With broad policy upheaval in the U.S. under President Trump’s second term, Sustainability Committees on corporate boards stand on shaky ground. The administration has effectively terminated significant allocations for renewable energy, retreated from the Paris Agreement, spurred ESG-backlash, weakened the EPA, NOAA, and SEC mandates. At the same time, the global momentum for ESG and Sustainability persists. Even if the U.S. is going in one direction, board members will have to balance the reality that Climate, social, litigation, and governance risks remain financially material and globally governed.

Key takeaways:

- 15-20% of S&P 500 companies have created standalone Sustainability Committees to centralize the governance of the growing Sustainability and ESG mandate for boards – disclosures, risk mitigation, strategy, and more

- Even with the politicization of “ESG,” the regulatory momentum at a state and global level is pushing for enhanced corporate governance measures

- Faced with policy upheaval and economic uncertainty, many large U.S. multinationals have continued to progress their Climate goals, yet have removed most public references to them

- 2025 and 2026 will bring more, not less, Sustainability and ESG topics for boards to take on – enhance disclosure requirements, the Cyber-Climate nexus, supply chain transparency and traceability, human rights

Corporate governance of Sustainability and ESG has expanded and matured

In the mid-2010s, ESG-related duties were typically embedded in Nominating and Governance or Audit Committee charters. By 2018-2022, however, a rising number of S&P 500 boards decided to dedicate committees for Sustainability or ESG—11% in 2022, which was up from 7% in 2019. In 2023, the number is closer to 15-20% of the S&P 500. The highest preponderance of companies that did so were in materials, energy, and consumer-facing.

The earliest mandates of Sustainability Committees focused on environmental oversight and compliance. Charters now encompass a growing list of topics: Climate strategy, supply chain human rights, diversity and inclusion, community relations, and ESG-linked executive incentives.

For corporate boards that do not have a Sustainability Committee, however, an alternate approach has been to include ESG and Sustainability dimensions in Audit and Compensation Committees. Audit Committees now oversee Sustainability disclosures given the proliferation of Sustainability, Climate, and ESG-related disclosures.

What’s changing – key policy shifts and backlashes create a turbulent tapestry for Sustainability Committees:

- Federal deregulation blitz. On Day One of President Trump’s second term, the administration withdrew from the Paris Agreement for the second time, declared a national energy emergency, paused the Inflation Reduction Act (IRA) funding, and disbanded Climate working groups

- SEC shift and greenwashing risks. The new SEC rules empower boards over investors, tighten requirements for ESG shareholder resolutions, and heighten disclosure scrutiny. Regulators are cracking down on greenwashing risk domestically and globally

- Climate and ESG-related litigation surges. Expect fiduciary and negligence suits tied to emissions reporting

- Carbon border taxes emerge. The UK and EU have implemented policies to streamline global carbon pricing and will pressure supply chains

