India represents one of the world’s fastest-growing economies and has become an increasingly attractive expansion target for industrial multinationals. Part of this is due to the growing restrictions and tariff barriers to operating in China, which have prompted U.S. and allied economies to seek alternative manufacturing bases. Whether it’s electronics and semiconductors, pharma and chemicals, textiles and engineering goods, EVs and steel, the Indian industrial base is expanding. However, challenges will have to be navigated — infrastructure bottlenecks and policy complexities, India’s own reliance on Chinese inputs, water scarcity, regional conflict, supply chain transparency, and energy instability. Is your organization ready to win in India?

Key takeaways:

- The opening of trade and broadening of diplomatic and defense-related activities, U.S. companies are presented with an alternative to China’s industrial, agricultural, services, and tech capabilities

- Industrial companies that have embraced a China+1 strategy are looking to transfer regional hubs and outsourcing capability to India to tap into the strong labor market and production-related financial incentives

- Although the economic opportunity is clear, the operational challenges remain considerable — regional conflict, compliance requirements, water scarcity, poor infrastructure, energy access and reliability, tariff barriers

- Board members will have to improve the evolving market dynamics to guide expansion opportunities

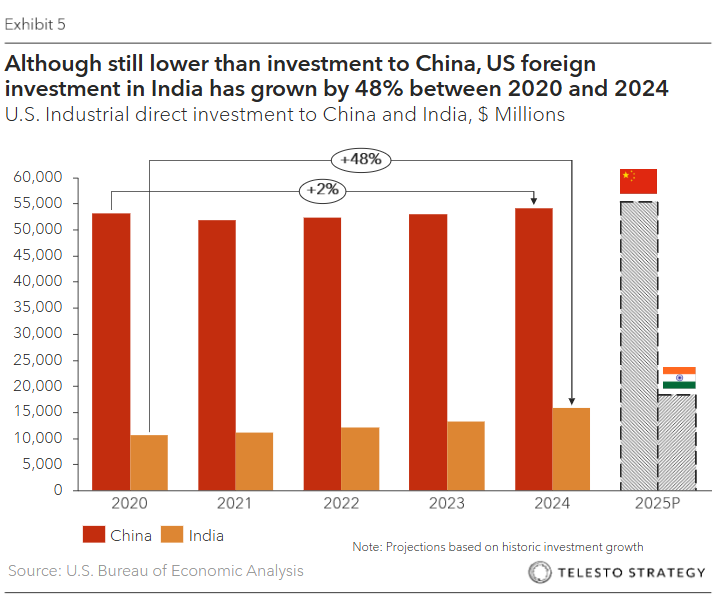

India’s industrial growth and manufacturing capacity have undergone significant transformation over the past five years (2020-2025), driven by a mix of policy reforms, supply chain shifts from China, and increased global interest in India as a manufacturing destination.

Center to the Modi administration’s agenda has been capital investment to improve India’s infrastructure — building new roads, airports, ports, and rail — critical to build out a competitive industrial base.

Yet, even with the historic capital investments being made by India’s government, manufacturing’s share as a percentage of GDP has remained stagnant in the last decade.

Trade deals spur investment opportunities

Beyond the growing economy, the regulatory and diplomatic opening of India is notable. The convergence of trade diplomacy, defense cooperation, and tech alignment between the U.S. and India creates a transformative moment for U.S. companies as they consider expansion opportunities in India.

In February of this year, the White House held a “Mission 500” U.S.-India summit to double bilateral trade to $500 billion by 2030 . Since then, negotiators have advanced on industrial, digital, and some agricultural goods. U.S. is looking for tariff cuts for steel, dairy, seed crops. An interim deal between the two countries would unlock reduced barriers for U.S. exporters, especially those in machinery, manufacturing, medical devices, tech firms, and CPG. U.S. leaders across parties are encouraging companies to move strategic supply chains out of China via tariffs, investment restrictions, and industrial subsidies.

We see manufacturers’ China+1 strategy play out, with over 90% of North American manufacturers reporting shifting some production out of China, with India emerging as the top alternative after China. Other beneficiaries include Mexico, Taiwan, Thailand, and Vietnam. However, recent announcements from the White House include all five of these trading partners and policies will not necessarily be stable.

