In an era defined by mounting regulatory scrutiny and intensifying stakeholder activism, corporate directors are increasingly vulnerable to litigation. What began as a risk primarily managed at the enterprise level has evolved into personal legal exposure — especially for directors of large multinationals navigating cybercrime, Sustainability and ESG commitments, broadening regulatory reporting requirements, and geopolitical risk. Although landmark cases assigning actual personal financial damages remain rare, regulatory, derivative, and criminal instruments are now calibrated to pursue individuals where negligence, misrepresentation, or oversight failures are evident.

Key takeaways:

- Corporate-related litigation is rising sharply, with new claims targeting corporate directors personally for failing to meet duty of care, duty of loyalty, and other oversight failures. Average claim for breach of trust and care is estimated at $1 million

- A range of new risks have emerged, which require improved governance, training, and disclosure: cyber, geopolitical, climate, ESG, and Sustainability

- Shareholder derivative suits, greenwashing claims, and duty-of-care violations are increasing, creating a complex litigation landscape

- Proactive board governance, scenario-based legal reviews, and alignment with evolving disclosure standards can help mitigate personal exposure

Breach of duties: Litigation risks on the rise for Corporate Directors

Corporate directors can face liability — and sometimes financial penalties — for failing to manage enterprise risks or for misleading disclosures. However, cases holding directors personally liable are still rare. Most actions at this time are targeting companies, not individual board members.

Corporate directors can be held personally liable in multiple ways when they breach their fiduciary duties, oversight responsibilities, disclosure obligations, or statutory duties — and the scope of exposure is growing as climate, sustainability, cyber, geopolitical, and other risks gain regulatory weight. Here is a breakdown of the main pathways to personal liability:

- Breach of fiduciary duties.

- Duty of care: Directors must act informed, prudently, and with due diligence. An example trigger would be approving a major transaction without sufficient information or reasonable inquiry

- Duty of loyalty: Directors must act in the best interests of the company and avoid conflicts. An example triggle would be self-dealing, usurping corporate opportunities, benefiting personally at the expense of the company

- Duty of good faith: Directors must act honestly, without intent to harm the corporation. An example trigger would be willful neglect of obvious risk, knowingly approving illegal acts, or intentional misconduct

- Oversight failures Directors are responsible for implementing and monitoring systems for compliance and risk oversight

- Securities Law and disclosure liability. Directors can be personally liable for misstatements or omissions in securities filings, ESG reports, or public statements. An example trigger would be signing or approving false or misleading disclosures in SEC filings, sustainability reports, or investor presentations

- Statutory and regulatory breach liability. Certain statutes impose direct liability on directors, bypassing corporate protections

- Insolvency and wrongful trading. In many jurisdictions, directors face liability for deepening insolvency or trading while insolvent

- Criminal liability. Directors can be prosecuted where their acts or omissions meet criminal thresholds

- Cybersecurity oversight liability. Directors can be liable for failure to oversee cyber risk or misrepresenting cyber readiness

- Cross–border liability. Directors of multinationals may be subject to overlapping liability regimes

- Geopolitical risk. Directors of multinationals may be responsible for human rights in conflict zones, sanctions and export ban violations, and trade compliance

- Greenwashing and ESG misrepresentation. Personal liability for overstating sustainability performance or commitments is emerging

- Climate–related fiduciary duty expansion. Courts and regulators increasingly treat climate and sustainability as core governance issues

Climate- and ESG-related litigation proliferates

In recent years, U.S. and global business leaders have expanded their enterprise risk management systems, out of necessity, to monitor the growing risk of climate- and ESG-related lawsuits. Local advocacy groups, cities, individuals, and class actions have increasingly sought financial damages for companies deemed responsible for environmental degradation.

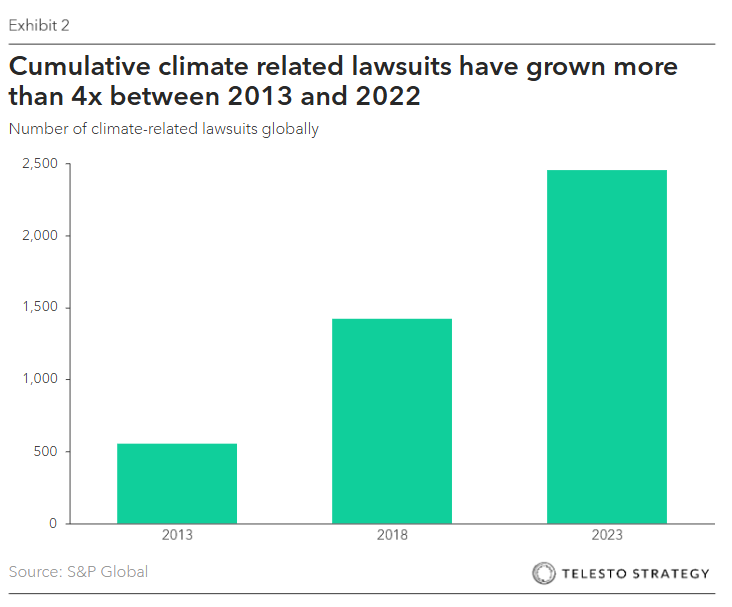

Climate change and ESG-related litigation cases grew more than 4x between 2013 and 2023. . In 2021-2022 alone, about 300 cases were filed, with broad geographic scope: thirty-nine new cases in the US, and the remaining 122 cases in forty-three countries and fifteen international or regional courts.i As of December 2022, the total number of historical cases had grown to 2,180.ii

In the U.S., the list of states and cities that have sued energy companies for their role in climate change grows by the day: Maine, Massachusetts, California, New York, Chicago, and many more. The lawsuits share a common position in alleging that large energy companies have misled the public and investors about the dangers of fossil fuels.

