Copyright © 2025 Telesto Strategy, LLC

All rights reserved

Key takeaways for management:

Understanding executive exposure

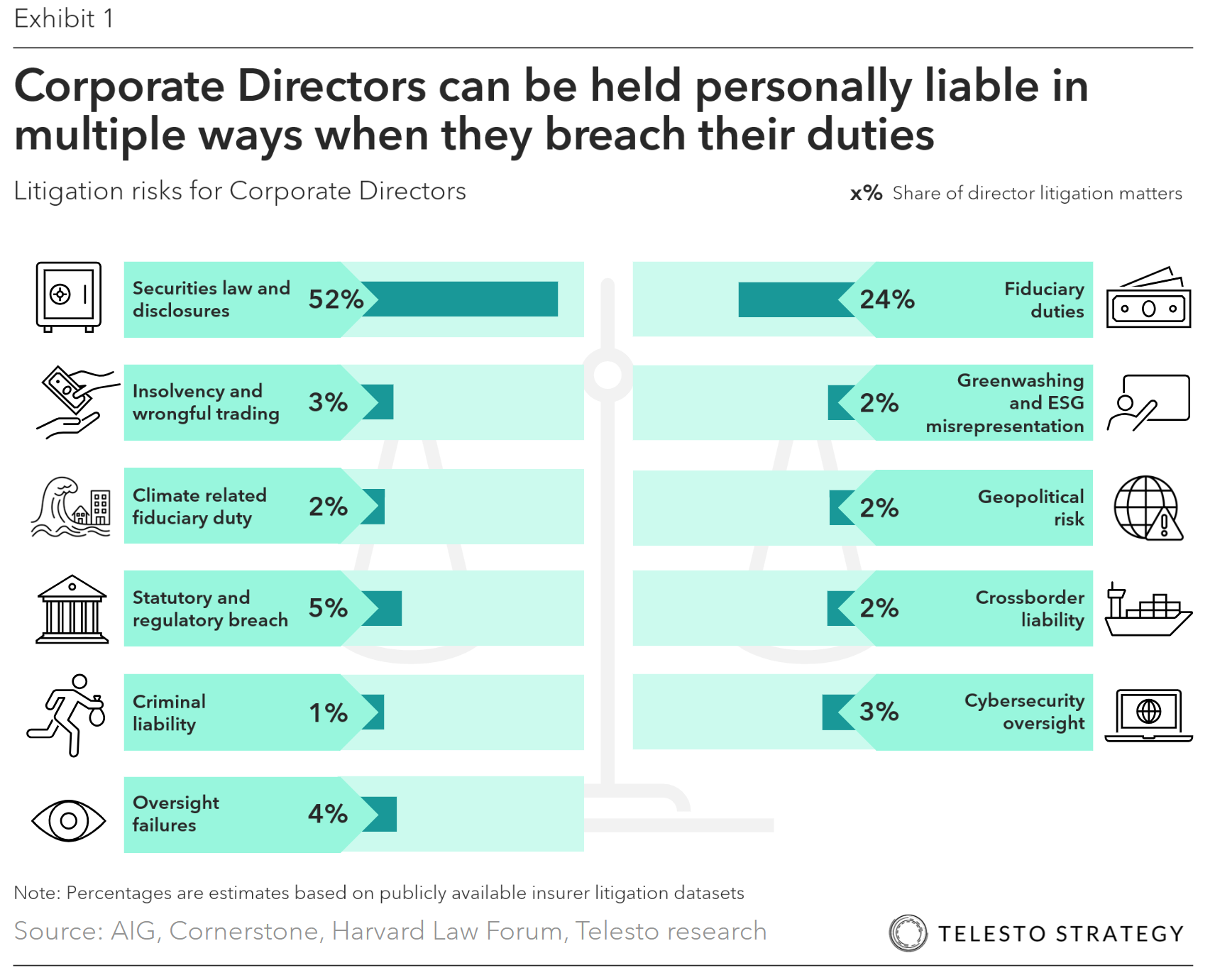

While personal liability remains relatively rare, the perimeter is expanding, especially for multinationals operating in regulated sectors or making public ESG and climate commitments. Increasingly, plaintiffs and regulators are scrutinizing executive-level decisions in areas such as disclosure, oversight, and operational governance.

Here are the core pathways through which executives may face legal exposure:

