Copyright © 2023 Telesto Strategy LLC, All rights reserved.

Ghana stands to gain significantly from growing climate capital flows; but first, it must address obstacles for both investors and recipients, all while building up the connective tissue that brings them together.

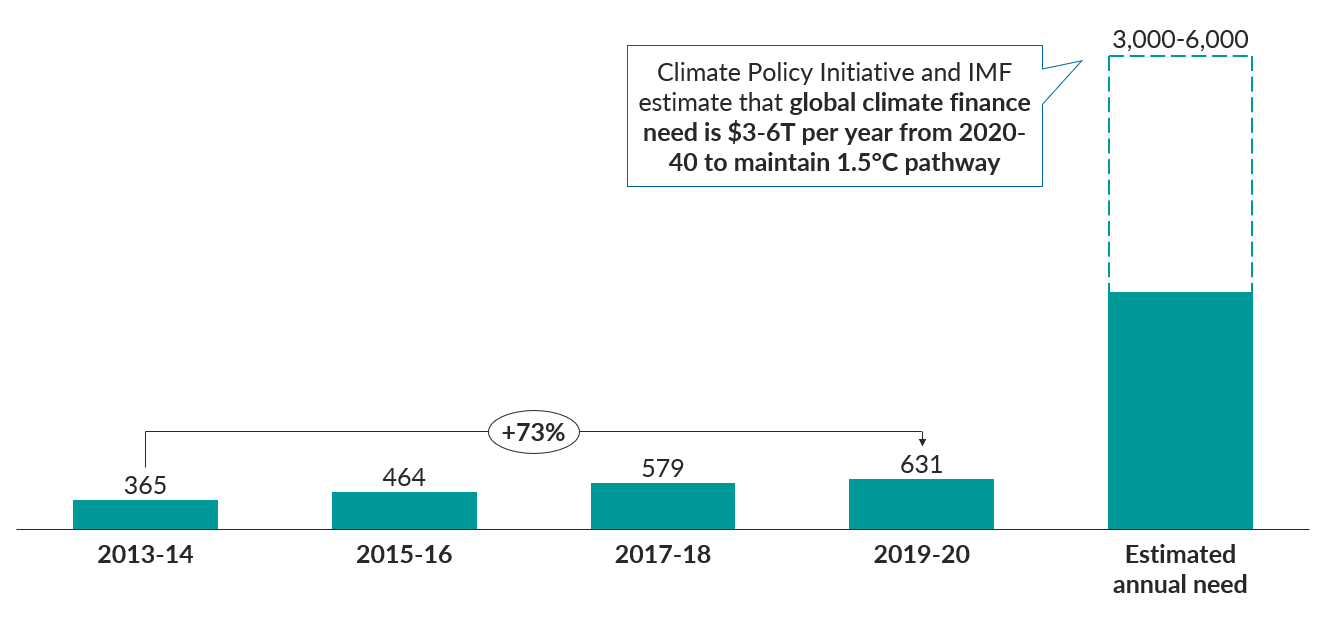

As the world continues to grapple with climate change, private and public sector actors look for investable opportunities to prevent and combat its deleterious effects. Indeed, from 2013 to 2020, global climate investments nearly doubled from $365B to $631B, with a series of high-profile investments (e.g., €86B invested in solar and wind power in the E.U., $41B invested in large-scale solar projects in China, $14.5B invested in renewable energy in India) have led the way. However, in spite of climate financing’s meteoric rise in recent years, the world is still far behind the $3-6T leading experts estimate is needed to stave off the worst of climate change.

Global value of climate finance ($B, 2013-2020 vs. 2030 need)

Source: Climate Policy Initiative (Global Landscape of Climate Finance 2021); IMF (Mobilizing Private Climate Financing in Emerging Market and Developing Economies)

Africa – with some of the world’s largest carbon sinks embedded in its sweeping forests, rich soils, and vast waters – stands out on the global stage for its climate investment potential. However, Africa also stands out for another less desirable reason: its climate financing gap. Despite its sizeable potential and its outsized exposure to the effects of climate change, Africa receives less than 5% of global climate investment, and its annual climate financing need is nearly ten times larger than actual flows.

Seeds of recent activity on the continent, however, are beginning to provide cause for hope. Several African nations are making clear strides to reduce carbon emissions without undermining economic growth. South Africa, for example, which generates 80% of its electricity from coal, just received international commitments worth $8.5B to catalyze its shift to renewable energy, of which the United States alone committed $1B. The Democratic Republic of Congo just received funding of $500M dedicated to protecting the Congo Basin rainforest, which represents 10% of the world’s tropical rainforests by land and absorbs 4% of global CO2 emissions annually.

Ghana has both significant need for and opportunity to attract climate finance

Ghana, Africa’s 10th largest economy, stands to gain considerably from burgeoning climate capital looking for investable opportunities across the globe. Like other countries on the continent, Ghana has a significant need for climate finance. Ghana is at elevated risk of increasing aridity, droughts, and extreme rainfall events; over half of its population and more than 70% of the rural population is employed in agriculture, forestry, and fishing; and ~53% of its energy supply comes from domestically produced oil & gas. Furthermore, Ghana’s Revised Nationally Determined Contributions (2021) place its needs at up to $15.5 billion to finance critical mitigation and adaptation investments over ten years.

