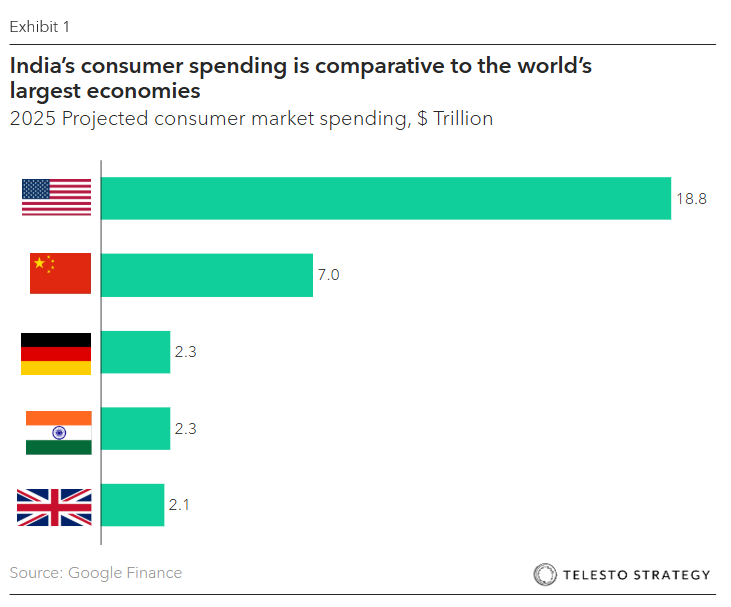

India represents one of the world’s fastest-growing consumer markets. Yet navigating demands a nuanced, strategic approach, especially in light of the growing volatility in accessing the Chinese consumer market. For CPG companies, the allure lies in India’s ~$616 billion FMCG (Fast-Moving Consumer Goods) market, projected to expand robustly through 2027. Multinationals in India have been reaping rewards, with 19 of 30 global consumer-goods MNCs delivering above-industry growth in India between 2018-2023. Yet, translating macro trends into scalable success entails overcoming deep-rooted challenges in market dynamics, trade policy, and operational complexities.

Key takeaways:

- The opening of trade and broadening of diplomatic and defense-related activities, U.S. companies are presented with an alternative to China’s industrial, agricultural, services, and tech capabilities

- CPG companies are eager to tap into the growing Indian consumer market and have been innovating their offerings, digitizing their operations to capture the opportunities

- Although the economic opportunity is clear, the operational challenges remain considerable—regional conflict, water scarcity, poor infrastructure, energy access and reliability, tariff barriers

- Board members will have to improve the evolving market dynamics to guide expansion opportunities

As the world’s most populous country, estimated at 1.428 billion, India has seen a remarkable segment of its population exit poverty since 1985. The middle class is expected to reach 580 million by 2030. With such strong consumer base, consumer-oriented companies must look more closely at opportunities in India.

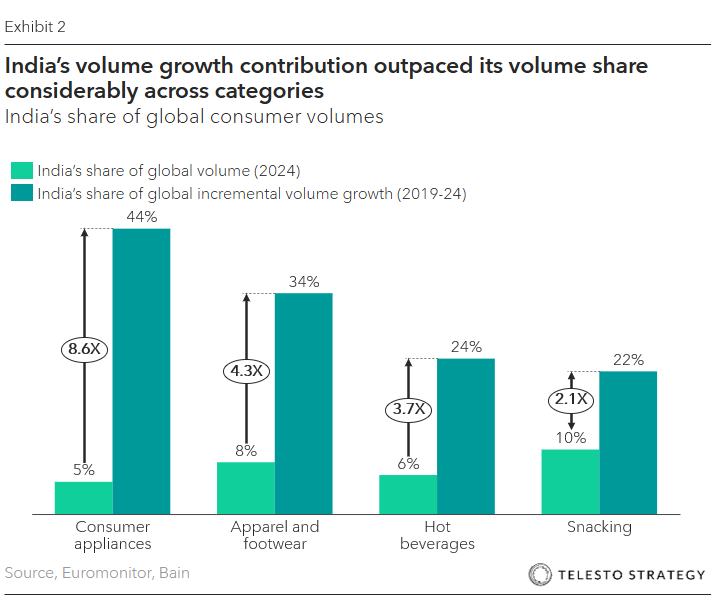

India’s attractiveness is clear—over the past five years, India’s volume growth contribution outpaced its volume share considerably across categories. With consumer preferences diverging and scaling, new categories are rapidly emerging, and consumer behaviors are being shaped.

