Copyright © 2023 Telesto Strategy LLC, All rights reserved.

4 ESG Trends that All Business Leaders Should Know

For businesses to stay competitive they need to understand the dynamics and evolving nature of Environmental, Social, and Governance (ESG) investing criteria, which is redefining the landscape of our modern economy.

2020 was a worldwide wake-up call. In the span of months, previously unimaginable events rattled our collective consciousness, shining a light on systemic issues in our economy and society. The worst pandemic in a century slammed the brakes on the global economy. Concurrently, the murder of George Floyd highlighted systemic racial injustice both in America and abroad. Wildfires and flooding impacted millions. Finally, the widening wealth gap was put in the spotlight, as the global economy proved more interconnected and automated and was criticized for leaving many behind.

As last year unfolded, both environmental and social issues came increasingly to be understood as interrelated threats. More and more, consumers and the public are now looking to business to demonstrate credible action and intention around these issues.

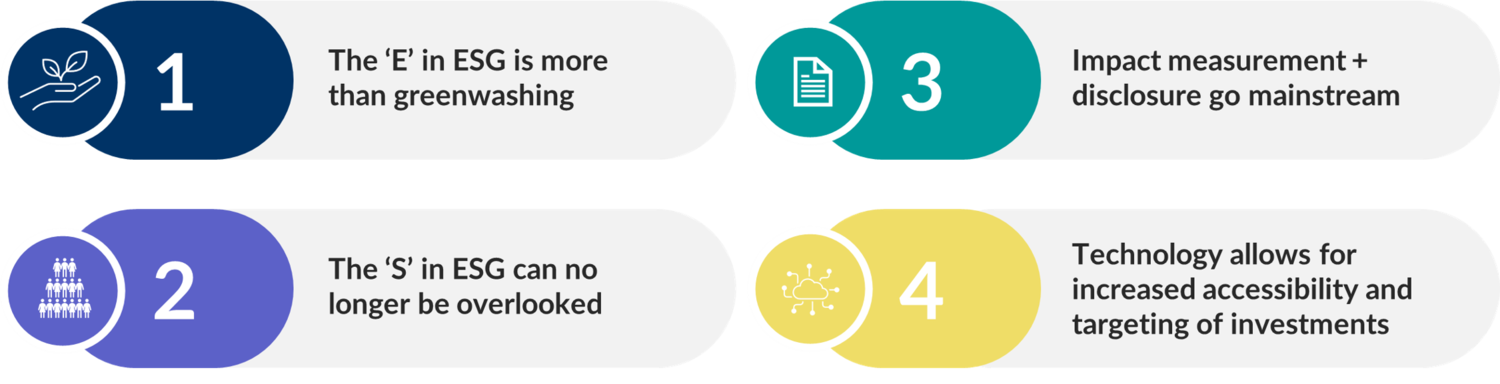

We’ve simplified the complexities and offer four key trends that all business leaders should understand and act on today.

First, some background: What is ESG?

ESG refers to the environmental, social, and corporate governance factors that investors use to evaluate the impact of investing in a particular company. These non-financial indicators point to the sustainability and social-related impact that may generate positive returns for both shareholders and other stakeholders in the business.

Although the concept of ESG has existed for some time, it has received renewed attention in the wake of broader societal trends that have called into question the validity of conventional shareholder-centric corporate strategy.

#1 – The ‘E’ in ESG is more than greenwashing

The breadth and depth of the ‘Environmental’ scope in ESG have evolved profoundly. It’s not just marketing. A growing number of governments and companies have committed to achieving net-zero carbon emissions by 2050, which consecrates climate science’s assessment of how quickly global emissions must be reduced to avert worst-case climate scenarios. Estimates from the Intergovernmental Panel on Climate Change show that limiting warming to 2°C by 2050 will require $3 trillion to $3.5 trillion in annual investments. Much of that investment must be directed toward low-carbon energy technology and energy efficiency, which will require five times more investment in 2050 it did in 2015.