Recognizing the gap it faces, Ghana has made noteworthy progress in enhancing the climate investment opportunities it can offer and preparing itself to receive new climate capital. With one of the largest contiguous tropical rainforests in West Africa, sweeping coastal areas, and extensive swathes of land cultivated through agroforestry, Ghana’s landscape offers climate financers ample opportunity to invest in carbon capture and prevention. Concurrently, Ghana developed public and private sector frameworks and tools to establish itself as an attractive destination for climate investment (e.g., through its 19 policy actions outlined in its NDCs), and the Central Bank of Ghana and the Ghana Association of Bankers have enacted a set of sustainable banking principles designed to catalyze and attract sustainability-focused investment through private financial institutions. The government of Ghana, in partnership with the IFC, has also announced the opening of a dedicated green bond exchange that positions Ghana as a mature and attractive recipient of climate finance. Furthering improving market confidence, in December 2022, the IMF and Ghana agreed to a $3 billion economic program under the Extended Credit Facility (ECF) to restore macroeconomic stability and debt sustainability in Ghana.

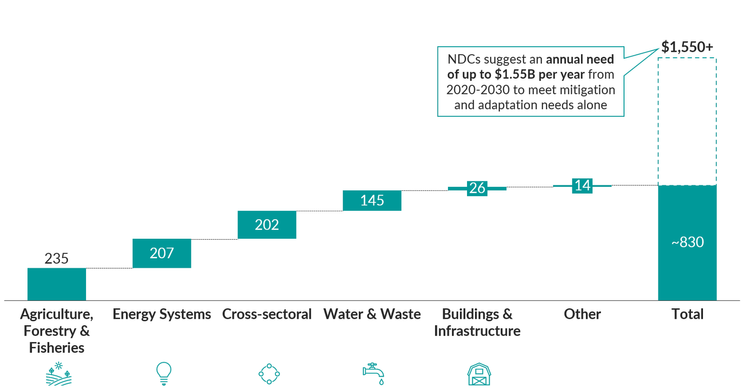

Total Climate Finance by Sector in Ghana ($M, Avg. 2019-2020)

Source: Climate Policy Initiative (Global Landscape of Climate Finance 2021); Republic of Ghana (Updated Nationally Determined Contribution under the Paris Agreement 2020 – 2030)

Despite the significant need and a growing set of viable investment opportunities, Ghana only received $830 million in climate investment in 2019-20. This figure – far short of the $1.55B per year needed to address mitigation and adaptation requirements set out in the NDCs and even further short of the tens-to-hundreds of billions more that could be directed towards globally impactful prevention efforts – begs the question: “What is preventing Ghana from attracting a greater share of growing global climate capital flows?”

Read more of our popular insights:

It begs the question: “What is preventing Ghana from attracting a greater share of growing climate capital flows?”

"There is no shortage of climate investment opportunities, and there is no shortage of climate capital looking to find them, but there is a missing “connective tissue” that helps connect and facilitate interactions between the two."

To determine an answer, it’s most helpful to understand the obstacles across the constituent parties involved in climate financing: investors (e.g., philanthropic foundations, financial institutions, donor governments) and recipients (e.g., businesses conducting climate projects, entrepreneurs).

For investors, many of whom are from the “Global North,” most of the obstacles gravitate towards:

- Lack of reliable knowledge on investable opportunities, stemming from limited “on the ground” experience and connections.

- Limited access to and understanding of entrepreneurial ecosystems in Ghana.

- Mismatched risk appetites and return expectations (e.g., concerns of high debt and inflation levels, alternative risk-reward profiles elsewhere).

- Bias towards more rigid and upside-capped financial instruments, especially debt / loans, which are less conducive to investing in climate opportunities in Ghana.

For recipients, many of whom are Ghanaian entrepreneurs and businesses seeking capital to launch or expand, the obstacles include:

- Lack of knowledge on the types of climate capital available and where to find them.

- Limited experience with the prerequisites of attracting investment (e.g., robust business plans and strategies, ESG readiness, compelling investor pitch materials, clarity on investment structures).

- Limited technical assistance and corresponding enablers (e.g., monitoring & evaluation tools, robust performance data) to ensure effective deployment and tracking of climate capital.

When viewed in this way, it becomes quite explicit that many of the challenges Ghana faces in attracting climate capital stem from mismatched expectations and misunderstandings between investors and recipients. There is no shortage of climate investment opportunities, and there is no shortage of climate capital looking to find them, but there is a missing “connective tissue” that helps connect and facilitate interactions between the two.

Building up that connective tissue between Ghana and global climate investors will take significant and sustained effort. It will not only take an openness on the part of investors and entrepreneurs to expand their horizons and meet halfway, but it will also take the deep commitment of technical advisors, of trusted partners, and of multinational actors to be the linkages.

To this end, Telesto Strategy will be co-hosting a working session on the future of climate finance inGhana. The multi-sectorial convening, which will be held February 9, 2023 in Accra as part of the U.S. State Department’s upcoming Partnership Opportunity Delegation (POD), will bring together investors and ecosystem decisionmakers to explore pragmatic solutions to attracting and growing climate finance in Ghana. Part of the U.S. State Department’s Connecting Climate Entrepreneurs (CCE) initiative, the POD will cultivate an array of partnership models to advance climate innovation, enterprise and entrepreneurship. We hope you can join us, and we look forward to driving measurable climate action together.