Trade deals spur investment opportunities

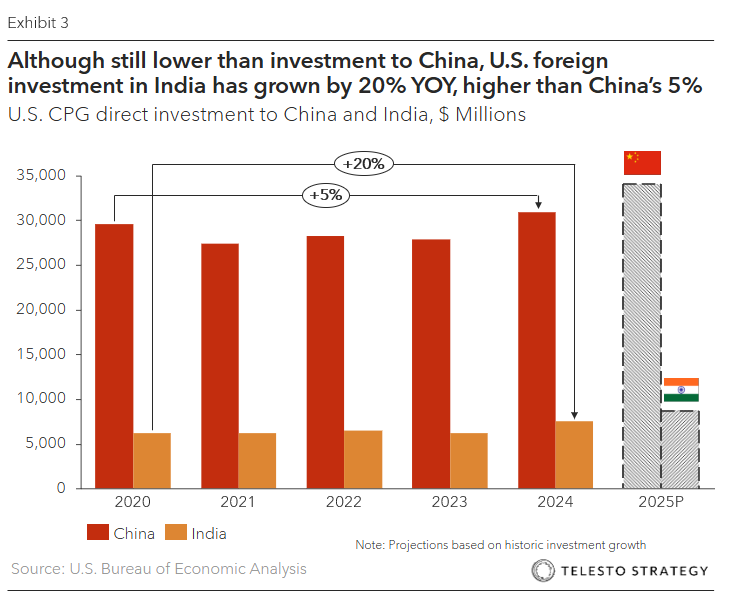

Beyond the sheer demographic appeal, the regulatory and diplomatic opening of India is notable. The convergence of trade diplomacy, defense cooperation, and tech alignment between the U.S. and India creates a transformative moment for U.S. companies as they consider expansion opportunities in India.

In February of this year, the White House held a “Mission 500” U.S.-India summit to double bilateral trade to $500 billion by 2030 . Since then, negotiators have advanced on industrial, digital, and some agricultural goods in five rounds of discussions. U.S. is looking for tariff cuts for steel, dairy, seed crops. An interim deal between the two countries would unlock reduced barriers for U.S. exporters, especially those in machinery, medical devices, tech firms, and CPG. U.S. leaders across parties are encouraging companies to move strategic supply chains out of China via tariffs, investment restrictions, and industrial subsidies.

We see manufacturers’ China+1 strategy play out, with over 90% of North American manufacturers reporting shifting some production out of China, with India emerging as the top alternative after China.

Attractors and opportunities for multinationals to India

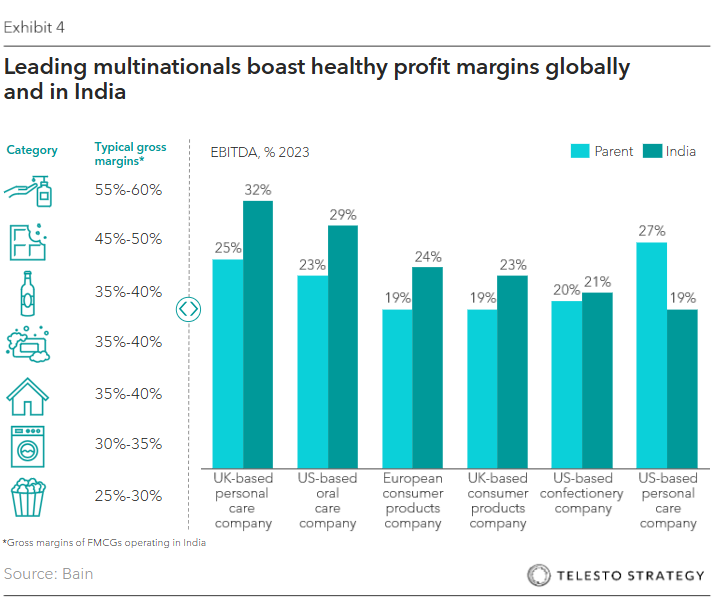

Beyond the sheer size of its population, several macroeconomic, policy, and technological factors are attracting increasing U.S. investment. Moreover, the financial benefits for parent MNCs are appealing. Winning CPGs deliver EBITDA margins that are in line with (and occasionally higher than their global parents.

What’s leading MNCs to these strong financials?