In general, children and youth, women’s groups, local communities, advocacy organizations, and Indigenous Peoples, among others, are taking a prominent role in bringing climate cases and driving climate change governance reform in more countries worldwide.

The ever-increasing variety of litigation mirrors the expansiveness of the corporate climate and ESG spectrum. Focal topics include but are not limited to climate change, pollution, environmental degradation, racism, food safety, human rights and trafficking violations, support to authoritarian states, sustainable farming, diversity in the board and senior management, and more.

Currently, categories of climate and ESG litigation are:

- Disclosure-based litigation. A company’s statements about a climate or ESG issue are challenged for allegedly being misleading or deceptive.

- Conduct-based litigation. A company’s underlying activities are directly challenged for allegedly violating a law addressing a climate or ESG issue.

- Governance-based litigation. A company’s leadership is challenged for allegedly failing to satisfy fiduciary duties and other obligations attendant to its role in managing the business and affairs of the business enterprise with respect to a climate or ESG issue.

Notable climate and environmental cases globally include:

- Germany. Liluya v. RWE – A Peruvian farmer sued RWE for contributions to glacier melting causing flood risk near Huaraz, Peru. The defendant sought RWE’s share of $4 million USD risk mitigation costs. In May 2025, the Higher Regional Court in Hamm dismissed the case—but importantly recognized that fossil fuel emitters could be civilly liable for climate damages in principle

- UK. McGaughey & Davies v. USS Ltd – Beneficiaries of a UK pension fund sued directors for failing to divest fossil fuels and misjudging climate risk. While the Court of Appel permitted a derivative claim in theory, the action did not succeed substantively, so no damages or personal liability awarded

- UK. ClientEarth v. Shell’s board – In 2023, ClientEarth field a derivative action alleging the Shell board breached duties by not preparing for climate transition under UK Company Act. The case was dismissed, and ClientEarth was ordered to pay Shell’s costs. No personal liability or financial penalty was imposed on directors.

Proliferation of geopolitical tensions, armed conflict, and human rights-related cases

In addition to climate risks, boards must also consider their readiness for the increase in political tensions, geopolitical risks, and the increase of armed conflict. Boards are expected to identify, monitor, and mitigate material risks to the business, including those that arise from geopolitical and conflict situations. A number of these risks are also growing:

- Duty of care and oversight failures in conflict zones

- Sanctions and export control violations

- Human rights-related liability

- Criminal liability for conduct in conflict zones

- Cross-border and extra-territorial enforcement

The exhibit below provides more detail on notable cases in which corporate directors have been held personally liable for human rights-related corporate wrongdoing. In each case, the court found that directors’ personal actions or decisions warranted piercing “the corporate veil” and holding them personally accountable.

Actions boards can take:

- Legal scenario planning. Engage with outside counsel and other technical experts to conduct litigation risk scenario analyses tailored to emerging climate, nature, and fiduciary duty cases globally

- Governance policy updates. Ensure board charters, risk oversight frameworks, and committee mandates explicitly address climate risk and ESG disclosure oversight

- Strengthen decision documentation. Keep detailed minutes reflecting the scope of debate, dissent, and reliance on expert advice in high-risk decisions

- Build competency and literacy. Undertake targeted board education on climate governance, ESG disclosure obligations, and cyber oversight responsibilities

- Reinforce personal protection. Review, and if necessary, enhance Directors and Officers (D&O) policy limits and scope, ensuring Side-A is sufficiently robust

- Proactively engage with regulators. Monitor and anticipate regulatory shifts in cyber, governance, climate disclosures, and fiduciary expectations. Where possible participate in industry consultations to shape evolving standards

Questions for the boardroom:

- Are we ensuring that long-term technological, political, sustainability, and climate resilience risks are integrated into strategic decision-making—not just financial metrics?

- Do we have independent verification of the data and assumptions used in board materials, especially for climate-related and cybersecurity disclosures?

- Could a reasonable outside observer conclude that we exercised informed, diligent judgement in approving key strategic moves?

- Do we have defined protocols for immediate board involvement in a material breach, climate incident, political crisis, or public allegation of misrepresentation?

- Are we aligned to the latest climate disclosure requirements in our operating jurisdictions?

- How is our board overseeing ESG strategy, climate risk (both physical and transition), nature risk, and scenario analysis?

- Do our climate and sustainability disclosures undergo rigorous legal review before publication?

- What Directors and Officers (D&O) insurance exclusions may expose individual directors to personal liability in climate-related cases?

- What training and legal updates are provided to the board regarding ESG, climate, and fiduciary duty trends?

Additional Telesto resources:

- Atlas, equips your organization’s corporate directors and leaders with the insights and knowledge necessary to stay up to date, mitigate risks, and seize business opportunities associated with sustainability, climate, and ESG

- Prism, our ESG benchmarking tool, helps your organization to rapidly strengthen its Sustainability, Climate, and ESG performance and disclosures through in-depth benchmarking of industry peers and identification of gaps and areas of distinction

- Board series: The Kitchen Sink Committee – AI, Cyber, ESG, and, now, tariffs. Are Audit Committees

- Entering the Quantum Economy – What boards need to know in 2025

Connect with Telesto Strategy to assess your board’s exposure and learn how to strengthen governance before it’s tested in court.