World leaders now recognize the systemic factors needed to transition to a decarbonized economy. The United Nations estimates that by early 2021, countries representing around 65 percent of global CO2 emissions and around 70 percent of the world’s economy will have made ambitious commitments to carbon neutrality.

However, It’s not just emissions. The health of the broader biosphere is also gaining greater attention. Biodiversity is increasingly recognized as a piece of the world’s ecological crisis that the private sector can and must address. However, most business models still treat biodiversity as an afterthought.

The World Economic Forum estimates that $44 trillion of economic value generation (representing more than half of world GDP) is moderately or highly dependent on nature. It ranks biodiversity loss and ecosystem collapse as one of the world’s top five risks in terms of likelihood and impact in the next 10 years. Damage to ecosystems like forests, grasslands, and coral reefs—and the associated biodiversity loss—could drain nearly $10 trillion from the global economy by 2050, according to the Global Futures report from the World Wide Fund for Nature (WWF).

More appropriate and innovative business models urgently need to be deployed to support global biodiversity targets. According to an S&P Global Trucost analysis of 3,500 companies representing 85 percent of the world’s total market capitalization, 65 percent of company business models generally align with the United Nations Sustainable Development Goals (SDGs), but less than 1 percent of business models align with SDGs 14 and 15, “life below water,” and “life on land.”

Governments are convening in October 2021 in China to establish a new accord on biodiversity and set global targets similar to the Paris Agreement on climate change. And in July 2020, 10 large financial institutions (e.g., BNP Paribas and Standard Chartered) announced plans to help institute a new U.N.-backed reporting framework to be called the Task Force for Nature-related Financial Disclosures, or TNFD.

With so much increasing complexity to the ‘E’ in ESG, corporate leaders must act to put in place capability to both answer and anticipate regulatory requirements and elevate these questions to the C-suite.

#2 – The ‘S’ in ESG can no longer be overlooked

COVID-19 has unmasked the often-sidelined nature of the ‘S’ in ESG. Diversity, Equity, and Inclusion (DE&I) is one area with plenty of room for improvement in the corporate world. More and more companies now realize that in addition to being fair and equitable, focusing on diversity is a financial win-win. Research reveals a strong correlation between sound diversity and inclusion practices and economic returns.

Using Refinitiv’s Diversity & Inclusion (D&I) Index, Credit Suisse researched gender diversity at more than 3,000 companies in 56 countries. Results showed that for firms where more than 20 percent of the top managers are women, share prices rose more over the past decade than the shares of other companies. And over a six-year period, more gender-diverse companies enjoyed a one-year return on equity that was 1.1 percent better than firms with less female representation.

Diversity isn’t the only key factor in the social component of ESG. Another critical factor in need of reform is tying executive pay to ESG. Europe is leading the way linking executive compensation to ESG performance. Almost half of the United Kingdom’s 100 biggest companies link executive pay (either through bonus targets or long-term incentive plans) to ESG measures. But the variables used to represent ESG in those compensation decisions may be lacking, especially in the US.

Companies tend to overvalue issues like occupational health and safety rather than things like climate change and gender diversity. A 2020 analysis of company public disclosures by Willis Towers Watson found that while about 11 percent of the top 350 European companies have linked greenhouse gas emissions to their executive incentive plans, only 2 percent of US. S&P 500 companies have done so.

As the ‘S’ in ESG gains a brighter spotlight, companies are making moves to be more diverse and set their executive compensation structures to how they perform on key components of sustainability.

#3 – Impact measurement + disclosure go mainstream

With both more dollars in the ESG space and better technology, it’s easier than ever for firms to measure and disclose their environmental, social, and governance-related impact. With more reporting on corporate ESG metrics and initiatives, increased scrutiny has helped the public assess whether companies are walking their big ESG talk.

The current ESG reporting landscape, for some, is synonymous with reporting fatigue and scoring disparities due to the decentralized ESG regulatory landscape. For instance, about 90 percent of S&P 500 companies publish sustainability reports, but only 16 percent refer to ESG factors in their filings. And those sustainability reports run long—so long in fact that they lose their efficacy and readability, as recent research from the European Union found that sustainability reports there average 243.5 pages.