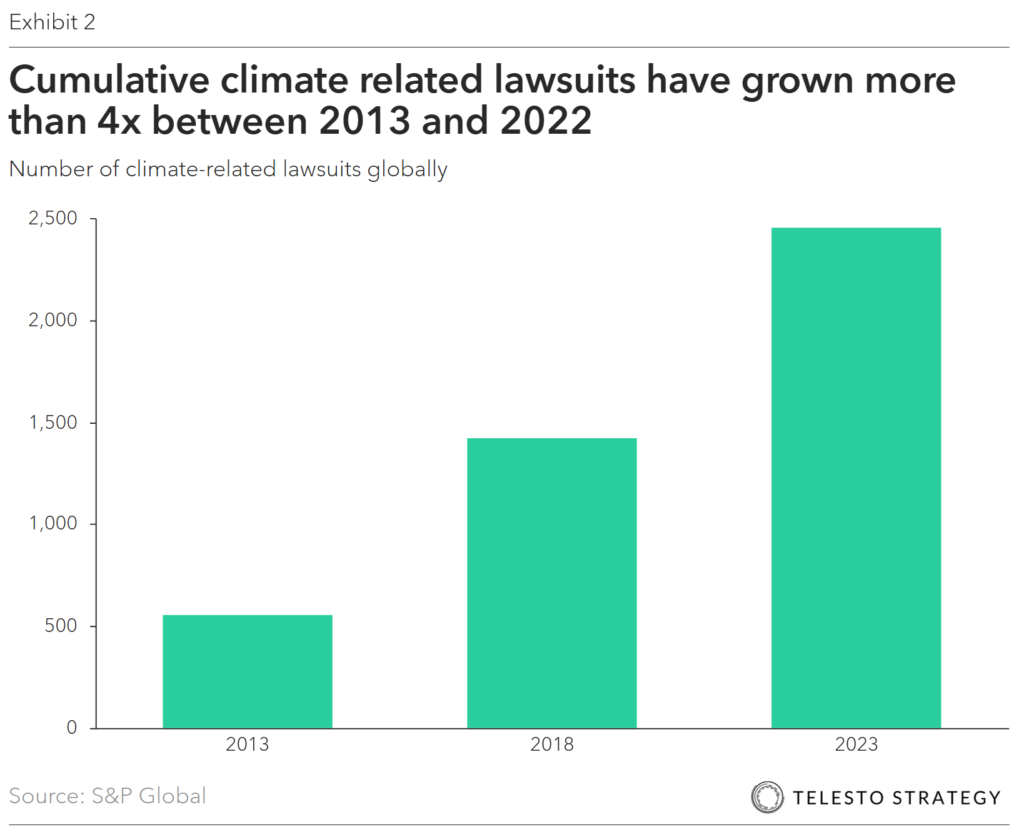

Climate- and ESG-related litigation is accelerating

Enterprise risk management systems have had to evolve rapidly to account for climate- and ESG-related lawsuits. Local governments, NGOs, individuals, and advocacy groups are actively filing claims against companies — and increasingly implicating the decisions made by senior leaders.

Climate change and ESG-related litigation cases grew more than 4x between 2013 and 2023. In 2021-2022 alone, about 300 cases were filed, with broad geographic scope: thirty-nine new cases in the US, and the remaining 122 cases in forty-three countries and fifteen international or regional courts. As of December 2022, the total number of historical cases had grown to 2,180.

Cases in the U.S. continue to expand across jurisdictions — including Maine, California, New York, and Illinois — and commonly allege that companies misled the public and investors on the environmental or climate impacts of their products or operations.

Globally, the themes driving litigation include climate change, pollution, human rights, diversity in leadership, food safety, and more. These are being brought not just by shareholders, but by local communities, youth groups, Indigenous leaders, and civil society coalitions.

Types of ESG-related litigation:

Notable climate and environmental cases executives should be aware of globally include:

Geopolitical risk, conflict, and human rights litigation expand exposure

Political instability and armed conflict have made risk management more complex. Regulators and courts now expect organizations to identify, monitor, and mitigate risks stemming from:

Cases that pierce the corporate veil and hold individual executives liable are rare — but increasing. Courts are assessing whether individual decisions or inaction justify personal accountability.

| Expanded area | Key drivers | Typical responsibilities added |

|---|---|---|

| Cybersecurity | Breach incidents, SEC cybersecurity disclosure rule | Oversight of risk posture, threat response, cyber audits |

| ESG & Climate disclosures | EU CSRD, California Climate Bills | Review of ESG reporting frameworks, greenwashing risk, materiality, climate risk, compliance, assurance |

| AI & Technology Risks | AI adoption, algorithm bias, internal controls on automation | Review of controls over AI-driven finance and reporting tools |

| Whistleblower protections | SEC bounty program, cultural transparency | Oversight of hotline mechanisms and retaliation policies |

| Audit quality and independence | PCAOB enforcement, investor concerns | In-depth audit firm performance review, rotation considerations |

| Political risk | Geopolitical tensions and operating risks, sanctions | Oversight of vendor due diligence, business continuity plans, government affairs strategy |

| Third-party risk and compliance | Global supply chain complexity, traceability, and transparency | Oversight of vendor due diligence, ethics and compliance |

What management can do now:

Here are six priority actions management teams can take to reduce exposure and build institutional readiness:

Questions management should be asking:

Additional Telesto resources

Legal exposure is no longer just a board-level issue — it’s a real and rising risk for executive teams. The best defense is clarity, documentation, and collaboration across legal, risk, and ESG functions.

Connect with Telesto Strategy to assess your litigation exposure, strengthen executive governance practices, and align with the latest regulatory expectations — before they become legal liabilities.

Copyright © 2025 Telesto Strategy, LLC

All rights reserved