- Explosive consumer spending. Forecasted to grow at 12% annually (roughly 3x the U.S. rate), which is expected to exceed $5.4 trillion in 2034 and the third largest consumer market by the end of the decade

- Digital tech and services. India’s tech and services sector continues to grow and is projected to reach $99 billion by 2030

- Existing U.S. presence. Major U.S. companies like Costco, McDonald’s, JPMorgan, Target, Deloitte, and Walmart are expanding their India operations, which makes it a competitive hub for finance, R&D, AI, digital, and cloud services

- Data centers and cloud infrastructure. India’s data center capacity is projected to double to 1.8 GW by 2026 and public cloud revenues to reach $13 billion by 2026

- Renewable energy targets. The Indian government has set ambitious clean energy targets, which include 500 GW of renewable energy by 2030, plus incentive-driven component manufacturing for electronics, automotive, EVs, and batteries. U.S. companies can benefit from these local incentives

- Stable macro and financial markets. U.S. investors can gain from asset class diversification—equity, debt, infrastructure, and REITs are performing strongly, this is coupled with a high GDP growth rate of 6% annually and moderate inflation (~6%)

- Playing to U.S. companies’ strengths. Demand for category innovation, specifically for healthy and eco-friendly products, plays to the strengths of U.S. CPGs

Which global CPG companies have made the biggest bets on India?

A growing number of CPG companies have made significant investments in India over the past 3-5 years, driven by India’s improved intrinsic market dynamics and greater geopolitical relevance.

- Unilever. With brands like Dove, Lux, and Brooke Bond, Unilver has made strong gains in tapping into the Indian consumer market. Hindustan Unilever (HUL) is adapting its supply chain for rapid urban delivery (e.g., Blinkit), while targeting premium segments. Has also launched refill stations for shampoo and detergent to appeal to sustainability-focused consumers

- Mondelez. Mondelez’s India strategy looks to capture value from premiumization and rural volume growth. They have already seen category success, as India is the #1 market globally for Cadbury Dairy Milk. To advance its strategy, Mondelez has expanded its R&D hub to become a global innovation center, has launched affordable SKUs for rural markets and premium editions for urban segments, and has invested in rural cold-chain logistics to support chocolate sales in high-temperature zones

- Nestlé. India is Nestlé’s second-largest market in Asia and focuses on nutrition, affordability, and local innovation. Has invested $600 million between 2020-2025 with a new factory in Gujarat. Has strong brand performance with Maggi, Nescafé, and KitKat have built strong consumer loyalty and growth.

- Coca-Cola. India is one of the company’s fastest-growing markets, with a focus on affordable, small-format beverages. It has invested $1 billion between 2020-2024, with further plans under “Fruit Circular Economy” to source mangoes, oranges, and other fruit from Indian farmers

- P&G. Strong demand for household care, baby care, and beauty for India’s growing middle class has led P&G to invest $244 million for innovation, supply chain, and sustainability in its India operations

- PepsiCo. Experiencing strong volume growth in 2025—Q2 organic beverage revenue rose ~9% and snacks up by ~4%