Attractors and opportunities for industrial multinationals to India

Indian industrial companies are experiencing a blend of sustained growth and ongoing challenges. While the sector has shown resilience with a 4.2% annual growth in the Index of Industrial Production (making up 15% of the country’s GDP), and a strong performance in sectors like basic metals, pharmaceuticals, and motor vehicles, it also faces hurdles like outdated infrastructure and skills gaps.

What’s leading industrials to sustained growth?

- Production Linked Incentives. India’s PLI scheme is boosting domestic manufacturing and attracting foreign investment.

- Competitive labor and production costs. Compared to China, India has a more competitive spread for labor and production costs. However, analysis should be nuanced to account for productivity differences and variation

- Digital tech and services. India’s tech and services sector continues to grow and is projected to reach $99 billion by 2030

- Existing U.S. presence. Major U.S. companies like Costco, McDonald’s, JPMorgan, Target, Deloitte, and Walmart are expanding their India operations, which makes it a competitive hub for finance, R&D, AI, digital, and cloud services

- Data centers and cloud infrastructure. India’s data center capacity is projected to double to 1.8 GW by 2026 and public cloud revenues to reach $13 billion by 2026

- Renewable energy targets. The Indian government has set ambitious clean energy targets, which include 500 GW of renewable energy by 2030, plus incentive-driven component manufacturing for electronics, automotive, EVs, and batteries. U.S. companies can benefit from these local incentives

- Stable macro and financial markets. U.S. investors can gain from asset class diversification — equity, debt, infrastructure, and REITs are performing strongly, this is coupled with a high GDP growth rate of 6% annually and moderate inflation (~6%)

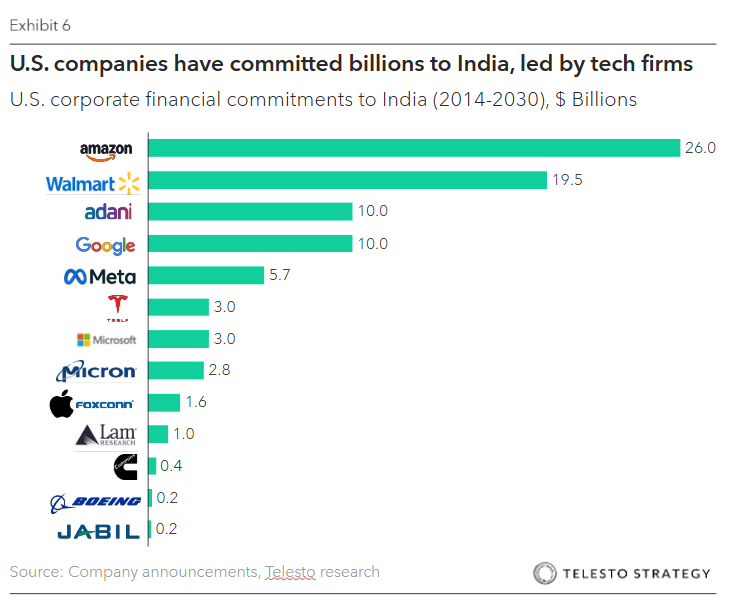

Which global industrial companies have made the biggest bets on India?

A growing number of industrial companies have made significant investments in India over the past 3-5 years, driven by India’s improved intrinsic market dynamics and greater geopolitical relevance.

- Ford. After a local market exit in 2021, Ford is restarting its Chennai manufacturing footprint ahead of re-entering global supply chains—supported by Tamil Nadu incentives and the PLI scheme

- GE. GE’s largest R&D site outside the U.S. is in Bengaluru, which houses 5,000 engineers and scientists, and is a key function for driving GE’s global innovation. In addition to R&D, GE co-produces its jet engines with HAL (~$1 billion deal)

- Caterpillar. With over 50 years in India, Caterpillar now operates across mining, construction, and energy to serve both domestic infrastructure and export markets. However, it faces tariff and supply chain complexity, with estimate to increase costs by $250-350 million in 2025. In 2024, Caterpillar reported $64.8 billion in global revenue, with $11.4 billion from APAC (18%)

- Boeing. Boeing partners with Tata to manufacture key defense products like Apache AH-64 helicopter parts and components for Stinger missile systems