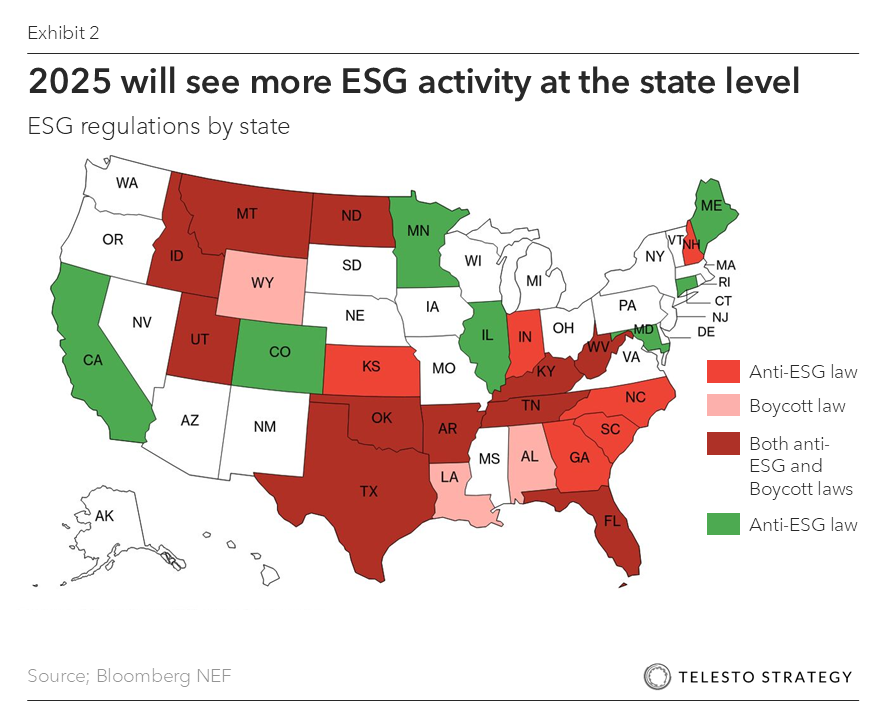

- State-led mandates mirror international reporting requirements. With California’s Climate bills passing in 2023 and being upheld after legal challenges, corporations will have to disclose emissions, climate risk, and ensure third-party review of all submissions. Additional states have used the CA model to propose similar legislation up for voting in 2025-2026: New York, New Jersey, Illinois, Colorado, Washington

- Anti-ESG backlash. An estimated 61 anti-ESG bills have been introduced by state legislatures, but either remain pending in committee or are supposed to carry over from the last legislative session. The laws look to restrict or prohibit the consideration of ESG factors in investment decisions, especially for public funds like pension plans. The most active states have been Oklahoma (14), South Carolina (9), Missouri (8), and West Virginia (7). Less than 10% of anti-ESG bills have been passed

- Pro-ESG legislation. While capturing less media attention, 7-10 states have enacted reforms to bolster ESG investing principles and pushed for legislation to allow the integration of ESG factors in state investment decisions, contracts, etc. Expect to see more activity in 2025

What to look out for in 2025 and 2026

- Expansion of committee mandates and environmental governance. Broader scopes will be a result of covering double-materiality, Scope 3 emissions, human rights, supply chain transparency and traceability, ESG performance, and the global uptick in relevant regulations

- Continued proliferation of dedicated committees. We see a momentum toward dedicated committees among mid-tier firms, pushing the total closer to 20-25%

- Corporate tightrope walking. U.S. companies will continue to maintain their Climate commitments while trimming their messaging about it, as they walk a tightrope between competing pressures on the environment. The latest research shows that ~70% of the 50 largest U.S. companies by market capitalization have remained committed to their Climate goals

- National security rises to the top. Driven by national security concerns, the linkage to energy security, critical mineral access, and supply chain resilience will find its way back to the Sustainability Committee’s activities

- A pivot from the “ESG” acronym. 80% of companies have adjusted their strategies in response to the political environment. Many have focused on messaging, have replaced “ESG” with alternatives such as “Sustainability,” “impact,” or reverted to “corporate responsibility”

- Double materiality oversight. Expect Sustainability Committee charters to embed dual-materiality (impact and financial) into committee mandates in line with GRI and CSRD standards

- Board-level ESG KPIs and remuneration. Boards will face more pressure to link director and executive pay to Climate and social targets, elevating ESG metrics within ESG Compensation Committee charters

- Cyber and Climate Risk intersection. ESG committees will collaborate more with Audit Committees as energy grids, operational resilience, and cybersecurity risks converge

- Supply chain traceability and transparency. With many changes to U.S. trade policy and corresponding shifts in trade flows, U.S. multinationals push for supply chain agility, vendor optionality, alongside enhancing traceability and transparency. Sustainability committees will have to be prepared to take on this additional responsibility

Beyond committee structure, how are companies responding to political pressures to curb ESG activity?

- Alphabet. Deleted a statement in its 2024 filing that described Sustainability as a “core value” and removed all references to “ESG.” All of its Climate targets have been maintained

- McDonald’s. Has delayed its Sustainability report amid the political and economic uncertainty. The company aims to reduce emissions by its suppliers by 2030, but has not released a Sustainability report this year

- UnitedHealth Group. Has not released a Sustainability report this year, however, has said in its proxy statement that it has maintained its goals that were announced two years ago

- Microsoft. Has released a Sustainability report reaffirming its goals

- Apple. After publishing its ESG Report in 2022, the company has dropped the acronym: all disclosures have been rebranded to “Environmental Progress Report.” The latest report reconfirms the Apple 2030 net-zero plan and boasts a 60 % absolute emissions cut since 2015

- Nvidia. Announced it has achieved its near-term goal of powering its offices and data centers with 100% renewable energy this year

