Economic warfare isn’t hypothetical—it spans commodity blockades, cyber coercion, financial retaliation, and increasingly violent tensions in a multi-polar global landscape. Boards must proactively integrate such threat vectors into strategic oversight by stress-testing scenarios, building financial and cyber resilience, diversifying supply chains, and cultivating agile governance. Through AI-assisted readiness and improved intelligence, boards can better decode geopolitical moves, reinforce supply chains, and safeguard both financial and ethical standing.

Key takeaways:

- Economic statecraft (tariffs, export controls, sanctions, and resource nationalism) is now a baseline operating condition, not an exception. Policy shifts are arriving faster and with fewer carve-outs

- The trade landscape is fragmenting—but evenly; world merchandise trade remains positive while services growth cooled in early 225. FDI is re-routing selectively rather than declining more rapidly

- Energy and technology remain at the center of the battlegrounds; price-cap and shadow-fleet dynamics continue to shape Russian oil flows. Chip and tool controls now span pay-to-export arrangements and vendor-specific constraints

- Logistics chokepoints will regain renewed emphasis, as the need to reroute adds time and cost to global supply chains

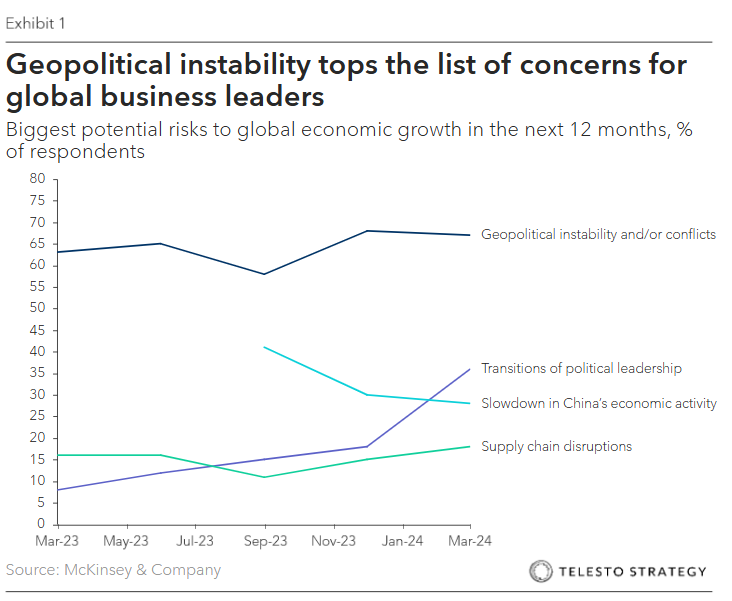

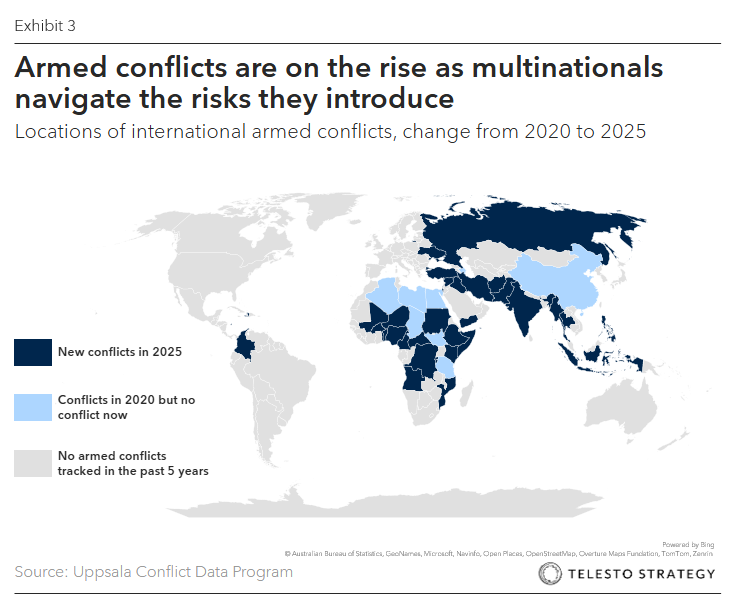

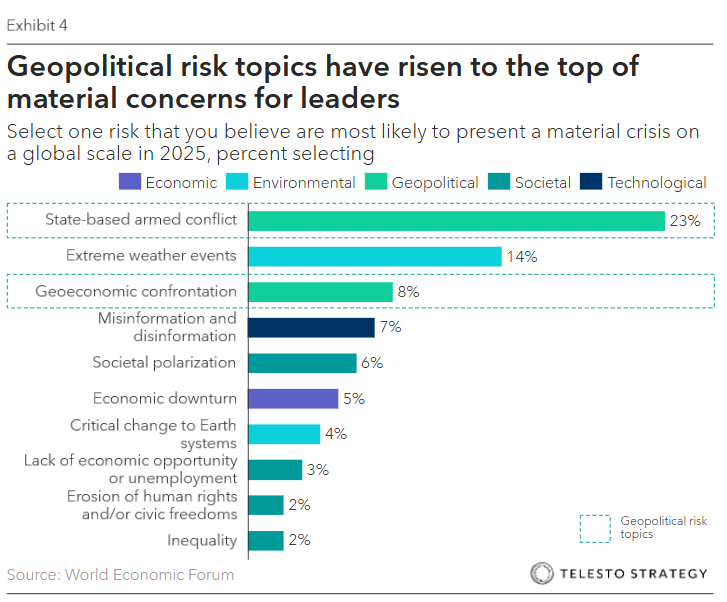

As economic warfare rewrites the enterprise risk calculus for multinationals, boards will have to pivot from reactive compliance to strategic resilience. Fueling the economic warfare is the intensity and duration of conflicts worldwide, which are at their highest levels since before the end of the Cold War.

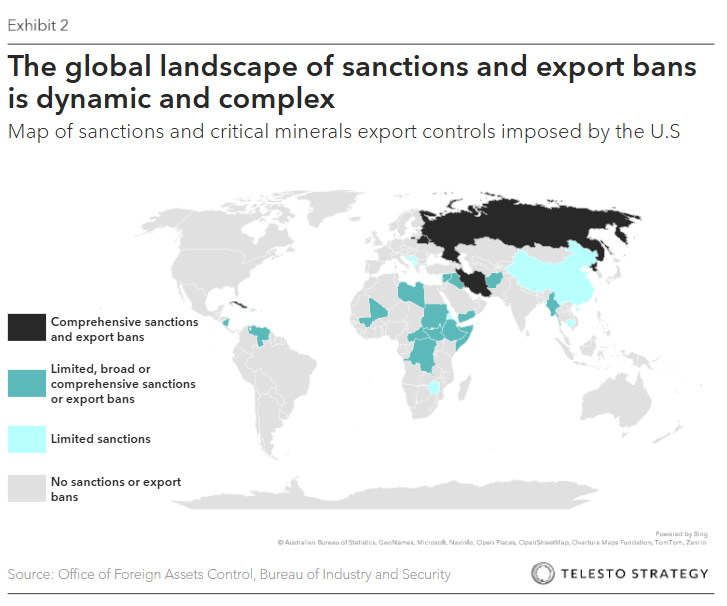

The global landscape of sanctions and export bans is dynamic and complex, influenced by evolving geopolitical rivalries, trade disintegration, and international policies. As cited by enforcing countries, these measures are employed to address issues such as: human rights violations, nuclear proliferation and terrorism, actions undermining territorial integrity and independence, and destabilizing activities in conflict zones.

Examples of recent flare-ups of geopolitical tensions showcase issues related to critical minerals, technology, logistics, and a hyper-focus on U.S.’s escalating competition with China:

- Port of Darwin compromises U.S. security interests. The Port of Darwin is at the center of a complex geopolitical situation involving Australia, China, and the U.S.A Chinese company, Landbridge, holds a 99-year lease on the port, raising security concerns for Australia and the U.S., particularly due to its strategic location and proximity to U.S military interest in Northern Australia. Pressure from the U.S. government started in the Obama Administration and has intensified; as such, the Australian government is currently exploring options to potentially regain control of the port, with potential involvement from U.S. companies

- Intel President under pressure. President Trump has called on the head of U.S. chipmaker Intel to resign “immediately” and has accused him of having problematic ties to China

- AI Chips. U.S. has updated its policy to allow sales of downgraded AI chips to China in exchange for 15% revenue share; companies may regain some sales but inherit policy risk optionality

- Red Sea Logistics. Suez Canal volumes fell ~50% in early 2024; carriers instituted surcharges and benefited from rate spikes, which has served as a reminder to multinationals and companies with global supply chains that route risk is now a cost lever

- EVs. In anti-flooding efforts, EU tariffs of 45% on China-built EVs took effect at the end of last year, which has altered the share and pricing power in Europe

- HPE-Juniper Merger Influence. U.S. intelligence agencies intervened to urge DOJ approval of Hewlett Packard Enterprise’s $14B acquisition of Juniper; the cited primary rationale is to reduce dependence on Chinese tech and protect national security

- U.S. Steel Acquisition by Nippon Steel. Although completed in mid-2025, extensive negotiations around CFIUS involvement, executive orders, and a “golden share” arrangement highlight tensions between allowing foreign capital flow and safeguarding strategic domestic capabilities

- Purchasing of Russian gas. The Trump administration sees India’s oil imports from Russia—even if technically permitted under price caps—as indirectly funding Moscow’s war efforts in Ukraine. The U.S. considers such purchases as undermining sanctions and national security objectives

What’s at stake for multinational companies?