- Cummins India. Produces a wide range of diesel and natural-gas engineer and has facilities across Pune, Phaltan, Chennai for engines and gensets for local and export markets

Industrial investment mirrors increase of India investment from high tech, CPG, and financial services players:

- Apple. Apple is significantly increasing its investment and manufacturing footprint in India, driven by a strategy to diversify its supply chain away from Chian and capitalize on India’s growing market. This includes investment in production capacity, particularly for iPhones, and launching retail stores. As its closest partner, Foxconn plans to invest $1.5 billion in its Indian operations to support Apple’s strategy

- Blackstone. Has invested ~$50 billion in India across private equity, real estate, technology, and healthcare. The firm is aiming to further expand its India portfolio with an additional $40 billion investment over the next five years, targeting a total of $100 billion in assets under management

- Cisco. With a focus on R&D, manufacturing, the entrepreneurial ecosystem, and digitization, Cisco has invested $2.2 billion in the Indian market

- Costco. Announced its first-ever Global Capacity Center in Hyderabad with 1,000 initial hires and plans for future scaling. Company leadership cited

- Citibank. Although it exited retail banking in 2023 in India, it has increased its investment in India’s institutional and investment banking sectors

- Amazon. Has pledged to invest $26 billion in India by 2030, which will be used to expand its e-commerce and cloud computing operations

- Coca-Cola. India is one of the company’s fastest-growing markets, with a focus on affordable, small-format beverages. It has invested $1 billion between 2020-2024, with further plans under “Fruit Circular Economy” to source mangoes, oranges, and other fruit from Indian farmers

- P&G. Strong demand for household care, baby care, and beauty for India’s growing middle class has led P&G to invest $244 million for innovation, supply chain, and sustainability in its India operations

Operational and market challenges require attention:

While the list of attractors is significant, boards will have to consider the myriad of operational risks in competing and winning in India.

- Cost inflation. Input, operational, and logistics costs have surged, driving margins down. Globally, shipping costs are up ~12%, labor is +30% since 2019

- Port disruption and lack of inter-modal integration. With inadequate drainage and road access, Mundra Port in Gujarat has experienced material delays. Moreover, with poor hinterland links and networks, multi-modal integration is limited and causes operational delays

- Digital and analytical capacity. Companies will need to leverage AI/ML in advanced forecasting and digital supply chain improvements to stay competitive

- Regulatory fragmentation and local presence. A complex and stringent regulatory environment often stifles India’s manufacturing sector. Businesses face a broad array of compliance requirements

- Water scarcity. 54% of India faces extremely high water stress, which places significant pressure on companies operating in the region. 60% of companies operating in India indicated that water scarcity affects their business and 87% of companies believe that water limitations will affect their business within the next decade

- Climate risk. Companies operating in India face significant and growing climate risks, India ranks 7 out of 181 countries in the Global Climate Risk Index. Over 75% of Indian districts are considered hotspots for extreme climate events

- Energy access. India’s rapid growth and increasing electricity demand are straining its power grid, leading to an ongoing energy crisis, unreliability, and financial losses—approximately 1.9% of its GDP annually. This results in extra costs for businesses that invest in back-up power supplies, ~$1.5 billion in 2022 alone