- Coca-Cola. Has scaled back several commitments to Sustainability. In December 2024, it quietly removed its high-profile pledge to make 25 % of packaging reusable by 2030, replacing it with less aggressive targets centered on recycled content and collection rates. Earlier in 2024, Coca-Cola rolled out a revised 2035 roadmap that keeps its net-zero ambition and recasts its Climate and packaging goals in less prescriptive terms

- Pepsi. Has recently adjusted its environmental targets, including those related to greenhouse gas emissions and packaging. The company has shifted its focus from ambitious, broad goals to more “specific” and “achievable” targets that match the policy environment. For example, its goal to reduce virgin plastic tonnage by 20% by 2030 is replaced with a target of an annual 2% reduction in virgin plastic tonnage

- Mondelez. Is pushing forward with its ESG reporting—its Snacking Made Right ESG Report retains the acronym and reconfirms 2025 carbon- and packaging-reduction targets

- P&G. In 2023 re-named its Sustainability report to “Corporate Citizenship” and has kept its Ambition 2030 Climate, water and waste goals intact. Moreover, in December 2024 P&G has agreed to publish more detail on wood-pulp supplier audits after investors threatened resolutions over forest impacts

- Caterpillar. The heavy-equipment maker released a comprehensive 2024 Sustainability Report in May 2025 that bundles ESG data, TCFD, and lobbying disclosures; many interpret their efforts as a signal that they are not walking away from environmental goals

Actions boards can take:

- Evolve the charter. Include responsibilities on the fiduciary, materiality, and risk-based activities regarding Sustainability strategy and underlying workstreams

- Strengthen board literacy and dialogue. Prioritize Climate literacy, scenario planning, continuous education, and peer-to-peer industry collaboration

- Push for Sustainability monetization. Evaluate the gamut of Sustainability initiatives and strategy for financial productivity over short-, medium-, and long-term, push for greater connectivity between the Chief Sustainability Officer and the Chief Financial Officer, and establish incentives for improved integration of their portfolios

- Build direct investor engagement. With the SEC imposing barriers on resolutions, Sustainability committees should build direct board-institutional investor dialogues and prepare defensive communications grounded in business cases. Expect ESG activism to shift to litigation and “no” votes

- Evaluate and embed ESG incentives. Assess current and potential ESG metrics to compensation and benchmark for peer organizations, organizational values, and long-term strategy

- Call for cyber evaluation. In addition to standard cyber threat detection and prevention protocol, require management teams to consider the Cyber-Climate nexus and preparations needed to ensure risk mitigation

Questions for the boardroom:

- Have management and the board agreed on what Sustainability and ESG mean for the organization?

- How is ESG defined, and how is the board’s governance structure enabling an ESG/Sustainability strategy for the enterprise?

- How have ESG and Sustainability governance responsibilities been distributed across the board and its committees?

- How often are ESG topics on the board agenda?

- How prepared are corporate directors to evaluate and provide guidance on ESG and Sustainability information?

- How can the company leverage disclosure information to improve enterprise competitiveness and value?

- To what extent do our Sustainability and Finance functions integrate their activities? How can their portfolios be better integrated to improve enterprise value?

- How do the fluctuations in U.S. trade policy impact our Sustainability Strategy and initiatives? How does global governance of supply chain incorporate traceability and transparency?

Additional Telesto resources:

- Atlas, equips your organization’s corporate directors and leaders with the insights and knowledge necessary to stay up to date, mitigate risks, and seize business opportunities associated with sustainability, Climate, and ESG

- Board series: The Kitchen Sink Committee – AI, Cyber, ESG, and, now, tariffs. Are Audit Committees ready

- Board series: When trade policy meets the balance sheet – Impairment pressures mount for the audit committee

- Board series: With IRA Tax Credits pulled and OBBBA passed, what’s next?

- Prism, our ESG benchmarking tool, helps your organization to rapidly strengthen its Sustainability, Climate, and ESG performance and disclosures through in-depth benchmarking of industry peers and identification of gaps and areas of distinction

- Recently released by Telesto Strategy’s CEO & Founder, Alex Kruzel, The Courage to Continue: Stay the Course on Sustainability to Secure our Future, explores the connection between corporate priorities and President Trump’s national security agenda

Connect with us today to turn policy disruption into strategic opportunity and position your board at the forefront of the energy transition.