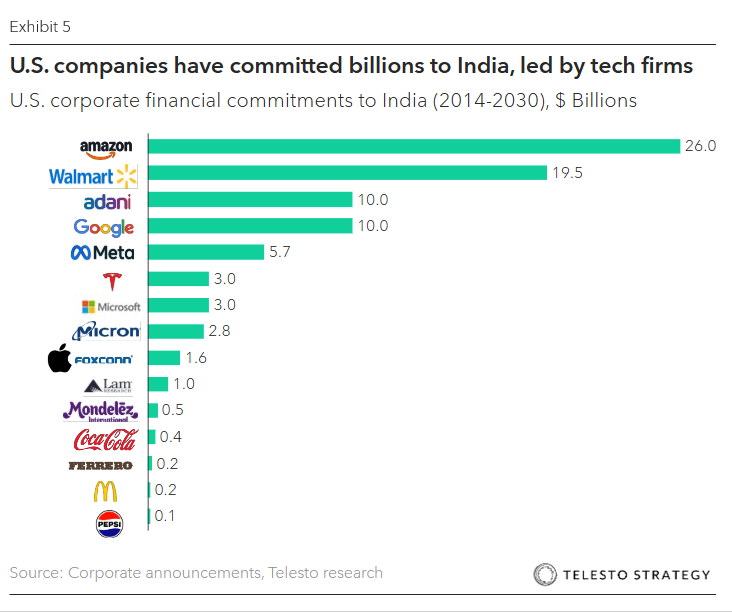

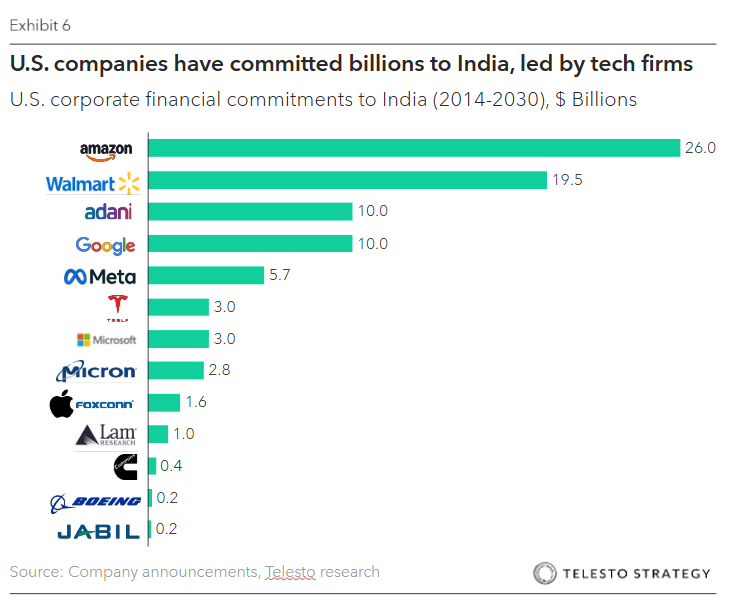

CPG investment mirros increase of India investment from high tech and financial services players:

- Apple. Apple is significantly increasing its investment and manufacturing footprint in India, driven by a strategy to diversify its supply chain away from Chian and capitalize on India’s growing market. This includes investment in production capacity, particularly for iPhones, and launching retail stores. As its closest partner, Foxconn plans to invest $1.5 billion in its Indian operations to support Apple’s strategy

- Blackstone. Has invested ~$50 billion in India across private equity, real estate, technology, and healthcare. The firm is aiming to further expand its India portfolio with an additional $40 billion investment over the next five years, targeting a total of $100 billion in assets under management

- Cisco. With a focus on R&D, manufacturing, the entrepreneurial ecosystem, and digitization, Cisco has invested $2.2 billion in the Indian market

- CostCo. Announced its first-ever Global Capacity Center in Hyderabad with 1,000 initial hires and plans for future scaling. Company leadership cited

- Citibank. Although it exited retail banking in 2023 in India, it has invested in India’s institutional and investment banking sectors

- Amazon. Has pledged to invest $26 billion in India by 2030, which will be used to expand its e-commerce and cloud computing operations

Operational and market challenges require attention:

While the list of attractors is significant, boards will have to consider the myriad of operational risks in competing and winning in India.

- Cost inflation. Input, packaging, and logistics costs have surged, driving CPG margins down. Globally, delivery costs are up ~25%, labor is +30% since 2019

- Complex distribution. India’s strained infrastructure forces CPG companies to design small-pack SKUs and navigate uneven last-mile delivery

- Digital and analytical capacity. Brands will need to leverage AI/ML in advanced forecasting and digital supply chain improvements

- Regulatory fragmentation and local presence. State-level variances in product registration, labelling, and packaging require nimble and on-the-ground compliance teams

- Intensifying competition with Indian CPGs. Domestic companies still have an edge in serving large, price-sensitive mass market with affordable, good-quality goods as well as have a closer pulse on local consumer needs.

- Consumer complexity. Shifting trends (eco-friendly, health-oriented, premium), fragmented tastes across regions, and rapid urban-rural divergence demand agile tailoring and continuous product innovation

- Water scarcity. 54% of India faces extremely high water stress, which places significant pressure on companies operating in the region. 60% of companies operating in India indicated that water scarcity affects their business and 87% of companies believe that water limitations will affect their business within the next decade

- Climate risk. Companies operating in India face significant and growing climate risks, India ranks 7 out of 181 countries in the Global Climate Risk Index. Over 75% of Indian districts are considered hotspots for extreme climate events

- Energy access. India’s rapid growth and increasing electricity demand are straining its power grid, leading to an ongoing energy crisis, unreliability, and financial losses—approximately 1.9% of its GDP annually. This results in extra costs for businesses who invest in back-up power supplies, ~$1.5 billion in 2022 alone

