Copyright © 2025 Telesto Strategy, LLC

All rights reserved

Key takeaways

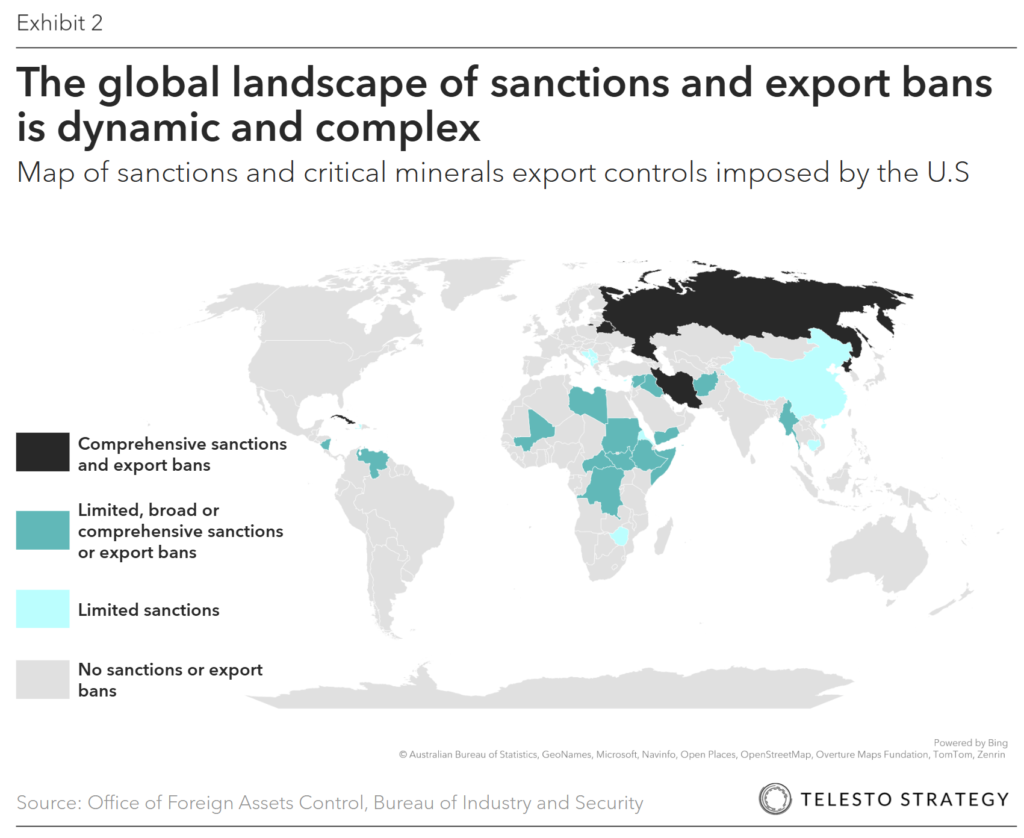

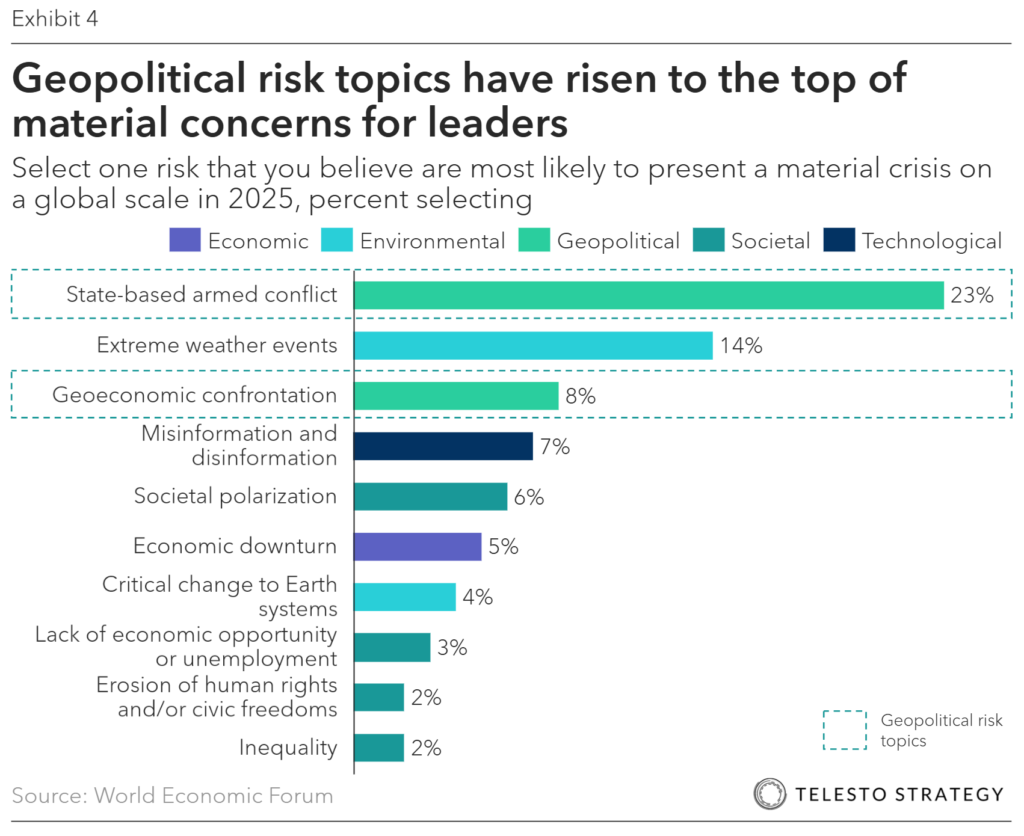

Sanctions, export bans, and shifting alliances

The global network of sanctions and export bans is constantly shifting, influenced by geopolitical rivalries, trade fragmentation, and policy changes. These measures target issues such as:

Examples of current geopolitical flashpoints:

Risks for multinational companies

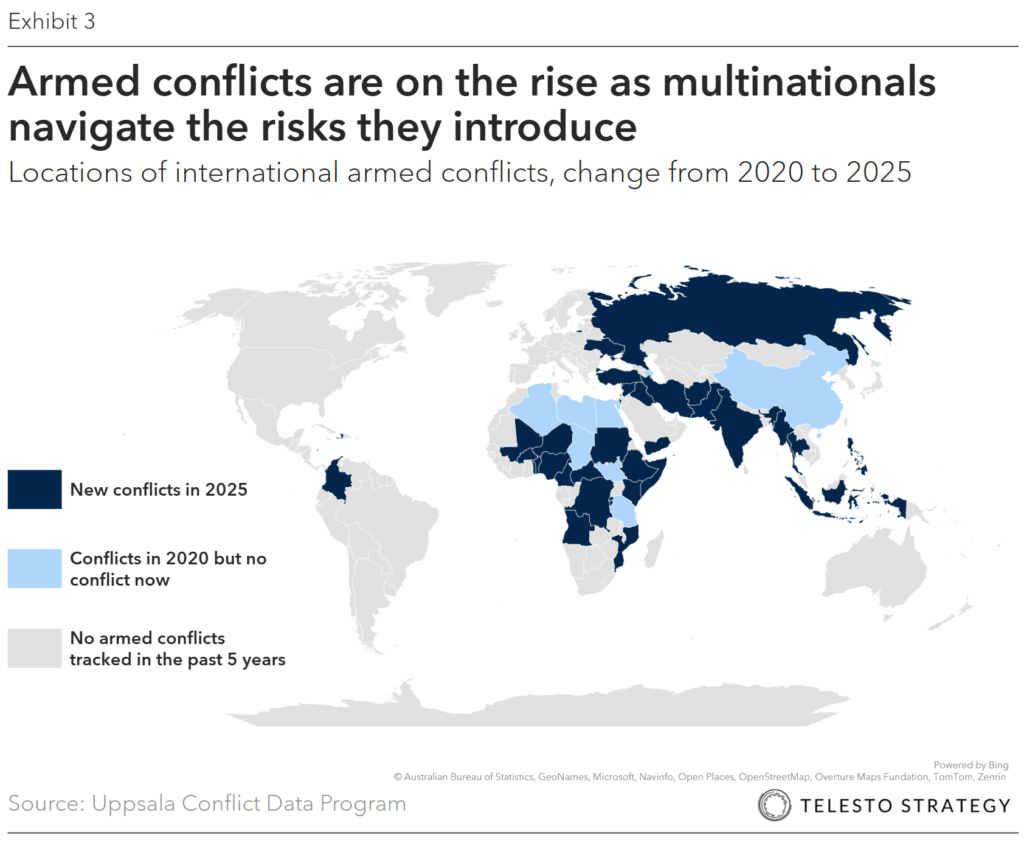

With global volatility at record levels, companies face broad exposure to operational, financial, and reputational harm. Key risks include:

Actions management teams can take:

Questions for management teams:

Additional Telesto resources

Contact Telesto Strategy to equip your management team with the intelligence, strategies, and operational tools to anticipate geopolitical shocks, protect enterprise value, and act decisively in high-risk environments.

Copyright © 2025 Telesto Strategy, LLC

All rights reserved