With so much in flux globally, companies find themselves with broadening exposure to operational complexity, financial loss, and, often, irrevocable reputational damage.

Economic warfare is only heightened by the growing global trend of increased tensions and outbreak of armed conflict. Key areas include the ongoing wars in Ukraine and Sudan, Gaza, Israel, and Iran, regime change in Syria, Cambodia and Thailand, a significant escalation in the Democratic Republic of Congo, a brief but intense conflict between Indian and Pakistan, as well as increase confrontation in the South China Sea.

As reflected in the examples above, the range of impacts requires swift and thorough attention:

- Reputational damages. Companies perceived as enabling sanctioned or controversial regimes may face boycotts, protests, or social media outrage. This is the case for brands like McDonald’s, Coca-Cola, and Starbucks over perceived support for Israel

- Stock price drops. Regulatory penalties are often dwarfed by the investor response, which reflects confidence erosion. Studies show that stock price reactions are on average nine times larger than the actual financial fines

- Heightened regulatory scrutiny and compliance costs. Once flagged, companies often face tougher oversight and skyrocketing costs for legal and compliance defenses

- Gross margin compression via input shocks. Concentration in minerals, intermediary components, final ports equates to higher spot exposure, as well as redesign and requalification costs

- OpEx increases for compliance and trade operations. License management, end-use and end-user screening, maritime diligence, and on-the-ground audits in “connector” and transshipment hubs

- Working capital swings. Longer routes and precautionary inventory for sanction and controlled inputs limit working capital flexibility

- Limited risk transfer options. Insurance premiums related to geopolitical risk and conflict outbreak have become more limited and costly, which requires companies to improve internal management of risks and mitigation strategies

- Increased labor costs. Geopolitical tensions can contribute to labor shortages or necessitate the hiring of specialized personnel for compliance and risk management

- Currency fluctuations. Political instability and economic warfare can result in fluctuations in exchange rates, complicating pricing and contracts in international trade and introducing financial risks

- Restricted market access. Sanctions, trade wars, or political tensions can limit access to markets

Actions boards can take:

- Create an economic warfare playbook and dashboard. Stand-up a cross-functional task force with board-level oversight; game out license-loss and secondary-sanction scenarios in tabletop exercises with enterprise leadership (e.g., Legal, Operations, Supply Chain, Finance, Security, Government Affairs). Consistently track and monitor: sanctions exposure, tariff deltas, lead-time/route risk, critical minerals status, license pipeline, revenue at risk by policy scenarios

- Stress-test supply chains. Use scenario modeling (e.g., export bans, tariffs, asset freezes) to identify chokepoints and diversify sourcing, notably for critical components and raw materials

- Increase legal and diplomatic capacity. Invest in specialized counsel or alliances for navigating jurisdictional conflict

- Create agile response protocols. Build flexible operational playbooks to pivot logistics, production, or markets based on real-time analytics and geopolitical intelligence

- Engage proactively with policymakers. Participate in industry dialogues and advocate for pragmatic frameworks that balance national security with global business continuity.

- Consistently Revisit China+1 Strategy. With growing tensions and operational complexities in East Asia and ASEAN, assess long-term exposure to increasing tariffs, sanctions, and supply chain disruptions.

- Engage with Public-Private-Philanthropic Partnerships. Collaborate early with relevant government bodies to align on security considerations, ensure compliance, and build trust and a broader partnership base through engaging proactively with non-profits and philanthropic organizations

Questions for the boardroom:

- Are we fully equipped to assess and manage conflicting sanctions and trade regimes across jurisdictions? What do we see as our exposure over the next 12-24 months?

- What are our priority “red lines” for disengagement in high-risk markets, and have they been tested recently?

- How exposed are we to resource nationalism or supply restrictions in critical materials or technology?

- What connector markets are we over/under-weight relative to trade-realignment trends?

- What visibility and scenarios do we have for operations in regions susceptible to economic warfare?

- How readily can we shift production, routes, or sourcing rapidly in response to geopolitical shocks?

- How do we best manage compliance, ethical and moral standards, and stakeholder expectations during geopolitical conflict?

Additional Telesto resources:

- Atlas, equips your organization’s corporate directors and leaders with the insights and knowledge necessary to stay up to date, mitigate risks, and seize business opportunities associated with sustainability, climate, and ESG

- Prism, our ESG benchmarking tool, helps your organization to rapidly strengthen its Sustainability, Climate, and ESG performance and disclosures through in-depth benchmarking of industry peers and identification of gaps and areas of distinction