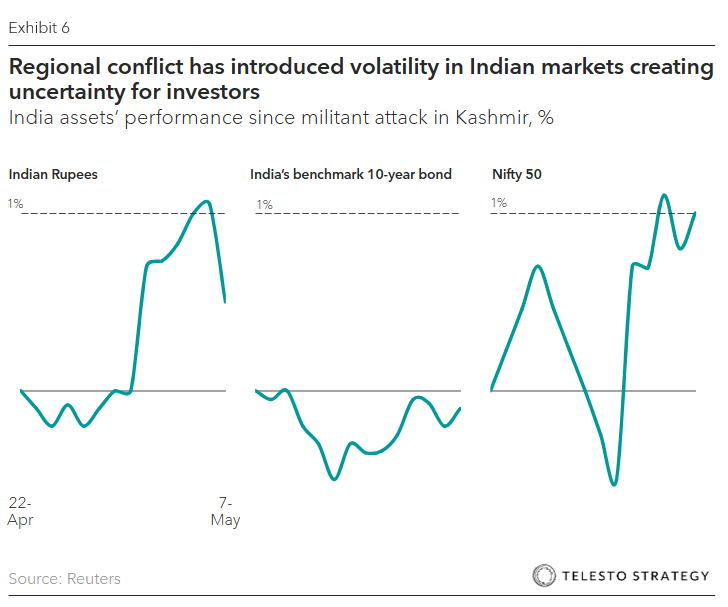

- Regional insecurity. With India-Pakistan tensions at a recent high, new risks are posed for companies operating in India—operational risks, market volatility, supply chain disruptions, and inflationary pressures. Even if trade India-Pakistan is limited, the conflict raises questions for investors and make keep investment away

Actions boards can take:

- Monitor trade policy and tariff negotiations. Audit committees must monitor India-US trade negotiations and agricultural disputes (e.g., delays in US agri-imports could destabilize input sourcing). Pricing resets may be necessary if the current tariff position holds

- Modernize digital infrastructure. Directors will need to press for investments in AI/ML and supply chain modernization, given the scale and complexity of accessing Indian consumers

- Conduct a ” Know Your Supply Chain assessment. Evaluate new and existing supply chain partners to ensure traceability and transparency

- Integrate sustainability and address questions of local impact. India’s middle class prioritizes environmental credentials, and the same question is gaining importance in local ESG reporting requirements. Boards must define KPIs tied to eco-packaging, decarbonization, clean formulas, and social impact

- Start small, prove model. Avoid big splash entries; instead, press for pilots, iterative design, and scaling. Reference phased approaches to growth

- Conduct climate risk assessment. Boards should oversee the completion of a comprehensive, TCFD-aligned climate risk assessment for India in its current and future Indian footprint

- Plan for energy instability. Tap into government incentives and clean energy credits to plan for on-site renewable energy investments to hedge against energy access risks

Questions for the boardroom:

- How will ongoing U.S.-India trade negotiations and tariff shifts (e.g., WTO disputes, digital trade rules, export bans) affect our supply chain and pricing strategies?

- What are the tradeoffs between organic growth, joint ventures, acquisitions, and strategic alliances in India?

- Are we pursuing localization of manufacturing, sourcing, and R&D? What is our “Make in India” compliance strategy?

- How do we assess the success of our existing and/or potential growth opportunity in India? Which metrics (e.g., ROIC, brand penetration, supply chain efficiency) will guide our expansion?

- What are the legal and reputational risks from India’s ESG and sustainability disclosure mandates?

- To what extent are we reliant on any vulnerable inputs from China or Southeast Asia that could jeopardize Indian operations due to regional conflict or trade tensions?

- Are our Indian operations integrated with our broader supply chain strategy – or do they function as a standalone regional hub? What are the tradeoffs?

- How do we mitigate the water scarcity and climate risks in operating in India? How do we build in adaptation and resilience measures? What are green financing opportunities available to us?

Additional Telesto resources:

- Atlas, equips your organization’s corporate directors and leaders with the insights and knowledge necessary to stay up to date, mitigate risks, and seize business opportunities associated with sustainability, Climate, and ESG

- Board series: The Kitchen Sink Committee – AI, Cyber, ESG, and, now, tariffs. Are Audit Committees ready

- Board series: When trade policy meets the balance sheet – Impairment pressures mount for the audit committee

- Board series: With IRA Tax Credits pulled and OBBBA passed, what’s next?

- Prism, our ESG benchmarking tool, helps your organization to rapidly strengthen its Sustainability, Climate, and ESG performance and disclosures through in-depth benchmarking of industry peers and identification of gaps and areas of distinction

- Recently released by Telesto Strategy’s CEO & Founder, Alex Kruzel, The Courage to Continue: Stay the Course on Sustainability to Secure our Future, explores the connection between corporate priorities and President Trump’s national security agenda

Contact us to explore how your India strategy can deliver more than just promise.