather events affect our shipping routes and delivery times?

- How are we ensuring compliance with carbon emissions targets and ESG expectations for shipping operations?

- How exposed are our logistics operations to cyberattacks on ports, shipping companies, or undersea cables?

- How are we using, if at all, freight hedging strategies to manage volatile shipping and insurance rates?

- Do we have visibility into Tier-2 and Tier-3 suppliers that may be disproportionately exposed to shipping delays?

- Should the board establish a Supply Chain & Risk Committee or elevate this into Audit/Risk oversight?

Additional Telesto resources:

- Board series: Know your supplier – Diversification risks amidst escalating trade wars

- Board series: Corporate diplomacy in the age of economic warfare

- Board series: Onshoring to the U.S. – Have boards considered the physical risks?

- Atlas, equips your organization’s corporate directors and leaders with the insights and knowledge necessary to stay up to date, mitigate risks, and seize business opportunities associated with sustainability, climate, and ESG

- Prism, our ESG benchmarking tool, helps your organization to rapidly strengthen its Sustainability, Climate, and ESG performance and disclosures through in-depth benchmarking of industry peers and identification of gaps and areas of distinction