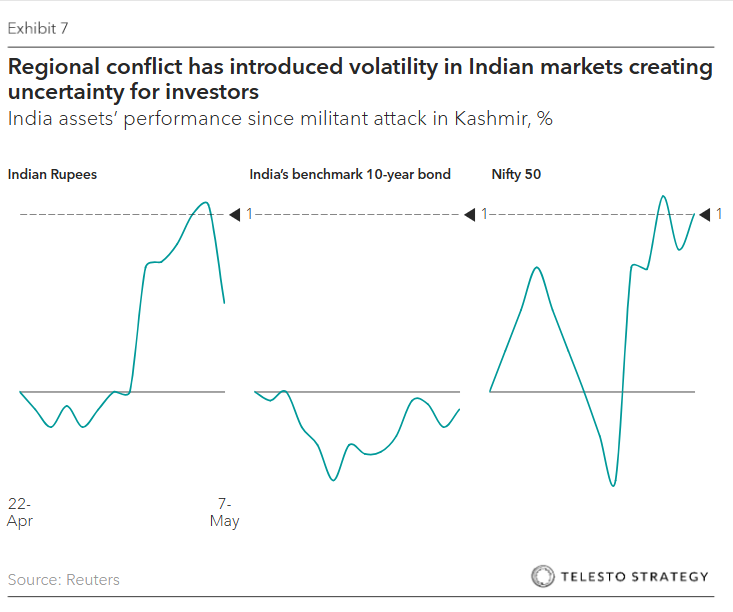

- Regional insecurity. With the India-Pakistan conflict at a recent high, new risks are posed for companies operating in India—operational risks, market volatility, supply chain disruptions, and inflationary pressures. Even if India-Pakistan trade is limited, the conflict raises questions for investors and may keep investment away

Actions boards can take:

- Monitor trade policy and tariff negotiations. Audit committees must monitor India-US trade negotiations and agricultural disputes (e.g., delays in US agri-imports could destabilize input sourcing). Pricing resets may be necessary if the current tariff position holds

- Modernize digital infrastructure. Directors will need to press for investments in AI/ML and supply chain modernization given the scale and complexity of accessing Indian consumers

- Conduct a ” Know Your Supply Chain assessment. Evaluate new and existing supply chain partners to ensure traceability and transparency

- Integrate sustainability and address questions of local impact. India’s middle class prioritizes environmental credentials, and the same question is gaining importance in local ESG reporting requirements. Boards must define KPIs tied to eco-packaging, decarbonization, clean formulas, and social impact

- Start small, prove model. Avoid big splash entries, instead press for pilots, iterative design and scaling. Reference phased approaches to growth

- Conduct climate risk assessment. Boards should oversee completion of a comprehensive, TCFD-aligned climate risk assessment for India in its current and future Indian footprint

- Plan for energy instability. Tap into government incentives and clean energy credits to plan for on-site renewable energy investments to hedge against energy access risks

Questions for the boardroom:

- How will ongoing U.S.-India trade negotiations and tariff shifts (e.g., WTO disputes, digital trade rules, export bans) affect our supply chain, operating costs, and pricing strategies?

- What is the cost breakdown of labor, capital, logistics, and compliance in India? How does it compare to other potential markets for expansion?

- What are the tradeoffs between organic growth, joint ventures, acquisitions, and strategic alliances in India?

- Are we pursuing localization of manufacturing, sourcing, and R&D? What is our “Make in India” compliance strategy?

- How do we assess the success of our existing and/or potential growth opportunity in India? Which metrics (e.g., revenue growth, operating margin, working capital turnover, ROIC, supply chain efficiency, FX-adjusted revenue) will guide our expansion?

- What are the legal and reputational risks from India’s ESG and sustainability disclosure mandates?

- To what extent are we reliant on any vulnerable inputs from China or Southeast Asia that could jeopardize Indian operations due to regional conflict or trade tensions?

- Are our Indian operations integrated with our broader supply chain strategy – or do they function as a standalone regional hub? What are the tradeoffs?

- How do we mitigate the water scarcity and climate risks in operating in India? How do we build in adaptation and resilience measures? What green financing opportunities are available to us?

Additional Telesto resources:

- Atlas, equips your organization’s corporate directors and leaders with the insights and knowledge necessary to stay up to date, mitigate risks, and seize business opportunities associated with sustainability, Climate, and ESG

- Board series: The Kitchen Sink Committee – AI, Cyber, ESG, and, now, tariffs. Are Audit Committees ready

- Board series: When trade policy meets the balance sheet – Impairment pressures mount for the audit committee

- Board series: With IRA Tax Credits pulled and OBBBA passed, what’s next?

- Prism, our ESG benchmarking tool, helps your organization to rapidly strengthen its Sustainability, Climate, and ESG performance and disclosures through in-depth benchmarking of industry peers and identification of gaps and areas of distinction

- Recently released by Telesto Strategy’s CEO & Founder, Alex Kruzel, The Courage to Continue: Stay the Course on Sustainability to Secure our Future, explores the connection between corporate priorities and President Trump’s national security agenda

Connect with the Telesto team to assess your company’s readiness and build a board-level view of how to navigate India’s opportunities and headwinds with clarity and confidence.