But things are changing. The International Integrated Reporting Council (IIRC) and the Sustainability Accounting Standards Board (SASB) are merging. A consortium of major reporting organizations recently announced their intent to create a unified global ESG reporting system. And the International Financial Reporting Standards (IFRS) has publicly solicited comments through a consultation paper on how it can help improve worldwide sustainability reporting.

Furthermore, artificial intelligence and machine learning will help standardize and improve ESG data. For instance, given the exact same background and data set, two different ESG analysts will reach the same conclusion about a company about 80 percent of the time. With just one variable changed, that rate drops below 40 percent. By reducing human error, technology breeds objectivity, which will make it easier for companies to make improved capital allocation decisions and establish streamlined ESG reporting while helping investors assess the efficacy of a given company’s sustainability efforts.

Finally, products like BlackRock’s new Aladdin Climate feature, which seamlessly integrates climate risk analytics into their robust and widely-used Aladdin platform, will make it easier for investors and companies to appreciate climate risks and adjust their decisions accordingly. As ESG data progresses, investors will be able to see just how much ESG assets outperform the market.

#4 – Technology allows for increased accessibility and targeting of investments

ESG investing used to be difficult for the average investor. Now, thanks to technological advancements and market demand, it’s never been easier to invest with ESG objectives. Investors are demanding ESG options in their portfolios, and companies are heeding the clarion calls to think beyond quarterly profits.

The total amount of ESG investment has ballooned. Between 2018 and 2020, total US.-domiciled sustainability invested AUM grew from $12 trillion to $17.1 trillion, representing a third of the $51.4 trillion in total AUM in the US. Plus, in 2020, asset managers with over $9 trillion in AUM pledged to invest only in companies with plans to achieve net-zero carbon dioxide emissions by 2050. Big institutional investors like CalPERs and Nordea committed to 1.5°C-aligned portfolio decarbonization targets for 2025. Global ESG assets are on track to exceed $53 trillion by then, representing over a third of the $140.5 trillion in projected total AUM.

As the availability of and demand for ESG investing products grows, direct indexing will allow retail investors to stream a customized investing portfolio like a music library based on their investing tastes. This democratizing process will make it easier for many people to create their own funds consisting solely of companies whose operations and commitments align with their values. For instance, if you want to invest in the Dow Jones Industrial Average but don’t want to invest in Chevron, direct indexing would allow you to buy 29 of the 30 Dow component companies but skip Chevron.

Direct indexing will also increase corporate accountability by making it easier for investors to engage in shareholder activism. Since a huge chunk of investment dollars is locked up in various all-or-nothing investment funds that normally don’t allow you to drop or exclude a particular company, widespread direct indexing would enable shareholders to en masse sell stock in companies they don’t want to support.

In his latest annual letter to CEOs, BlackRock CEO Larry Fink highlighted the dramatic implications of innovations like direct indexing. “Because this will have such a dramatic impact on how capital is allocated, every management team and board will need to consider how this will impact their company’s stock.” When the CEO of the world’s biggest asset manager tells other CEOs and boards that they better be ready for investors to more dynamically revalue their companies, they will listen.

Visionary leadership is needed

Environmental and social ambition alone won’t suffice for companies to innovate, evolve, and drive value to a broad value chain of stakeholders. Action is needed.

With trends like net zero emissions, biodiversity, socioeconomic diversity, impact measurement and disclosure, and increased accessibility of product options, ESG is at a generational tipping point and will transform how businesses see themselves as part of a global economy and a planet in need of some long-overdue changes.

We’ve highlighted the most pressing ESG trends to equip visionary leaders and their teams for success as they work toward assembling the rapidly changing pieces of the ESG puzzle. This will drive value in the short term and especially as the decade of action unfolds in efforts to meet the Paris Agreement targets.

For more on how to get started with ESG, see Telesto’s services page.

Our latest insights